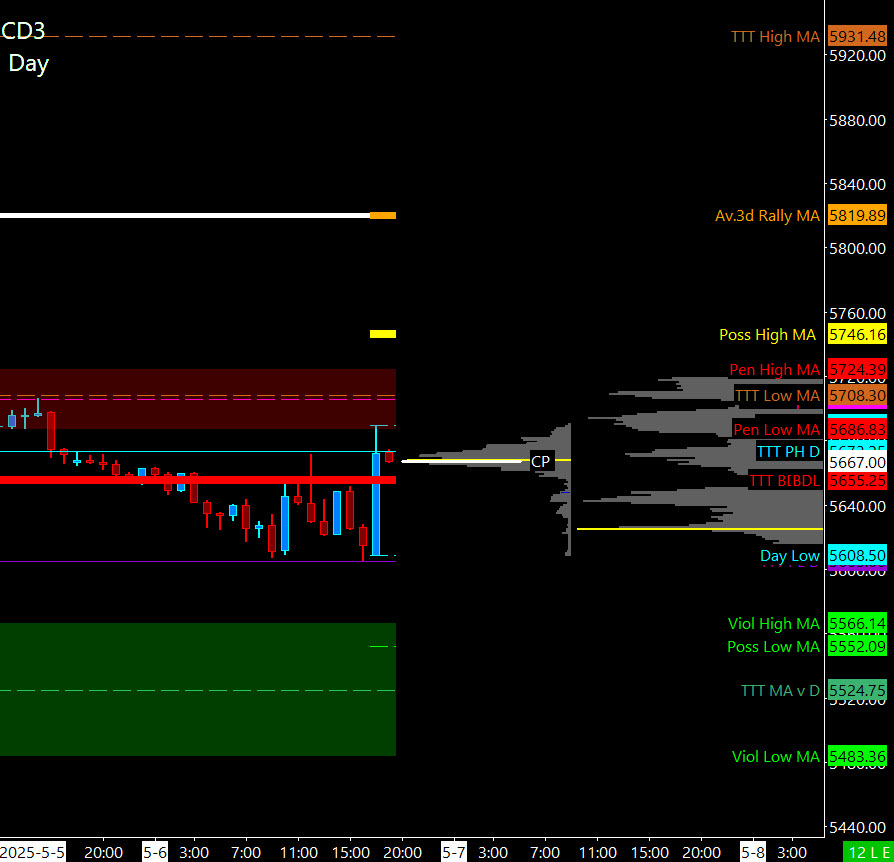

S&P 500 (ES)

It was a previous session 2 days of cycle: Normal CD2 was rolled out as GAP first got lower CD1 Low (5655.25) and fell below trade to successfully retest the 5600 pivot. The buyers then filled the open gap by increasing prices.

It was a somewhat “unstable” rhythmic day, but the structural level remained true, offering excellent trading profits to opportunistic and disciplined traders.

The undisciplined traders handed them their proverbs and moved relentlessly in pursuit, playing the winner/loser game. The range was 80 points on the exchanged 1.245 contract.

Free trial Link to PTG/Taylor 3-Day Cycle

Click this link for a more detailed summary of the trading session. trading Room Summary 5.6.25

…Transition from day 2 to day 3 of cycle

I will move to 3 days of cycle: As long as the price exceeds CD1 low (5655.25), the positive 3-day statistic (89%) is met.

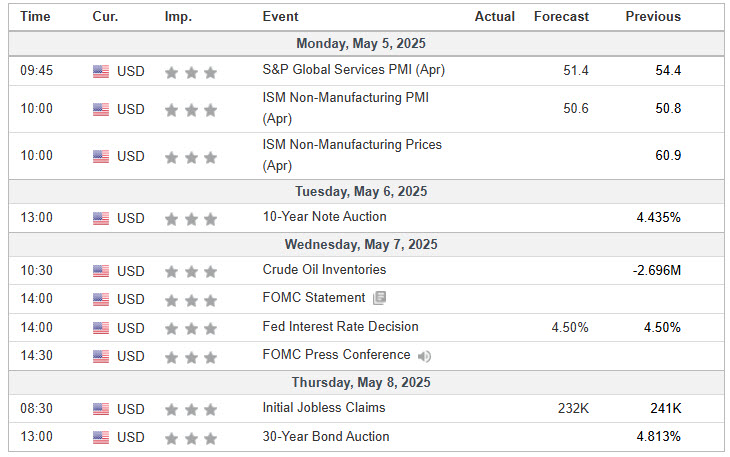

Today, “Fed Day” (FOMC) is following @2:30 EDT along with the JPOW Presser.

The Federal Reserve is widely expected to maintain benchmark interest rates within the current range of 4.25% to 4.50% during the upcoming decision on Wednesday, May 7, 2025. According to CME Group FedWatch Tool, There is a 97.8% chance that the Fed will remain stable and maintain a rate .Investopedia+1Investopedia+1CBS News+1Investopedia+1

Despite demands for interest rate cuts to stimulate President Trump’s economic growth, the Fed remains cautious. Recent tariff-induced inflation pressures have maintained inflation beyond the Fed’s 2% target, projecting a one-year outlook at 6.5% consumer inflation at 2.4% in March . Furthermore, the economy has shown resilience, with job growth strong in April and the S&P 500 trade trading on revenues prior to 21x, suggesting that immediate interest rate cuts may not be necessary. .CBS News+4Market Watch+4Investopedia+4Business Inn

The Fed’s next meeting is scheduled for June 17th-18th and July 29th-30th. The June rate cut appears unlikely, with the 70% chance remaining unchanged, but the July meeting shows that the potential rate cut is 80%, depending on economic data. . https://www.kiplinger.com/news/live/may-fed-meeting-commentary-2025?utm_source=chatgpt.com

Of course, there are no changes to the PTG… simply follow your plans. Triple your setup and manage your $risk. There is always a hard stop loss for exchanges.

PTG’s Primary directive (PD) that’s right Always be consistent in The dominant force.

So the scenario to consider for today’s trading.

Bull scenario: Prices will maintain bids above 5670+ and initially target the 5705-5720 zone.

Bear scenario: Prices will maintain offers below 5670+– and initially target the 5655-5645 zones.

PVA High Edge = 5648 PVA Low Edge = 5622 Prior POC = 5642

ESM

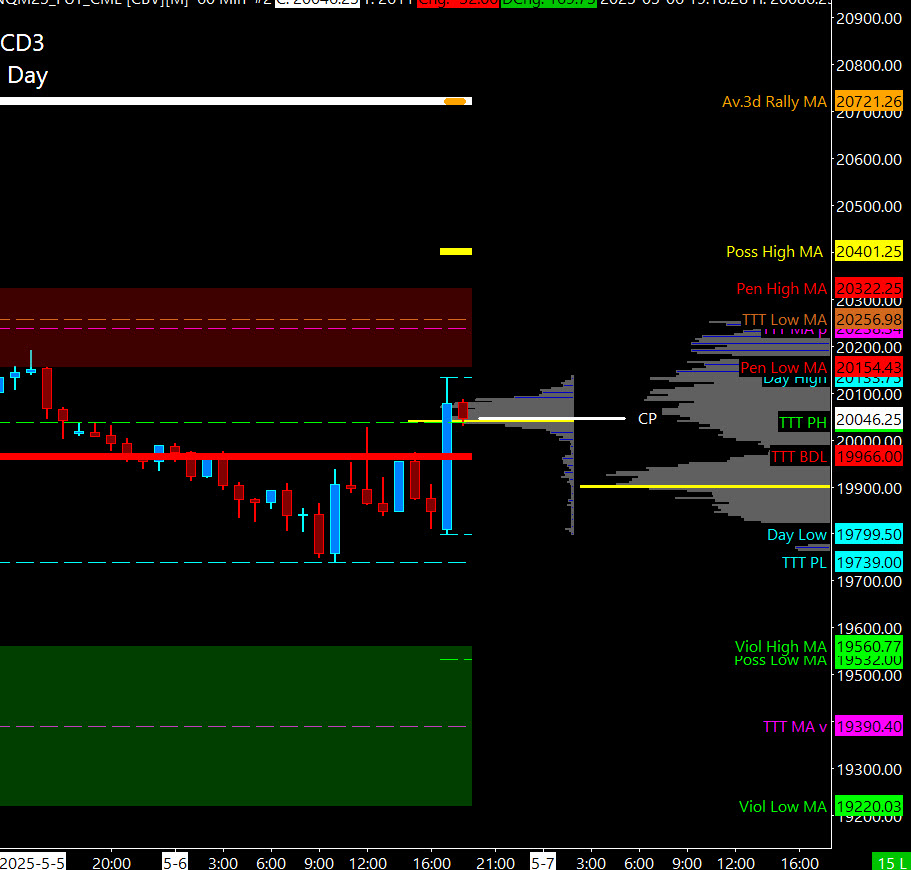

NASDAQ (NQ)

It was a previous session 2 days of cycle: Normal CD2 was deployed as the price first dropped CD1 Low (19966) to successfully retest the 19740 pivot. The buyers then filled the open gap by raising prices, but then traded down to a closed bell, honoring the 19822 open range midpoint. The range was 297 points in exchange for the 509K contract.

…Transition from day 2 to day 3 of cycle

I will move to 3 days of cycle: As long as the price exceeds CD1 Low (19966), the positive 3-day statistic (89%) will be met.

There is a hope for an increase in today’s “merry-go-round” trading with the Fed’s JPOW Presser.

Of course, there are no changes to the PTG… simply follow your plans. Triple your setup and manage your $risk. There is always a hard stop loss for exchanges.

PTG’s Primary directive (PD) that’s right Always be consistent in The dominant force.

So the scenario to consider for today’s trading.

Bull scenario: Prices maintain bids above 20036+- and initially target the 20200-20240 zone.

Bear scenario: Prices maintain offers below 20036+- and initially target the 19966-19900 zone.

PVA High Edge = 19949 PVA Low Edge = 19839 Prior POC = 19900

NQM

Economic Calendar

Trade Strategy: Our tactical trade strategy simply remains unchanged. Both the long side and the short side can be traded from the pivot level. Keep focused Bull/Bear Stacker and Premium/Discount. As always, when you are consistent with the dominant power within the day, you will increase your chances of generating a winning trade.

Keep focused…not bias…discipline Always use the stop!

Good deal…David

“It’s not enough to know. You have to apply. You’re happy to not enough. We have to.” –br

*****This Trade Strategy Report is popular for “education only” purposes and should never be considered a recommendation for buying and selling futures products. ”

Past performances do not necessarily indicate future outcomes

Important note! No representation has been made that the use of this strategy or system or trading method will generate profits. Past performances do not necessarily indicate future outcomes. There is a substantial risk of losses related to trading securities and options on stocks. You should only use risk capital. Traded securities are not suitable for anyone.

Disclaimer: Futures, options, and currency trading all have great potential rewards, but also great potential risks. To invest in these markets, you need to be aware of the risks and willing to embrace them. Don’t trade with money you can’t afford to lose.

This website is not a solicitation or offer to buy or sell futures, options, or currency. No representation has been made that the account is likely to achieve similar profits or losses as discussed on this website. Past performance of trading systems or methodologies does not necessarily indicate future outcomes.

CFTC Rule 4.41 – Performance outcomes have certain limitations on hypothetical or simulated performance outcomes. Unlike real performance records, the simulated results do not represent actual transactions. Additionally, the transaction is not running, so the results could be less than the impact, if any, if there were certain market factors, such as lack of liquidity. Generally, simulated trading programs are subject to the fact that they are designed with the benefit of hindsight. No representation has been made that the account may achieve similar profits or losses as indicated.