I frequently check in to see items floating around Wall Street circles and blogs.

-

Long-term trends in markets and economies.

-

Additional details about what appears to be underestimated or exaggerated.

-

Link to some great explanators about the concept.

** Everything about 5/31/2025

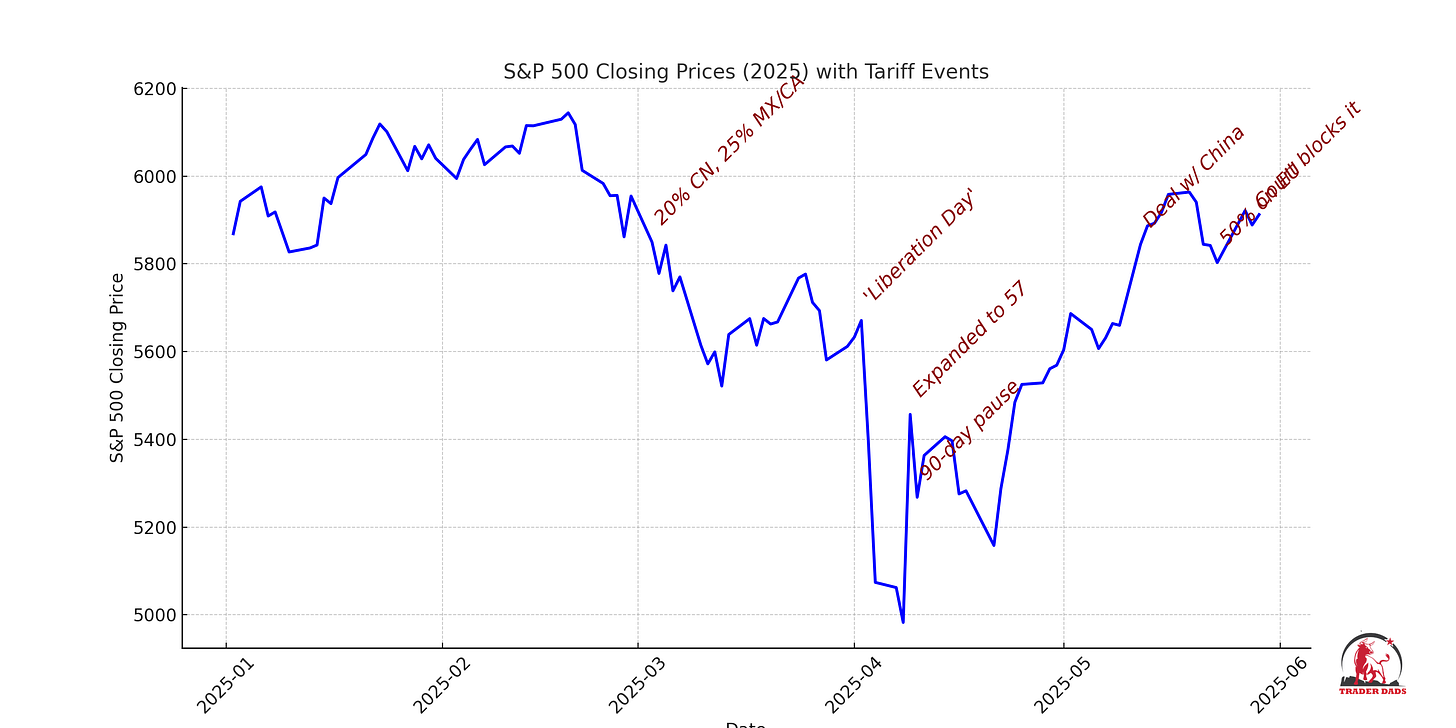

The S&P 500 won the best month of 6.2%, with the best month since May since 1990 and the best since November 2023. The Dow rose 3.9% in May, while the Nasdaq surged nearly 10%.

This sounds impressive until you think SPX will drop by 5.75% in March and another 0.7% in April 2025 (at most 17.6% drawdown))

So, where will all that volatility leave us this year? that Tower of Terror Freefall and rebound trips were nothing more than whipping investors, a higher Bix floor, and a loss 0.51% YTD return.

Experts, research analysts and public are part of the unstable tariff announcement from the White House, which causes the swing, and at first glance it seems like that. However, I argue that some common sense and visionary valuation models were able to save a lot of stress and avoid or endure dips that would likely set some big, low-risk purchase opportunities.

If there is one first sin of market theory, it is Efficient market hypothesis.

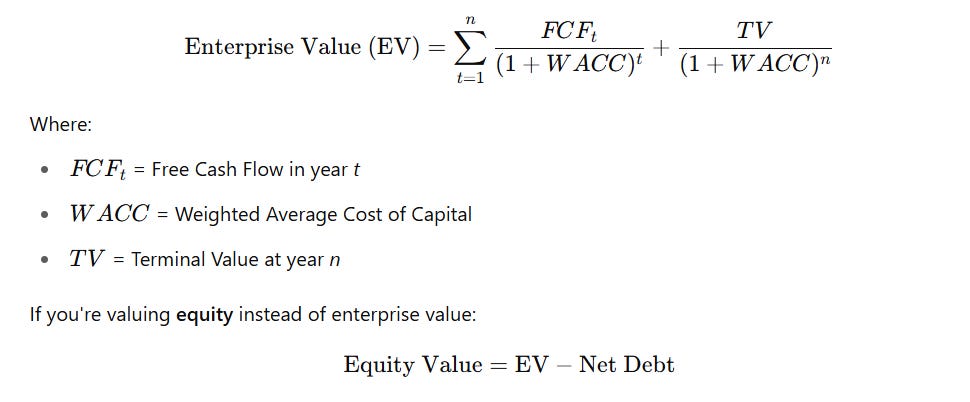

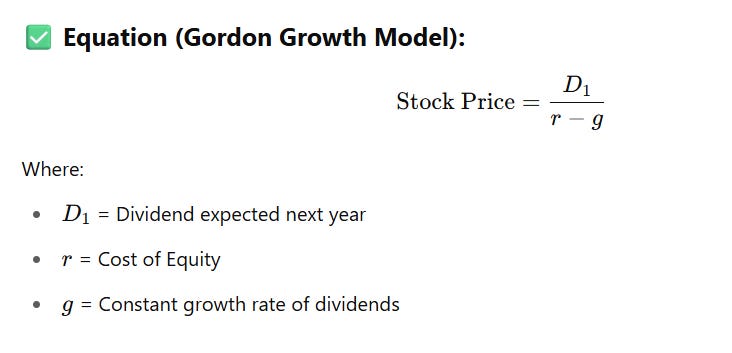

The basic idea of EMH is that the price reflects all the information available. This premise follows two major stock price models: Discounted Cash Flow (DCF) and Dividend Discount Model (DDM) immediately Update the updated values and model inputs This is based on how this will proceed in the future.

Discounted Cash Flow –

Dividend Discount Model (Gordon Growth) –

For the Spring 2025 announcement, the assumption added to the model is that tariff charges will pay the government tariff fees or inherently emit cash flow companies as they will lose sales from increased costs/supply crunch entirely.

Therefore, the molecules drop

But does the model take sanity and politics into consideration? It’s definitely not!

In the short term, the market is a voting machine, but in the long term it is a metering machine. Benjamin Graham

This assumption results in excellent, accurate, instantaneous pricing, but the model cannot generalize to future market conditions, leading to inaccuracies in forecasts and ultimately losses. In poker, this probably doesn’t take into account the implicit odds To play hands.

-

Is it reasonable to assume that tariffs will remain at +125% for a very long time?

-

Is it reasonable to assume that if a billionaire line feels distressed with holding a portfolio, it won’t reach a deal as soon as it is?

-

Is it reasonable to think that some companies will grasp workarounds to recover sales and margins?

All dramas that are accurate and accurate at this time could not see the simple implicit prediction that policy measures by novice economics and trade teams would soon be reversed or invalidated.

The result was a lesson in a hurry to buy crowds and dip buyers, hugging buyers, and “perfect” information too fast to learn models too fast.

Are you interested in joining the Trader Papa Podcast in 2025? Shoot the email! I want you to sit for discussion

thought? question? comment?

Reach out! Maybe I’ll post the full topic or as a Q&A

corderdads@substack.com