Since 2010, US stocks have been a global vy hope, generating almost four times the returns of their international counterparts.

However, since April 2, President Trump’s tariff policies have cut US stocks and denied investors. Does this mean that the US market is a toast? Certainly not, but it indicates a potential change in foreign investment. So, if you’re not yet there, now may be the time to consider diversifying globally. And we can help in that aspect.

Hello World. We are here to invest.

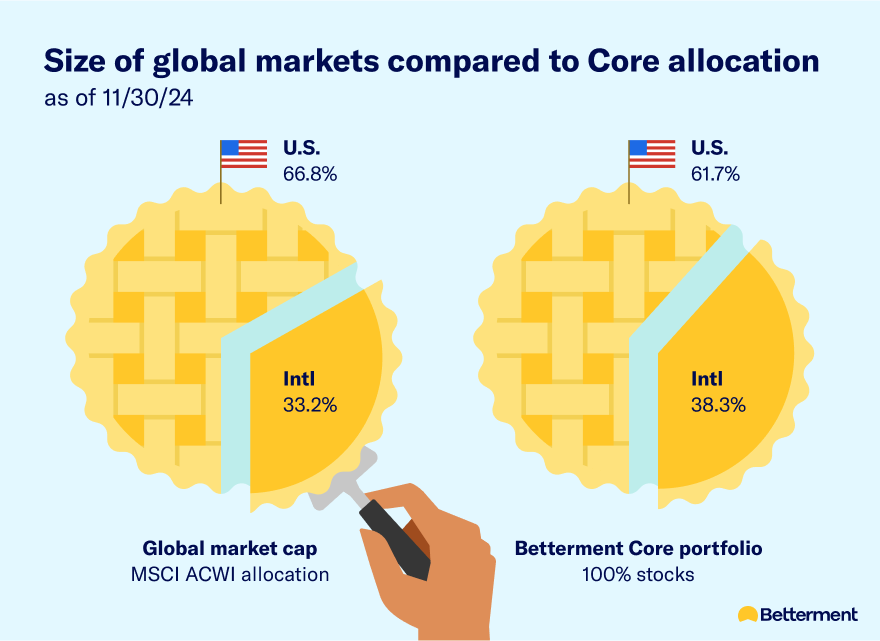

The US market is big, but not the only game in town. Every day, hundreds of billions of dollars of assets trade hand-in-hand in international markets. That’s why the Betterment Core portfolio was built on the idea that more diversification is less risky and roughly reflects the relative weight of the global market.

As mentioned above, the US market has been in tears for the past 15 years since 2020. This record winning streak is fueled by us Home bias, or the tendency of American investors to support the American market. However, history shows pendulums that usually swing back and forth every five to ten years. For example, the international market was excellent in the 2000s, and there was a huge surge in the late 1980s.

As mentioned above, the US market has been in tears for the past 15 years since 2020. This record winning streak is fueled by us Home bias, or the tendency of American investors to support the American market. However, history shows pendulums that usually swing back and forth every five to ten years. For example, the international market was excellent in the 2000s, and there was a huge surge in the late 1980s.

So, what should investors do?

If you’re investing in the long term, then the US market could hit at least one broad, rough patch. And in that scenario, a globally intelligent portfolio is very likely to smooth your returns every year. This start was unfolding in 2025, with Betterment Core portfolio and its global diversification that outperforms many typical US-only funds.

As of 5/2/2025. Betterment Core Composite Actual time-weighted returns: 10.52% in 1 year, 12.35% in 5 years, 7.30% in 10 years, 5/2/2025. Compound performance calculated based on the dollar-weighted average of actual client-time weighted returns for the core portfolio at 90/10 allocation, net fees. The investment involves risk as performance is not guaranteed.

As of 5/2/2025. Betterment Core Composite Actual time-weighted returns: 10.52% in 1 year, 12.35% in 5 years, 7.30% in 10 years, 5/2/2025. Compound performance calculated based on the dollar-weighted average of actual client-time weighted returns for the core portfolio at 90/10 allocation, net fees. The investment involves risk as performance is not guaranteed.

That being said, diversification is on the slide scale. There are no passes/fails, no good or bad. If you’re looking for a bit more international exposure, but not in one range of pre-built portfolios, you can invest in a flexible portfolio and adjust the appropriate allocation.

But if you have little experience in investing and simply need options that require work, readjust it. It updates its pre-built portfolio annually, touching on US and international exposures based on the latest long-term forecasts. While we cannot predict when the global tide will turn, we can always make sure we don’t miss it.