Shortly before midnight on October 19, 1987, Stephen Guilfoyle finally called his fiancé.

The Wall Street veteran worked all day on the infamous Black Monday, when the Dow Jones industrial average was a key measure of US stock market performance at the time, losing 22.6% in a single trading session.

💵💰Don’t miss the move: Subscribe to thestreet’s free daily newsletter 💰

That day, Guilfoyle’s spot on the New York Stock Exchange’s trade floor is just below the ninth podium and in front of Post 9, now the CNBC NYSE studio.

“NYSE trading volume that day was three times the average per day,” Guilfoyle wrote to him. thestreet pro “And at the time we exchanged all the shares in the old fashioned way. This is the price of eight Spanish, old open-out clean, two-way, continuous auction model. No circuit breakers. No timeouts.”

Veteran traders remember dark days in the market

The global losses were estimated at $1.71 trillion, and the severity of the crash caused an extension of economic instability and repeated fears of Great Fear Pression.

“On normal days, paperwork is finished between 5pm and 6pm,” Guilfoyle said. “On that day, the trading floor looked still open for business at 11:30pm when we took our first break of the day.”

More Experts

- Stanley Druckenmiller sends a Curt 7 Word Reaction to the Tariff War

- Jim Kramer underwrites Blunt’s tariffs after stock crashes

- Scott Galloway sends a strong social security message

- Suze Orman sends a 401(k)S, recession-resistant message

Guilfoyle went to wage phone banks outside the stock exchange and called his fiance, now his longtime wife.

“We told her it would probably take a while before we could see each other again,” he said.

The Wall Street veteran uses this ferocious in-person account to assess the defeats that current tariffs have produced, so he has looked back at various times that have been hampered by the market for decades, dating back to 1929.

“Since then, we had the 1989 Mini Crash, the March 2000 dot-com bubble crash, the 9/11 terrorist attacks, and eventually I returned to the US military after a long break in service.

Guilfoyle also reminiscent of the 2020 Covid Crush. He worked straight ahead without missing a day despite getting quite ill in a horrifying match between the first variant of that virus and the long Covid that lasted over two years.

Analyst: Panic Thresholds are primarily met

“Is this now?” he asked. “Is this a crash? That might be true. I don’t count flash crashes. They only happened because Wall Street replaced human traders with algorithms. It made me feel bad on Thursdays and Fridays.

The S&P 500 lost more than $5.4 trillion last week, but on a global basis it lost about $9.5 trillion on April 7th, including sales in Europe and Asia.

Related: Stanley Druckenmiller sends 7-word cart response to the tariff war

“We are pleased to announce that we are committed to providing a range of technical strategists at LPL Financial,” said Adam Turnquist, Chief Technical Strategist at LPL Financial. “The technical damages have been serious, but importantly, the market conditions thresholds for panic and washing/sales have now been largely met.”

The first quarter revenue season begins in a serious week when several major banks begin to report their numbers.

“In this new era of extreme uncertainty, I have wondered how many companies actually publish future-looking guidance, despite what appears to be some kind of negative certainty.

“Many companies have not provided guidance for more than a year after Covid closures and supply constraints in the Covid era,” he said. “Would they rely on such avoidant behavior again? I know if I’m the CEO of a multinational company. That’s exactly what I do.”

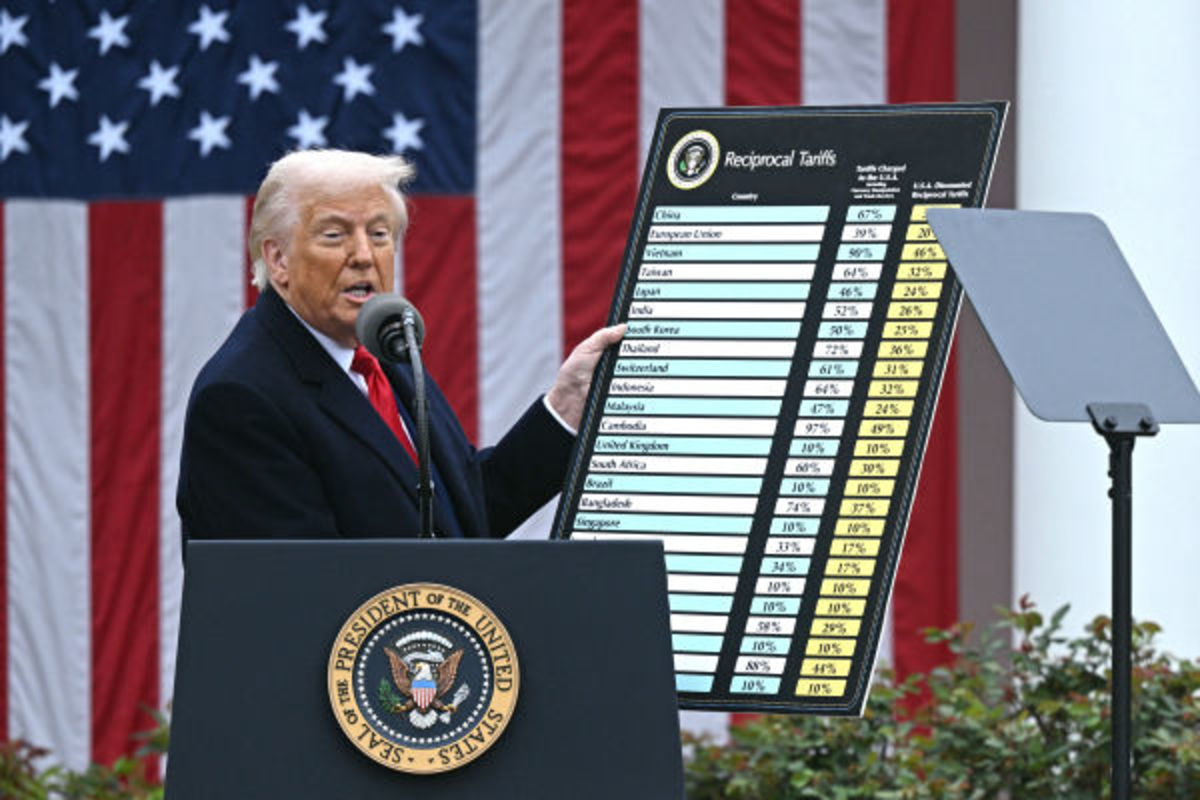

The Dow was whipped with 721 points or nearly 2% after Kevin Hassett, director of the National Economic Council, told Fox News that more than 50 countries responded by approaching President Donald Trump’s tariff policy in a “great” deal.

On the X platform, prominent hedge fund manager Bill Ackman called for a 90-day suspension of tariffs “to give the president a time to carefully and strategically resolve his historically unfair global trading position.”

“The futures opened on Sunday night in the same ugly fashion that we went out together on Friday,” Guilfoyle said. “That reminds me. Friday, October 16th, 1987 was a pretty bad day for the US market too. Let those hips go, kids.”

Related: Veteran Fund Manager Predicting S&P 500 Crash Announces Amazing Update