Readers ask:

100 years is heartbreaking in terms of the scale of human history. What is the possibility that capital will become a very rich and technical innovation? Mainstream (continuing to buy) advisors don’t even entertain this possibility.

This question addressed one of many market research I have done over the years.

I’m always getting a variation on this question – what if the long-term inventory is not intended to last?

There’s a lot to cover here, but the beginning is a history lesson.

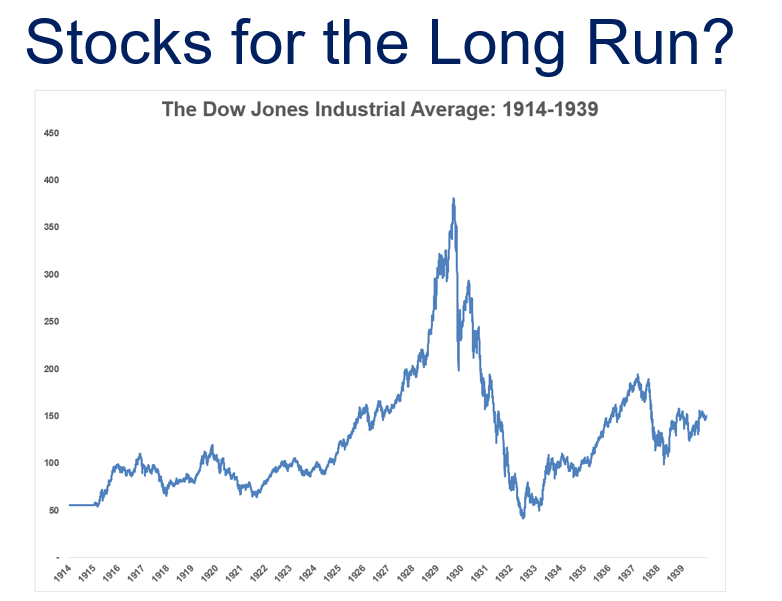

The whole long-term stock idea is still relatively new. Investors didn’t feel that way in the 1930s and 1940s after witnessing the stock market falling 85% during Great Depression. Can you blame them?

Furthermore, even before the 1960s, few investors knew what the long-term return of stocks was.

No one had any data.

That is until the VP of Merrill Lynch, named Louis Engel, rose to the plate. Engel was tasked with grasping the long-term returns of the stock market so that he could give Merrill’s brokers ammunition when talking to clients and prospects. No one actually had any data in one place, so Engel went to the Chicago School of Business. The Chicago School of Business said that if Merrill funds the research, it will do historical research.

The professors’ group was able to compile a dataset of stocks listed on the NYSE between 1926 and 1959. This process took nearly four years to complete and created what is now known as the Security Pricing Research Center (CRSP).

They now had a long-term historical record of US stock market returns, which was far better than most investors had expected.

Despite the huge crash during that huge recession, the US stock market totaled over 2,700% between 1926 and 1959. That’s 10.3% per year.

For fun, I decided to see the annual returns in the aftermath of that research:

Quite close.

There are about 100 years of excellent stock market data, but I only know about it for 65 years. I fully agree that this is a drop in the bucket in terms of our history as a species. If you are using data from 1,000 or 10,000 years, everyone will feel much more confident about past market data and relationships.

But even if the history of studying is much longer, the future always has the same level of uncertainty. There is always a possibility of a paradigm shift that no one will come.

Historical data is not perfect, but what other options are available? The old saying “I rather want to be almost right rather than exactly wrong” seems to fit here.

I have asked many people about stocks nowhere for decades, but this question asked me about a situation like Japan that sounds like a Star Trek situation. I’m not a trekki, but my general understanding of this series is that technology can solve many big problems through abundance, such as poverty, illness, work, environment, and more, and explore new galaxies and civilizations.

Anything is possible, but it’s hard to believe that the world’s biggest companies will essentially sign up for technology that will make them go out of business.

I understand why certain investors worry about stock market destruction. It’s a scary possibility, but I don’t think it makes sense to waste your time worrying about it.

Whatever the reason, if the stock market doesn’t rise over the long term, it will cause much more problems than the portfolio. Your investment is not important.

Also, let’s say you are trying to hedge against this end-of-life scenario. What is your plan? Buri your money in your backyard? Hoarding bullets and gold bars?

My baseline assumption is that humans strive to make more money and improve their stations in life. Companies look for ways to innovate and increase profits. The economy grows. Bad things happen, but there are progress in the long run.

Perhaps these baseline assumptions may prove wrong in a dystopian future, but you can prepare for the situation other than building a bunker under your home.

If you don’t think your future will be better than your past or present, what are the key points for your investment?

The only way to guarantee you will fail as an investor is to avoid investing in the first place.

We delved into this question in this week’s Ask the Compound.

https://www.youtube.com/watch?v=z1etrrmylfi

Bill Sweet We rejoined this week’s show to discuss questions about putting all our retirement assets into a Roth IRA, how to shift our careers into finances, how to save for your child’s future, and tax considerations when moving from Florida.

Read more:

Risk-free S&P?