Technical analysis is a way to trade the market.

Use historical prices (or volumes) to help you make transaction decisions.

Hundreds of technical analysis tools are available, but most of them fall into one of these categories…

- volume

- Indicator

- Chart Pattern

- Support and resistance

But here it is…

Despite the wealth of these tools (RSI, MACD, Probability, Fibonacci, etc.), most traders lose money in technical analysis.

why?

Because they’re making one of these mistakes…

No trading plan (returns “nasty surprises”)

Let’s ask…

Entry or exit, which is more important?

Most traders focus on entry and believe that good entries will guarantee profits.

As a result, they use technical analysis to mainly time the entries.

But the perfect entry cannot be found in every transaction.

Without a plan, important questions remain. What happens if the market moves against you? What would you sell if the profits were reversed? What happens if an accidental, profitable transaction occurs?

Obviously, you need more than the best entry for a transaction.

To become a profitable trader, you need a trading plan that tells you what to do no matter what happens.

The next mistake is…

No edges (masking consistent losses)

So, what is the true purpose of technical analysis?

It is to help develop trading systems to gain advantage in the market.

So, what is Edge?

Edge (aka expectation) means that trading activity will produce net positive results over time.

The mathematical formula is:

e = (Victory % x Average Gain) – (Loss average loss %)

Here are a few examples to show how this works…

Example 1

- Winning rate: 70%

- Average gain: $80

- Loss rate: 30%

- Average loss: $100

E = (0.7 x 80) – (0.3 x 100) = $26

This means you can earn an average of $26 per trade. So after 100 trades, you can expect to make around 26×100 = $2600.

You may be thinking…

“So, do you need to get a high victory to be a profitable trader?”

no.

This is another example of a high victory, but has negative expectations…

Example 2

- Winning rate: 70%

- Average gain: $10

- Loss rate: 30%

- Average loss: $100

E = (0.7 x 10) – (0.3 x 100) = – $23

This means you can expect to lose an average of $23 per transaction.

What this shows is that in itself, your win rate or reward-to-reward ratio is useless.

Both are necessary to see the edge.

Technical analysis can help you develop trading systems aimed at this critical edge.

So, let’s be honest…

…Does your trading system have an edge?

If you don’t know the answer, that’s because you have…

No data (that leads to lack of discipline)

Without data, it will be impossible to define your edge, see if your trading system works, or maintain discipline to follow the rules.

In fact, it usually leads to abandoning the system after a small loss.

So first of all, these are the data that need to be tracked…

- Annual Return %

- Number of transactions

- Maximum drawdown %

- Winning rate %

- Lose rate %

- Average gain $

- Average loss $

Now you’re probably thinking:

“How can I access such data?”

There are two approaches.

First, you can journal your transactions and accumulate this data over time. However, it will take some time. It takes months or years to get a decent sample size.

Another approach is backtesting (and that’s what I like). I’ll explain in more detail later…

But for now, another reason most traders fail is what they have…

No risk management (blowing multiple accounts)

Imagine having two traders, John and Sally.

- They have a $1,000 account

- They have a 50% victory

- They have an average risk-to-reward ratio of 1-2

- John takes the risk of $250 per trade

- Sally takes the risk of $20 per transaction

The results of the next 8 transactions are as follows…

Losie lose win win win.

This is the outcome for both traders…

John’s Results: -$250-$250-$250-$250= It’s exploding

Surrey Results: – $20- $20 – $20- $20 + $40 + $40 + $40 = +$ 80

Do you understand the importance of risk management?

As a trader, you regularly encounter losses and are guaranteed.

However, proper risk management includes them, making them easier to manage.

Disassemble it…

Most traders lost their money in technical analysis…

- There is no trading plan

- There is no edge

- No data

- There is no risk management

All of these issues point to the same root cause. Lack of proven, quantifiable trading systems backed by data.

But once you get it, all of these issues go away.

Now you’re probably wondering:

“So, how can we develop a working trading system?”

This is my answer…

Let’s Technique

This is the technique I used to develop multiple trading systems, so even during a recession, you can still make money in the Bull and Bear markets.

This is proof…

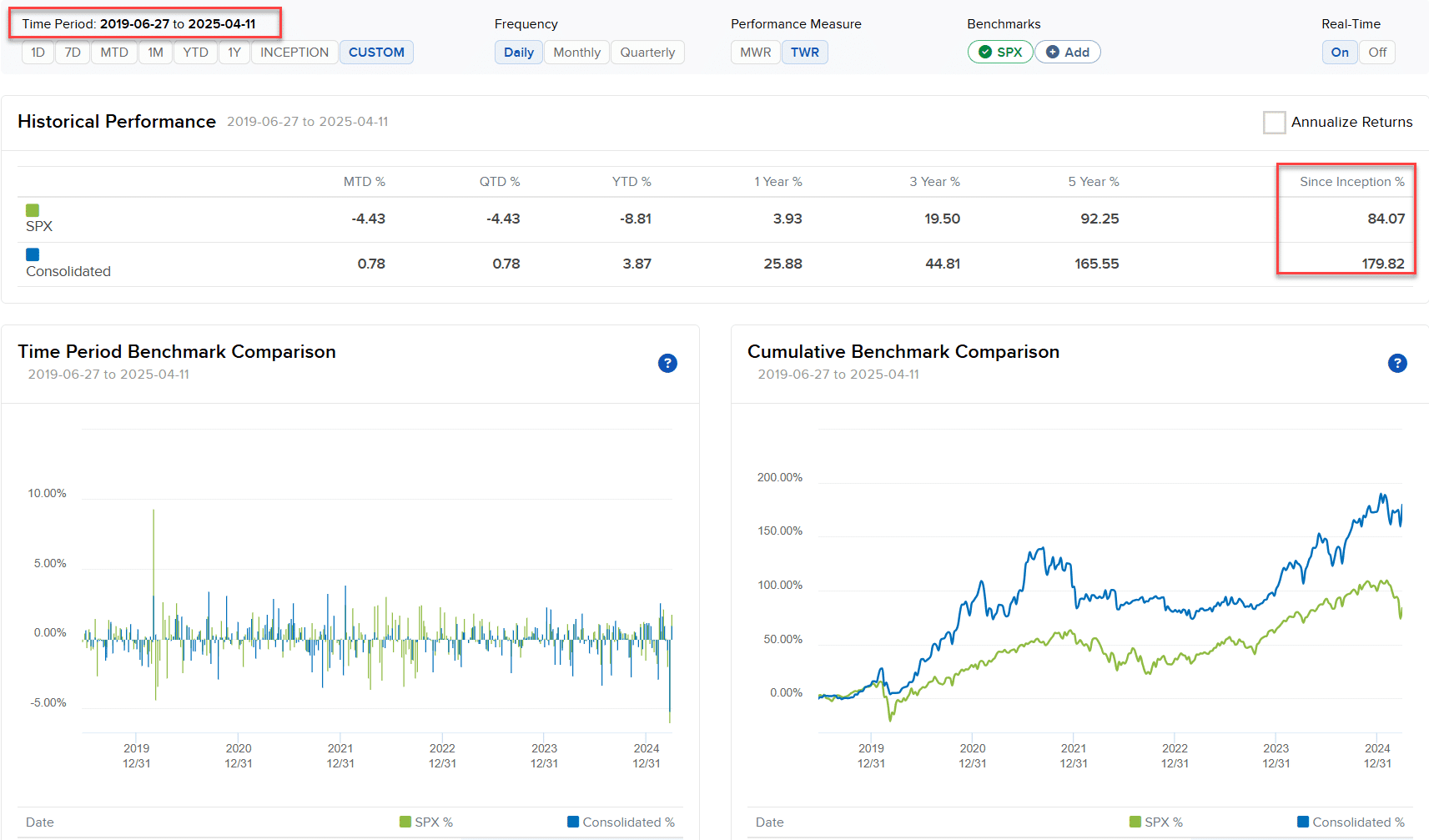

As you can see, from 2019 to 2025, my trading accounts increased by 179% (compared to 84% on the S&P 500).

So, how does the let technique work?

It can be broken down into four parts…

- rEAD Trading Book from Backtested Results

- eTatrest concept

- tEST trading system

- tThe trading system is weak

Let me explain…

Read the trading book with backtested results

I would like to read a trading book that provides trading system rules and backtest results. Here are three reasons…

- First, there’s a framework, which saves you time

- The backtest results give more reliability and can be used to compare with the results

- The author’s reputation is at risk. This means that trading systems may work

After reading some of these books, you will notice that most profitable trading systems have similar characteristics. That’s when you move on to the next step…

Extract concepts

The concept is the fundamental principle that drives the performance of trading systems.

for example…

The concept of breakout means buying after the price has been favored for you.

The concept of counter trends means buying on down trends (and shortened with uptrends).

The concept of trailing stop loss means giving your deals to the “breathing chamber” in the hopes of getting on the trend.

All profitable trading systems combine several core concepts. Understanding these allows you to develop multiple trading systems.

Ask yourself these questions to extract the concept of trading systems…

- What are the characteristics of the trading system?

- What types of market conditions are best?

- What types of market conditions are declining?

- What is the trading setup?

- What is the exit signal?

From these questions you will understand the concepts behind a trading system, how it works, why it works, and how to develop it for yourself.

Next…

Test your trading system

To test your trading system, you can run a backtest.

This means running transactions with historical data, so you can see how the trading system is running over time.

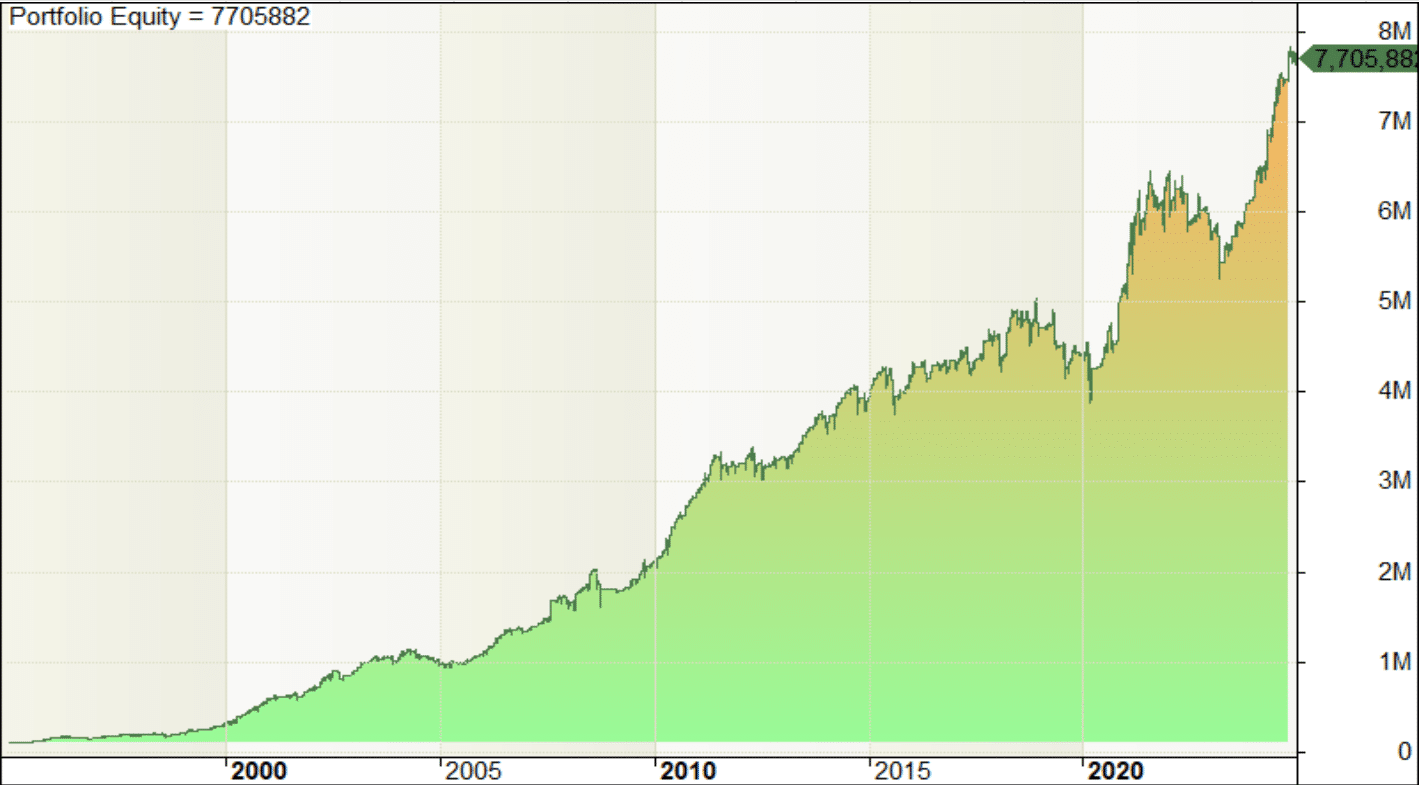

For example, the results for the Bollinger Band Trading System are:

If you see these types of results, are you confident in trading your system on a live market?

probably!

This is the power of backtesting. It shows whether trading systems work, save time and money, and build confidence, especially during drawdowns.

Now you may be wondering:

“If the book provides results, why should we backtest the trading system?”

That’s because we don’t know if the backtest results are accurate or not. You need to verify it yourself.

And finally…

Adjust the trading system

If you are happy with the results of your backtest, you can test your live market system (with a small account).

But if you want to improve the following…

- Reduce maximum drawdown

- Improve risk-adjusted returns

- Reduce correlation with existing systems

Here are some things you can do to achieve that…

Reduce maximum drawdown

Most stock trading systems are against overall market trends, which leads to a deep drawdown. Therefore, using trend filters can reduce maximum drawdown.

For example, you only buy stocks if your S&P 500 is above the 200-day moving average. Otherwise, keep cash.

Improve risk-adjusted returns

To improve risk-adjusted returns in your trading system, you can test the parameters in a variety of settings to see which behavior is best.

For example, if the stock price goes down for five days, the trading system becomes longer. What if I tested low values for 10, 20, or 50 days? What is the impact of that? Do risk-adjusted returns improve with increased duration or do performance worsen?

Reduce correlation with existing systems

This is a little known fact…

Trading multiple trading systems with little correlation improves risk-adjusted returns, reduces maximum drawdowns, and has a smoother equity curve.

So how do you reduce the correlation between trading systems?

One way is to test your trading system in different markets. For example, instead of the US stock market, you can test it in the Canadian or Australian stock market.

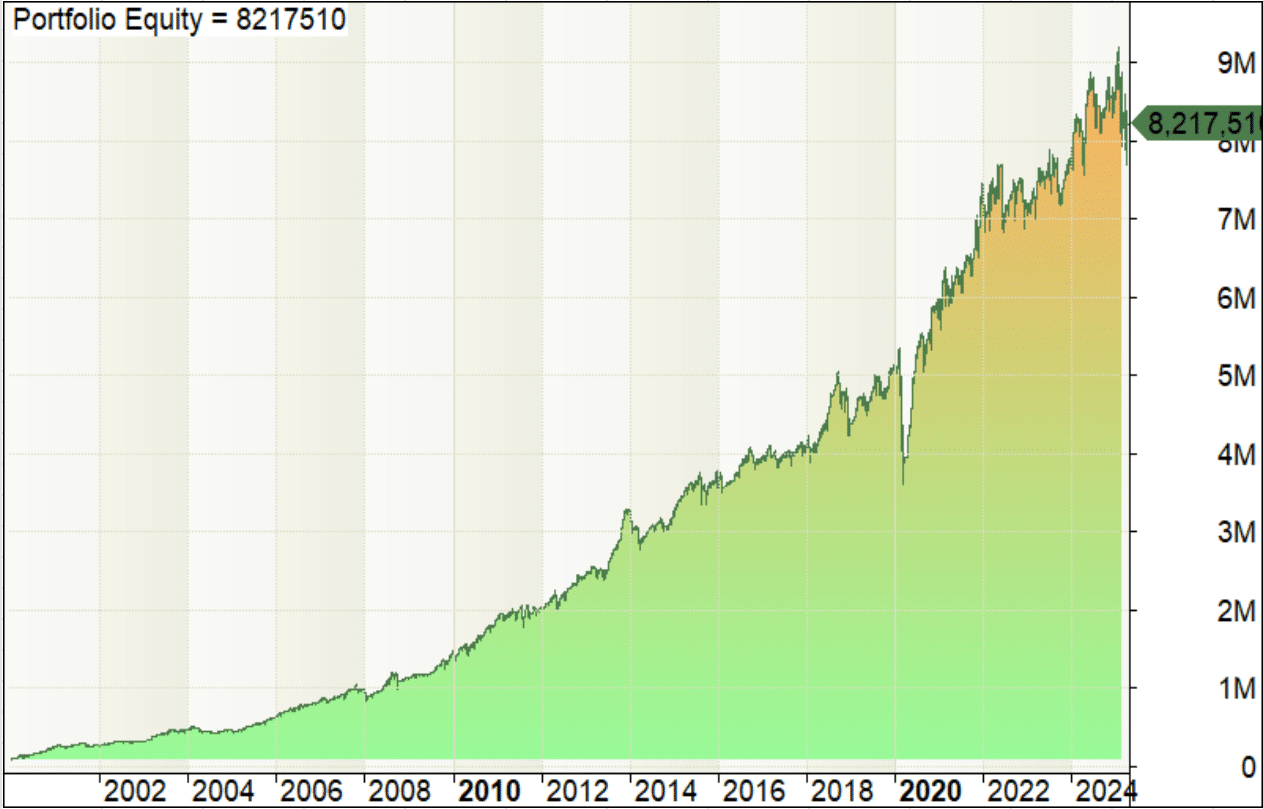

Using the Rett Formula, I have developed multiple trading systems over the years.

For example, the average return trading system has generated an average of 18.69% over the past 29 years…

If you want to know more, Functional trading system.

Discover three proven trading systems that work and earn profits during the Bull Market, Bear Market, or recession.

Conclusion

So here’s what you learned today:

- Most traders lose money in technical analysis because they have no trading plans, edges, data, or risk management.

- To solve these problems, you need a working trading system, quantifiable and supported by data.

- One way to develop a profitable trading system is to use the let technique. 1) Read trading books with reverse test results 2) Extract concepts 3) Test trading systems 4) Adjust trading systems

This is what I want to know…

What kind of struggles are there regarding technical analysis?

Leave a comment and let us know what you think!