Many believe they understand why domestic prices rise along with tariffs. Declining competition Increase prices and make profits. The explanation seems cynical and refined, and while it’s not entirely wrong, it misses a deeper truth. Furthermore, this “explanation” suggests that people are able to respond appropriately to domestic companies and raise prices. Price management and threatsthat would make things worse. In fact, tariffs also raise domestic prices even in completely competitive industries. Let’s see why.

Let’s say you tax the imports of French and Italian wine. As a result, demand for California wines is rising, and producers in Napa and Sonoma will expand their production to meet that. The key points are as follows: In particular, it is difficult to expand production without increasing costs due to the large expansion of normal times.

More production requires more land for Napa and Sonoma wine producers. However, the most productive and cost-effective land is already in use. The expansion will result in producers being inappropriate. This is a land that is less productive for wine or is more valuable for other purposes. Wine production competes with the production of olive oil, dairy products, artisan cheese, heirloom vegetables, livestock, housing, tourism, and even geothermal energy (Sonoma). Therefore, as wine production increases, costs increase The cost of opportunity increases. As wine production expands, the prices we pay will be less produced for other goods and services.

Therefore, the fundamental reason domestic prices are rising in tariffs is that they need to replace other high value use by expanding production. The higher cost of money reflects the opportunity cost, the value that property such as olive oil and cheese produces more wine.

And the basic reason why trade is beneficial is that foreign producers will send wine in exchange for less resources than they need to produce their own wine. Put another way, there are two options. By diverting resources from olive oil and cheese, you can produce more wine domestically or produce more olive oil and cheese, and exchange some of it for foreign wines. The latter makes us wealthy when foreign producers are low in costs.

Tariffs reverse this logic. By bringing wine production back to the house, they force us to use more expensive resources – we get the same wine at the expense of olive oil and cheese more than necessary. This results in a net loss of wealth.

Please note that tariffs do not increase domestic production. They shift domestic production from one industry to another.

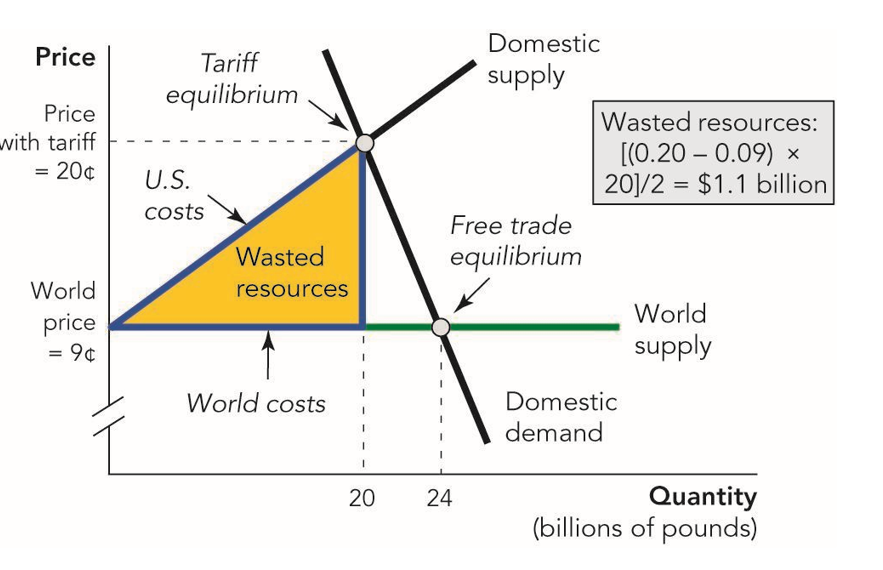

This is the diagram from Modern principlesuse sugar as an example. Without tariffs, you can buy sugar at a global price of 9 cents per pound. The tariffs are pushing domestic production to up to £20 billion.

As the country’s sugar industry expands, it draws resources from other industries. The value of these resources exceeds what we paid foreign producers. That excess cost is represented by a labeled yellow area Waste resources– The value of the goods and services that have given up by redirecting resources to domestic sugar production, instead of producing other goods and services that have a comparative advantage.

Of course, all of this is explained in modern principles, which are the best textbooks for economic principles. It’s more necessary than ever.

Why do domestic prices rise with posting deadlines? It first appeared in the Limit Revolution.