There are two major economic trends over the last decade:

1. Consumers spend money no matter what.

2. Investors will continue to buy dip no matter what.

People are waiting for these trends to break, but they simply don’t. At least not yet.

What does it cost?

You would imagine a recession breaking the spending patterns of many consumers. We’ll see. Inflation did not do that.

I don’t know what it takes to stop investors from buying pain when stocks are running low.

April has been a very unstable environment for the stock market. Investors are not at least in a hurry to exit retail varieties.

Retailers were buyers:

I wrote a piece called “The New Death of Stocks” with the Millennials in 2014. This was from a UBS report at the time.

The next generation of investors are remarkably conservative, resembling the World War II generation who retired to age during Great Repression. This leads to their attitude towards the market, as they look at millennials, including people with higher net worth, and see millennials who hold significantly more cash than any other generation. And although they are optimistic about their goals and their ability to achieve a financial future, Millennials seem somewhat skeptical of long-term investments as a way to get there.

It was combined with the bursting of the dot-com bubble and the huge money crisis that stumbled many investors. Millennials were skeptical of the market.

The next generation now has a completely different relationship to risk.

Wall Street Journal We introduced a small number of young investors to see how volatility influences investment decisions. They leaned in pain:

“This is just a cry of a cry,” says Oksnevad, who maintains around 90% of his seven-figure portfolio, including retirement benefits, with cryptocurrencies such as the Bitcoin Buyer Strategy and related stocks. “I’m running straight to it.”

The 37-year-old marketing director didn’t mind that Bitcoin price had sunk nearly 6% that day or increased exposure to relatively dangerous assets during its most significant market meltdown since March 2020. Instead, he focused on the potential for rebounds.

“That’s what I’m looking for. I’ll make decades of returns in weeks or months,” he said. “I really think volatility is where fortune is created.”

Here’s one more:

“Children these days are “no risks, no ‘lalis’,” said Patrick Wheland, a content creator and day trader who has poured thousands of dollars into ProShares Ultrapro QQQ over the last few weeks. (“Rari” is a slang for Ferrari.) The fund’s stock is a triple leverage ETF that aims to generate three times the daily performance of the Nasdaq-100 index during its historic gathering on April 9th, but it fell by more than 20% this month.

“I think you have to be offensive,” he said. “If you’re having such a big shaking in the market, it’s hard to avoid risk.”

Bull markets and pandemic-induced profits have created a new kind of investor that is not afraid of volatility. They rush to a burning building.

Some investors quies the vehicle of their choice, but this action is noteworthy. Over the years, we’ve been delved into the investor’s head, but dropping into the market is an opportunity. I think it’s great that young investors learned this lesson so quickly.

When the next lost decade comes, can they eventually learn another lesson? Certainly, however, these periods are not easy for investors, regardless of age or experience.

And there is no guarantee that a massive market crash will immediately change investors’ behavior.

The bull markets of the 1980s and 1990s were another glorious era when investors learned the art of long-term investment and DIP purchases. Even when the stock market fell 50% during the rupture of the dot-com bubble, most investors remained on the course.

Maggie Mahal recorded this period in her book Bull:

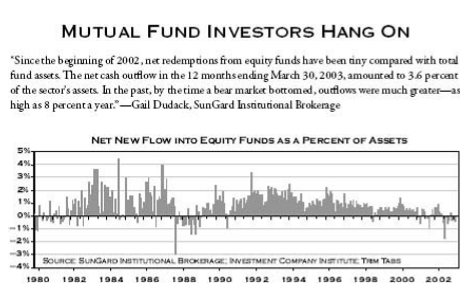

So, even after it became clear to the majority of investors that the Great Bull Market was over in 1982-99. The mass redemption from stock funds that many had predicted never happened. In March 2003, Gail Dudack said: “The net redemption since the beginning of 2002 was negligible compared to the total assets of stock assets. The 12 months of net cash outflows ended March 30, 2003 reached 3.6% of the sector’s assets.

This is the visual:

In 2002, the stock market fell 22%, but Vanguard found that average account balances increased by 1% as people continued to concentrate their funds in the market.

It wasn’t until the 2008 crisis that many investors began tap-outs.

Once habits are formed, breaking the pattern is not that easy.

The recession may do that, but the next generation of investors are happy with the volatility.

It’s a welcome development.

Michael and I talked about investors buying dips and other things in this week’s Animal Spirits Video.

https://www.youtube.com/watch?v=dsc4x7j0uoy

Subscribe to Compounds So you won’t miss an episode.

Read more:

One of the best investment books I’ve read for a while

Here’s what I’ve been reading recently:

Book: Book: