S&P 500 (ES)

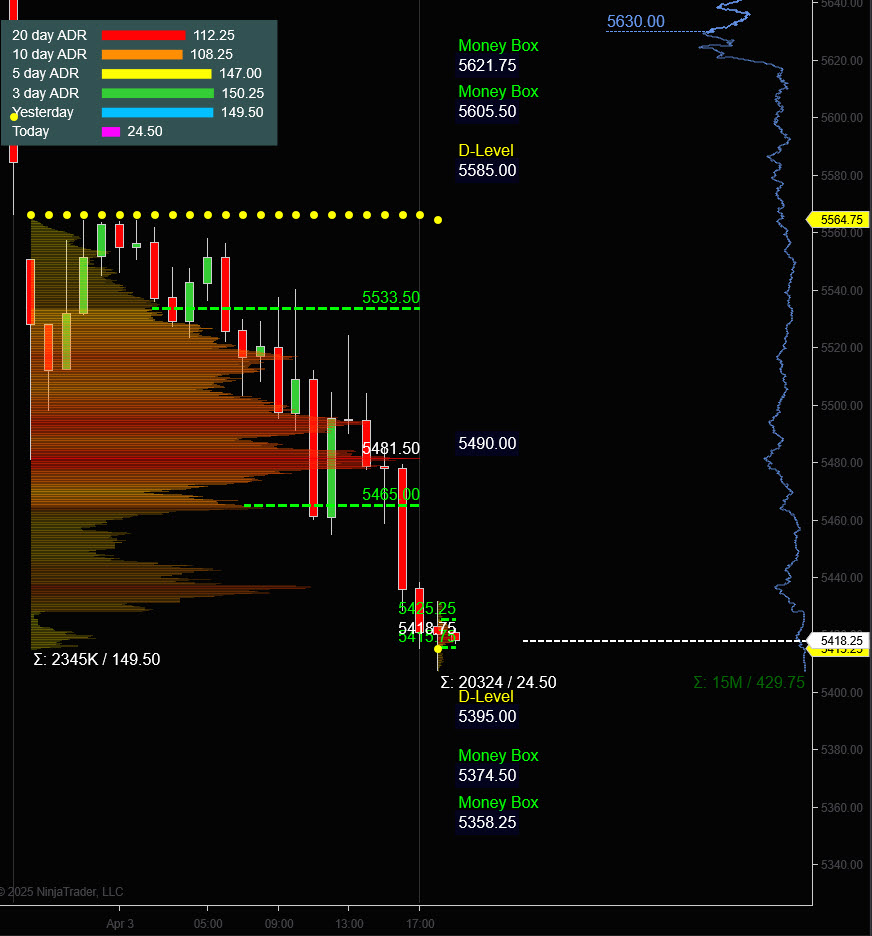

It was a previous session 1 day cycle: As prices fell, reached violation level and established a new cycle of 5415.25, sales on the first day of this cycle no longer faded and reached violation level. One of our community traders @Manny provided a graphical interpretation from his lens.

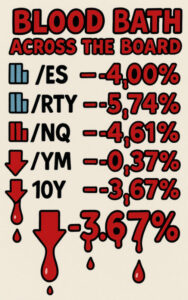

As depicted, there was no place to hide from the onslaught of sustained sales pressure. The scope of this session was 149 handles on the exchanged 2.345m contract.

PTG Glossary

Free trial Link to PTG/Taylor 3-Day Cycle

Reconstruct negative beliefs into something that reinforces them

Click this link for a more detailed summary of the trading session. trading Room Summary 4.3.25

…Transition from 1st day to 2nd day of cycle

…Transition from 1st day to 2nd day of cycle

I will move to 2 days of cycle: Prices have fallen by around 9% from their all-time high on February 19th, with no indication of a tradeable bottom pattern.

Mantra that it is the last trading day of the week “Sales will continue until morale improves.” This is the theme of current momentum.

Given that it’s a CD2 today, the Bulls have the opportunity to stabilize by selling price action heading into the weekend. Investors will receive their first QTR investment statement, so there is a possibility of $ risk of Monday’s approach/$selling off.

Of course, there are no changes to the PTG… simply follow your plans. Triple your setup and manage your $risk. There is always a hard stop loss for exchanges.

PTG’s Primary directive (PD) that’s right Always be consistent in The dominant force.

So the scenario to consider for today’s trading.

Bull scenario: Prices will maintain bids above 5415+, initially targeting the 5455-5465 zones.

Bear scenario: Prices will maintain offers below 5415+- – and initially target the 5395-5390 zones.

PVA High Edge = 5533 PVA Low Edge = 5465 Prior POC = 5482

ESM

Nasdaq (NQ)

It was a previous session 1 day cycle: The first day of textbook cycle fell, reaching violation levels, establishing a new low cycle of 18614. The bull continued “Sliding the soap” I can’t find solid traction during this session. The range was a 563 handle on the exchanged 871k contract.

…Transition from 1st day to 2nd day of cycle

I will move to 2 days of cycle: Prices have dropped by around 14% from the all-time high of December 16, 2024, with no indication of a tradeable bottom pattern.

CD2 is usually for balance and integration to curb current momentum sales.

Of course, there are no changes to the PTG… simply follow your plans. Triple your setup and manage your $risk. There is always a hard stop loss for exchanges.

PTG’s Primary directive (PD) that’s right Always be consistent in The dominant force.

So the scenario to consider for today’s trading.

Bull scenario: Prices maintain bids above 18614+, initially targeting the 18750-18840 zone.

Bear scenario: Prices are 18614+ – Maintain the following offers and initially target the 18550-18500 zone.

PVA High Edge = 19036 PVA Low Edge = 18796 Prior POC = 18876

NQM

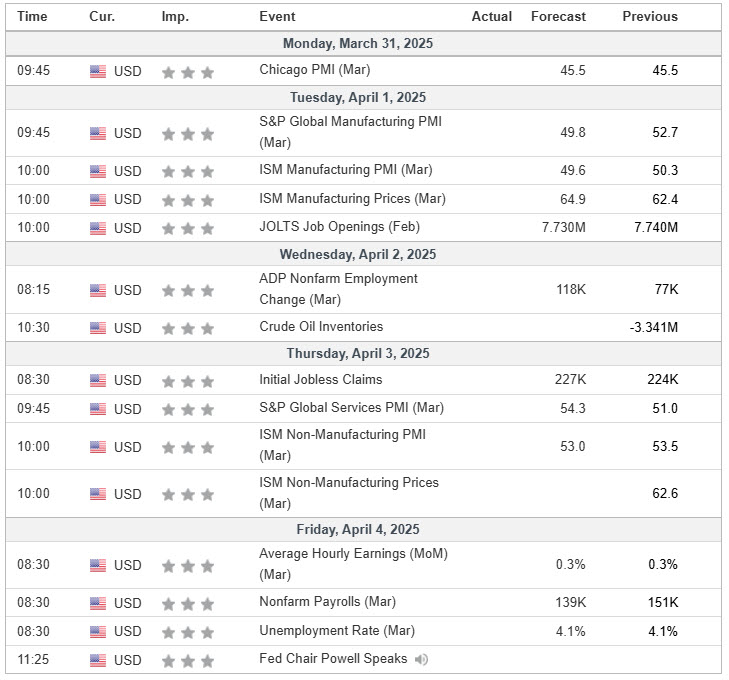

Economic Calendar

Trade Strategy: Our tactical trade strategy simply remains unchanged. Both the long side and the short side can be traded from the pivot level. Keep focused Bull/Bear Stacker and Premium/Discount. As always, when you are consistent with the dominant power within the day, you will increase your chances of generating a winning trade.

Keep focused…not bias…discipline Always use the stop!

Good deal…David

“It’s not enough to know. You have to apply. You’re happy to not enough. We have to.” –br

*****This Trade Strategy Report is popular for “education only” purposes and should never be considered a recommendation for buying and selling futures products. ”

Past performances do not necessarily indicate future outcomes

Important note! No representation has been made that the use of this strategy or system or trading method will generate profits. Past performances do not necessarily indicate future outcomes. There is a substantial risk of losses related to trading securities and options on stocks. You should only use risk capital. Traded securities are not suitable for anyone.

Disclaimer: Futures, options, and currency trading all have great potential rewards, but also great potential risks. To invest in these markets, you need to be aware of the risks and willing to embrace them. Don’t trade with money you can’t afford to lose.

This website is not a solicitation or offer to buy or sell futures, options, or currency. No representation has been made that the account is likely to achieve similar profits or losses as discussed on this website. Past performance of trading systems or methodologies does not necessarily indicate future outcomes.

CFTC Rule 4.41 – Performance outcomes have certain limitations on hypothetical or simulated performance outcomes. Unlike real performance records, the simulated results do not represent actual transactions. Additionally, the transaction is not running, so the results could be less than the impact, if any, if there were certain market factors, such as lack of liquidity. Generally, simulated trading programs are subject to the fact that they are designed with the benefit of hindsight. No representation has been made that the account may achieve similar profits or losses as indicated.