Moore continues to govern (economic) errors and is currently working on the CBO’s (and JCT) records on forecasting. “Save us from the CBO”

…Mr. Hassett has revealed issues that have been transforming Washington into a bad policy for decades.

The most powerful forces in Capitol Hill are the Speaker of the House and not the Senator, but the CBO and JCT. These two unelected institutions are predicting how law will change spending and income over the next decade. In many cases, these predictions are very off-basic.

Before relying on what he claims, it is useful to remember that Mr. Moore (who doesn’t have a PhD, I don’t think he’s ever been to the CBO’s modest office) made the following claim:

Stephen Moore lies, lies, lies (and therefore belongs to the Trump NEC).

Polling data analysis by Stephen Moore

Stephen Moore: “Coal is number one when it comes to electricity.”

Stephen Moore’s analysis of income tax and employment growth

More documents on “Stephen Moore is a Liar”

Stephen Moore is a liar, part 2

Stephen Moore is a liar

CNN: Fire this clown

Development of homosocial reproduction and economic policy in the White House

“The Economics of the Supply Side of Tooth Fairy and Slip Dic”

All governors’ subordinates (economists)

State Employment Trends: Are Low Tax/Right-Right/Low Minimum Wage Regime Corresponded to Growth?

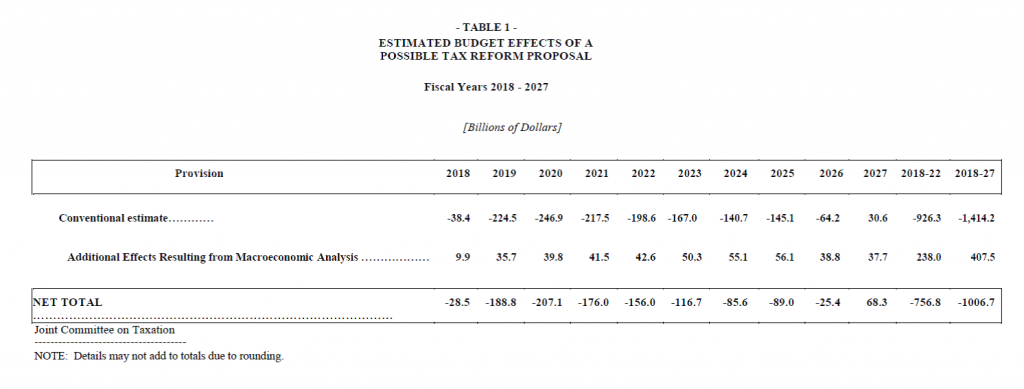

Return to projection. As far as I know, I have a JCT (not a CBO, but not reported in the CBO document) that estimates the estimate of deviation from baseline.

sauce: JCT (November 30, 2017).

In a way he knows that CBO’s “fiscal effect” estimates are modest, he does not cite the research, does not show calculations, or indicates whether the underestimation is more than five years of horizon or more than ten years. there is Management and CBO revenue forecast assessmentno significant defects in CBO revenue estimates were shown for 2018-2019. Therefore, given Moore’s preference for data errors, I would be wary of taking his claims at face value.

I do Know that nominal and real GDP and inflation CBO projections are comparable to blue chip predictions and are equal for decades to be slightly less than dosing predictions (see this 2023 CBO evaluation).

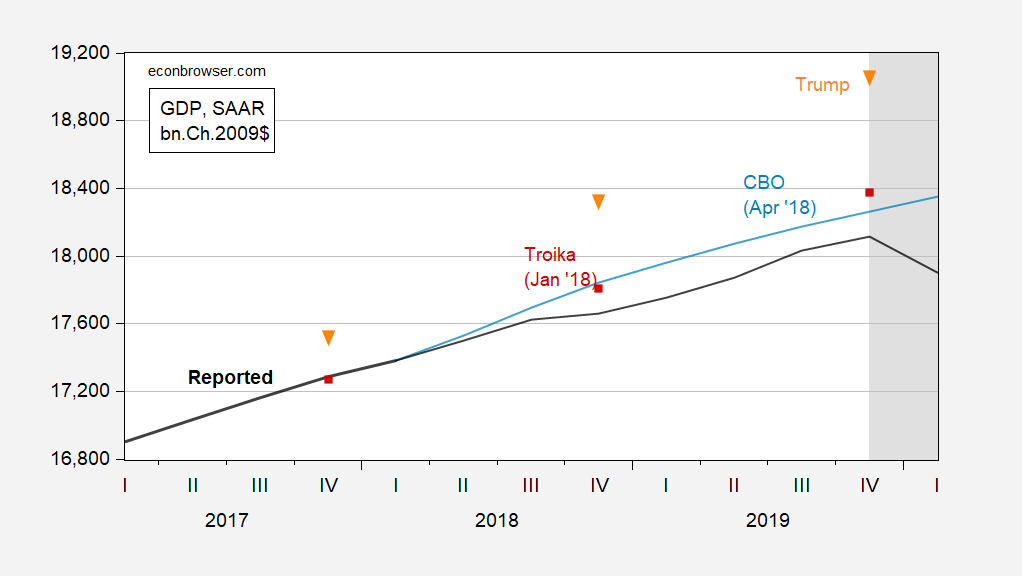

This is the CBO vs. Trump administration (incorporating the JCTA).

Figure 1: GDP (black), CBO (light blue), Troika/Management (Red Square), Donald Trump (Orange Triangle), All Bn.Ch.2009 $SAAR. The inter-peak recession as defined by Nber is shaded in grey. Source: BEA, CBO (April 2018), President’s Economic Report, 2018, CNBCnber, and author calculations.