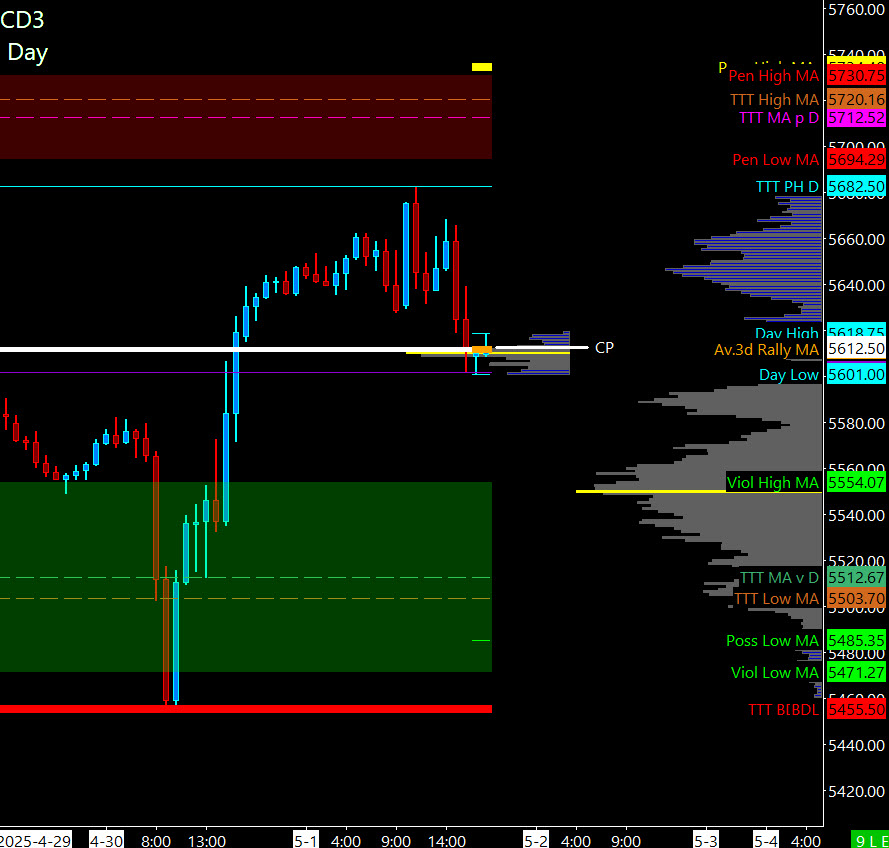

S&P 500 (ES)

It was a previous session 2 days of cycle: Normal As prices immersed in the responsiveness and sustained bids of previous high discoveries, CD2 unfolded, promoting and expanding the rally meeting 5673 PT as it has been outlined previously DTS Briefing 5.1.25. Note the CD2 pattern on the right (see graphics). The range was 80 points on the exchanged 1.307 contract.

I was grateful when the plans came together, as outlined in the previous evening. 🙂🙂🙂

Free trial Link to PTG/Taylor 3-Day Cycle

Click this link for a more detailed summary of the trading session. trading Room Summary 5.1.25

…Transition from day 2 to day 3 of cycle

I will move to 3 days of cycle: Price targets have been fulfilled, and prices have now reached short-term balances.

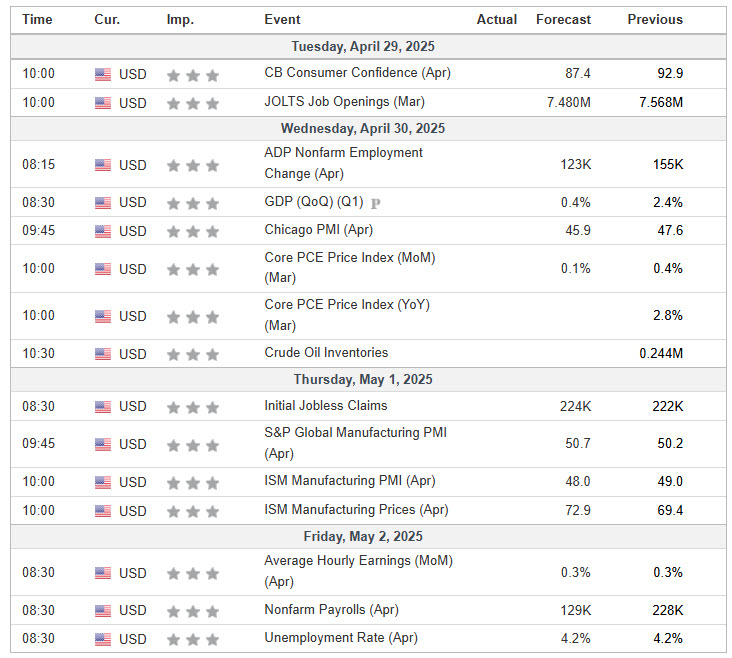

Today is a very important non-farm salary (Jobs Report), so today I will mark it as a “wild card” for direction.

Market expectations

Economists surveyed by Dow Jones Newswires and The Wall Street Journal predict that the report would show an increase in employment of around 133,000 in April, down from the 228,000 added in March . This slowdown in job growth has been attributed to several factors, including the recent economic contraction and the impact of tariffs on various sectors.Investopedia+1Moomoo+1

Economic context

Future NFP releases will gain importance against the background of economic challenges.

-

Economic contraction: The US economy experienced contraction in the first quarter of 2025, showing its first such decline in three years .Reuters

-

The impact of customs duties: President Donald Trump’s tariff policy is linked to a negative impact on the US economy as certain stocks are observed in the manufacturing sector. .Reuters+2Investopedia+2Business Insider+2

-

The Struggle of the Manufacturing Sector: Research shows that manufacturing sectors aimed at benefiting from tariffs are instead frozen in the face of layoffs. .Investopedia

Recent market trends:

Ahead of the NFP release, the SPDR S&P 500 ETF Trust (SPY) closed at $558.47, an increase of 0.70% from the previous day . Investco QQQ Trust Series 1 (QQQ) ended at $481.68, winning 1.20% . Meanwhile, the SPDR Gold Shares ETF (GLD) fell 2.07% to $297.46. .

Investors and analysts will watch carefully the April NFP report on insight into the US labor market and its potential impact on monetary policy.

Of course, there are no changes to the PTG… simply follow your plans. Triple your setup and manage your $risk. There is always a hard stop loss for exchanges.

PTG’s Primary directive (PD) that’s right Always be consistent in The dominant force.

So the scenario to consider for today’s trading.

Bull scenario: Prices maintain bids of over 5610+, initially targeting the 5635-5650 zones.

Bear scenario: Prices will maintain offers below 5610+- and initially target the 5590-5580 zones.

PVA High Edge = 5665 PVA Low Edge = 5634 Prior POC = 5644

ESM

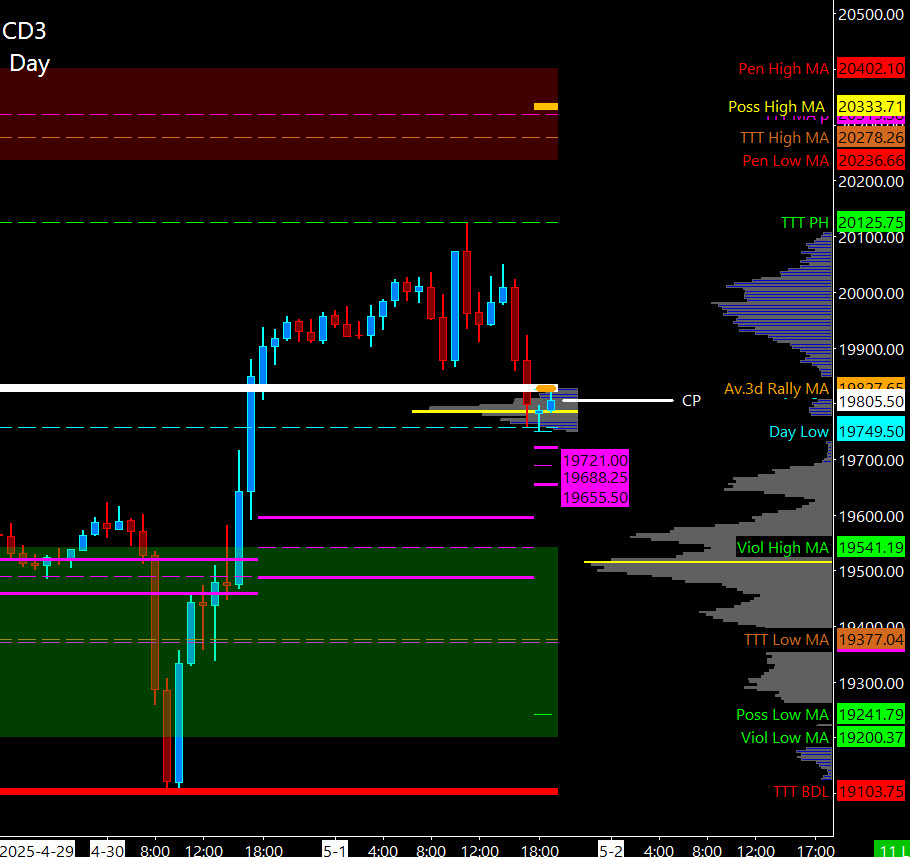

Nasdaq (NQ)

It was a previous session 2 days of cycle: Normal CD2 was deployed as prices fell to advance the rally meeting the 19985 PT, as previously outlined, and to discover extended responsiveness and sustained bids in advance DTS Briefing 5.1.25. The range was 368 points in exchange for the 581K contract.

…Transition from day 2 to day 3 of cycle

I will move to 3 days of cycle: Price targets have been fulfilled, and prices have now reached short-term balances.

Today is a very important non-farm salary (Jobs Report), so today I will mark it as a “wild card” for direction.

Friday is the day of capital preservation!

Of course, there are no changes to the PTG… simply follow your plans. Triple your setup and manage your $risk. There is always a hard stop loss for exchanges.

PTG’s Primary directive (PD) that’s right Always be consistent in The dominant force.

So the scenario to consider for today’s trading.

Bull scenario: Prices maintain bids above 19825+- and initially target the 19915-19975 zone.

Bear scenario: Prices are 19825+ – Maintaining the following offers, initially targeting the 19710-19690 zone.

PVA High Edge = 20025 PVA Low Edge = 19915 Prior POC = 19975

NQM

Economic Calendar

Trade Strategy: Our tactical trade strategy simply remains unchanged. Both the long side and the short side can be traded from the pivot level. Keep focused Bull/Bear Stacker and Premium/Discount. As always, when you are consistent with the dominant power within the day, you will increase your chances of generating a winning trade.

Keep focused…not bias…discipline Always use the stop!

Good deal…David

“It’s not enough to know. You have to apply. You’re happy to not enough. We have to.” –br

*****This Trade Strategy Report is popular for “education only” purposes and should never be considered a recommendation for buying and selling futures products. ”

Past performances do not necessarily indicate future outcomes

Important note! No representation has been made that the use of this strategy or system or trading method will generate profits. Past performances do not necessarily indicate future outcomes. There is a substantial risk of losses related to trading securities and options on stocks. You should only use risk capital. Traded securities are not suitable for anyone.

Disclaimer: Futures, options, and currency trading all have great potential rewards, but also great potential risks. To invest in these markets, you need to be aware of the risks and willing to embrace them. Don’t trade with money you can’t afford to lose.

This website is not a solicitation or offer to buy or sell futures, options, or currency. No representation has been made that the account is likely to achieve similar profits or losses as discussed on this website. Past performance of trading systems or methodologies does not necessarily indicate future outcomes.

CFTC Rule 4.41 – Performance outcomes have certain limitations on hypothetical or simulated performance outcomes. Unlike real performance records, the simulated results do not represent actual transactions. Additionally, the transaction is not running, so the results could be less than the impact, if any, if there were certain market factors, such as lack of liquidity. Generally, simulated trading programs are subject to the fact that they are designed with the benefit of hindsight. No representation has been made that the account may achieve similar profits or losses as indicated.