I’ll admit, this is a bit gross…

but, maximum There is a thrill in the life of a systematic investor. you.

It’s the overall point of all the effort as you’re trying to face it.

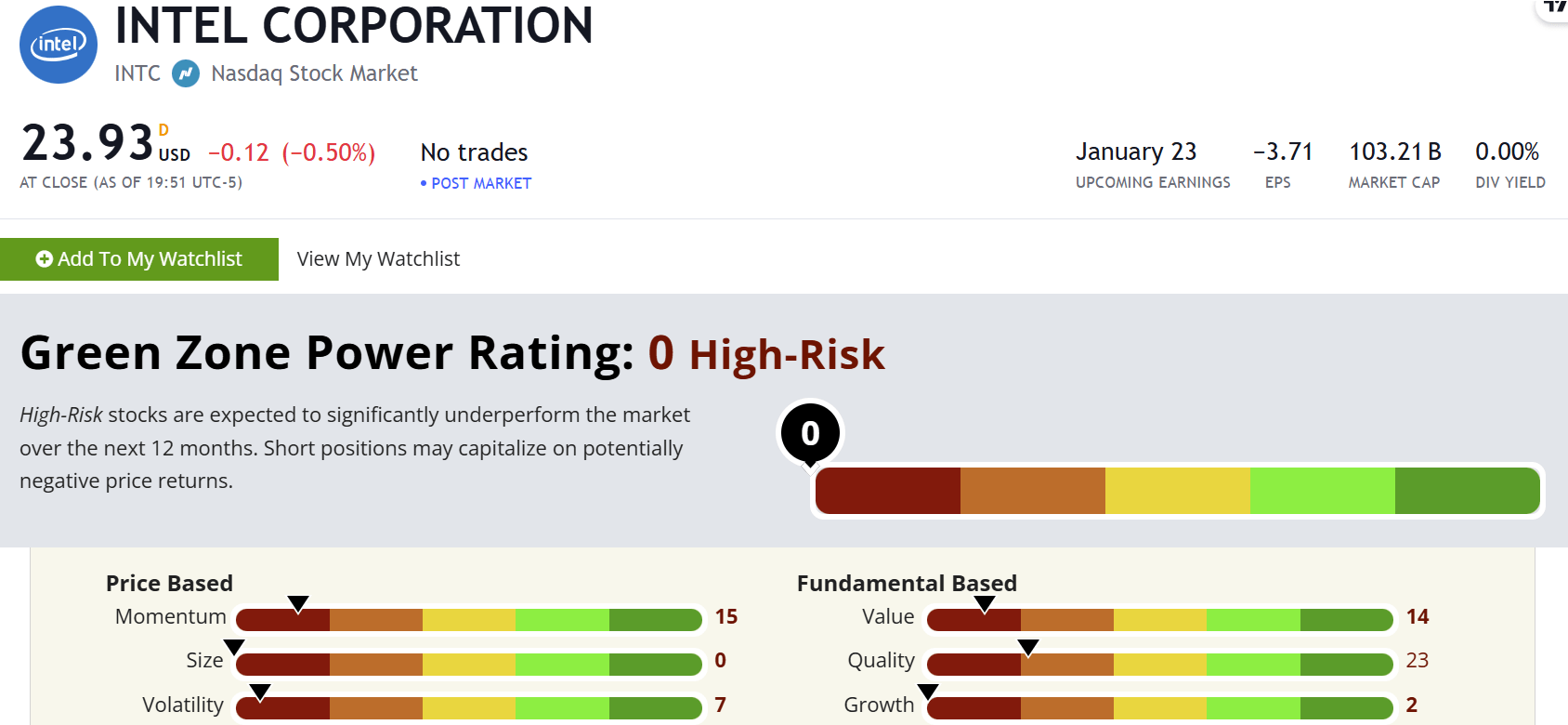

Green Zone Power Assessment creates a system that processes more data, projects more accurately, and allows individual investors to reach more balanced conclusions than ever before.

What if that means the outcome is amazing? Well then.

And now my rating system is Intel (NASDAQ: INTC). Titan in the semiconductor world with a 78% market share in the PC world… Intel gains big, fat, zero.

I admit – such a low score for such a dominant tech company will surprise me. And I couldn’t be happy about it!

After all, my Green Zone Power Rating System is not designed around a company. Designed around Investors. And we continue to discover many times that the “best” companies in the world are not the best investment for people like you and me.

Therefore, the above scores reflect the company investment. It tells you how INTC shares could be run and whether you should buy them.

Obviously, it shouldn’t be.

But with Intel you need to zoom out and take a look at the larger photos in INTC.

Tragic domination of Intel

I Really It cannot be emphasized well that Intel was in fact the “golden boy” of the first big computer boom.

The founder of Intel was a group of exiles at Fairchild Semiconductor. There is no one other than Gordon Moore, the father of “Moore’s Law.” These men were foresighted people who could see the future of computing decades ago.

In 1971, Intel delivered the world’s first commercial microprocessor and developed a lasting partnership with IBM, becoming Shoo-In to dominate early personal computing in the 1990s.

Intel had it all. For decades, they maintained dominant market share in most sectors.

But at the same time, Intel has never really been innovated beyond its core vision of producing cutting-edge CPUs.

Certainly this is my Green Zone Power Rating System identified by Intel very Early stage. The INTC ratings fell first from full territory back in 1999, falling to 59 out of 100.

Intel’s stock soon followed suit, sinking 83% from September 2000 to September 2002.

After the crash in the Dotcom era, Intel has made multiple forays into mobile devices.

After spending $10 billion on the new mobile division in 2020, Intel eventually sold its 5G business to Apple.

Recently, Intel has completely missed the AI bus. Despite the clear control of the company in the CPU space, it never became a member of “Magnificent Seven.”

Finally, we are undoubtedly the biggest financial disaster in Intel’s long and renowned history…

In 2005, Intel CEO Paul Otellini pushed the company to buy an emerging competitor called Nvidia (NASDAQ:NASDAQ:). NVDA) $20 billion.

At the time, Nvidia was making graphics cards (GPUs) mainly for video gamers.

And for some reason, the biggest CPU innovator in history appears to have not seen the value of buying Nvidia for $20 billion.

It is one of the great “what if” moments of modern technology.

This is because Nvidia’s value has skyrocketed from $20 billion to more than $3.36 trillion over the past 19 years.

It can be argued that Intel’s failure to follow the Nvidia acquisition is the only worst failure in the company’s history.

But once again, we are investing in stockIt’s not just the company.

So, a few years later, in 2009, Intel’s ratings were once again bullish.

Two Inter stories

As you can see, there is a big difference between the way Intel stocks performed within the stock portfolio and Intel’s stocks, which you read in the headline…

At any time, mainstream financial media may be celebrating Intel’s latest generation of cutting-edge chips. Meanwhile, INTC’s stocks have plummeted.

This cutting appears more frequently than you notice. And it could cost a lot of money to careless investors.

That’s why we first created a green zone power rating system, which helps us get through the hype and identify if there’s a specific inventory. actually It’s worth your time and investment.

And now, Intel is showing the lowest possible rating of 0 out of 100. This is just as clear as you can avoid INTC.

As we head towards 2025, we’ll be focusing on Intel here. Daily Money and Market.

Partly because of our own pathological curiosity, but we have our own pathological curiosity, as at least one major tech giant appears to indicate a potential disaster.

For good profits,

Adam Odell

Chief Investment Strategist,

Money and the market