Goldman Sachs has reduced the chance of a recession from 35% to 30% in the next 12 months to 45%.Reuters). It is important to note that these forecasts are conditional on future policy paths. These times are less clear than ever.

This is my math.

The current quota set for Ice Summary/Removal is 3000/day. If that pace is achieved (which almost certainly scoops up more than criminals), then about 1.1 million people will be removed a year later.

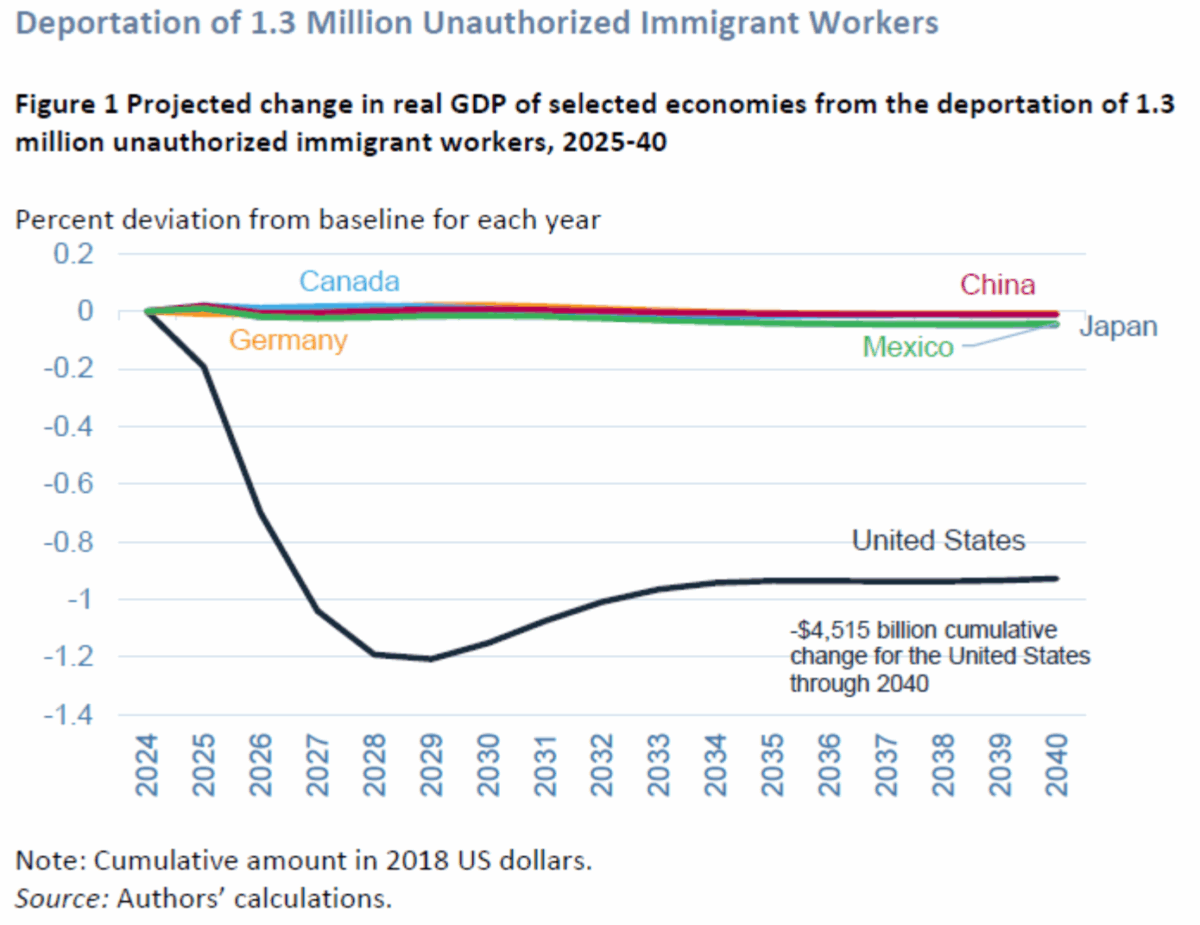

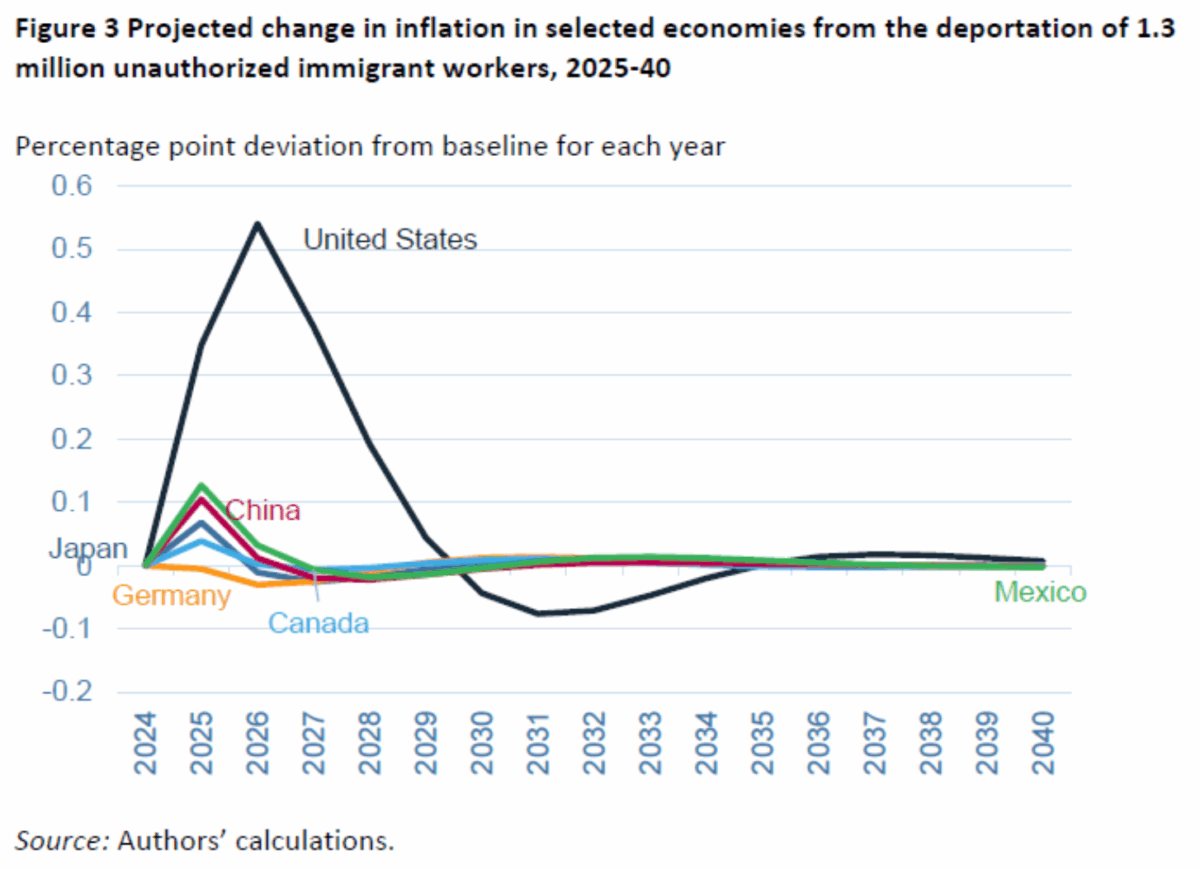

McKibben, Hogan, Noland (2024) 1.3 million simulation estimates have been removed.

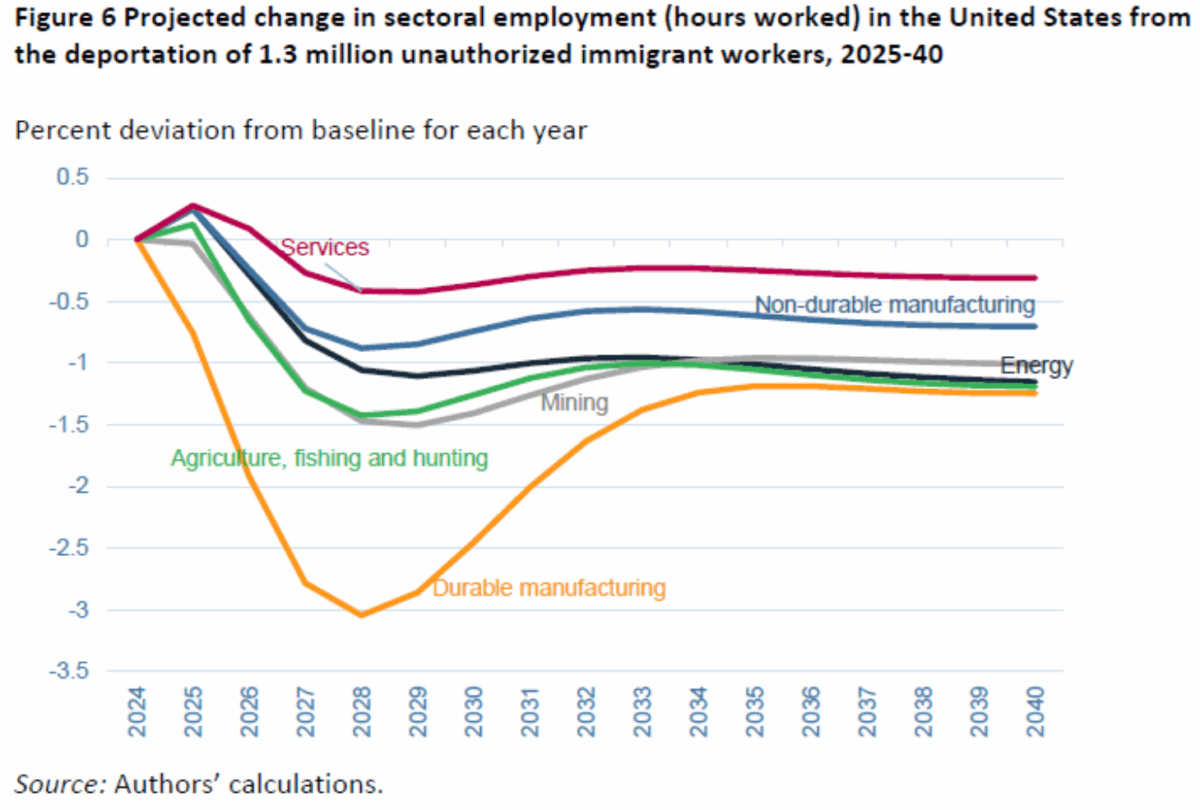

Interestingly, the impact on employment in durable manufacturing seems to be quite large, much larger than that in agriculture, fishing and hunting. The idea that the impact is heavily limited to agricultural employment seems to be wrong in both conditions and absolute numbers (around 800,000 workers in agriculture and around 8 million in durable manufacturing).

The impact of 2026 looks rather modest – about 0.6 ppt deviation from baseline. Please note that the estimate is deportation/removal only. They do do not have Includes customs duties. Assuming the current suspension conditions apply, the lower limit estimate from trade policy is -0.3 PPT for 2026, as China (including past tariffs) holds a universal 10% tariff of around 45%. With retaliation, that -0.9 PPTS.

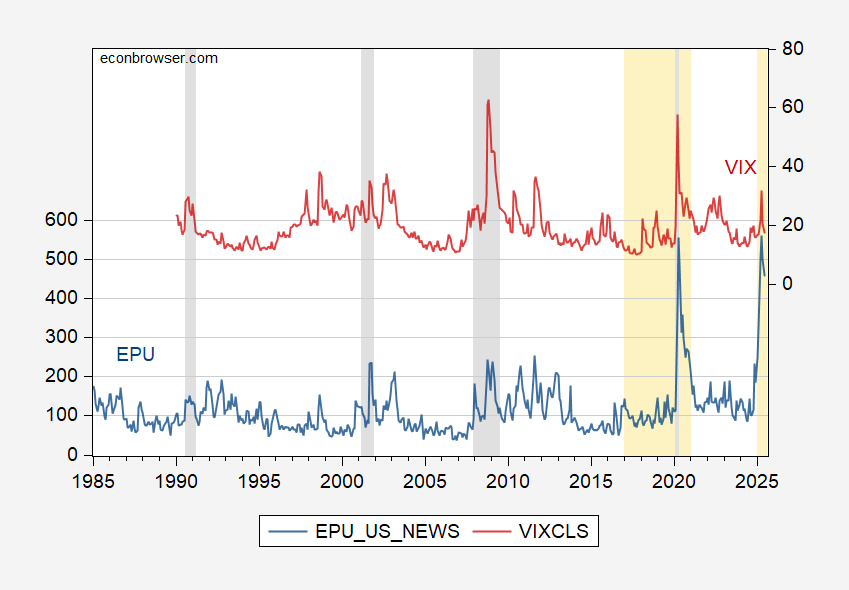

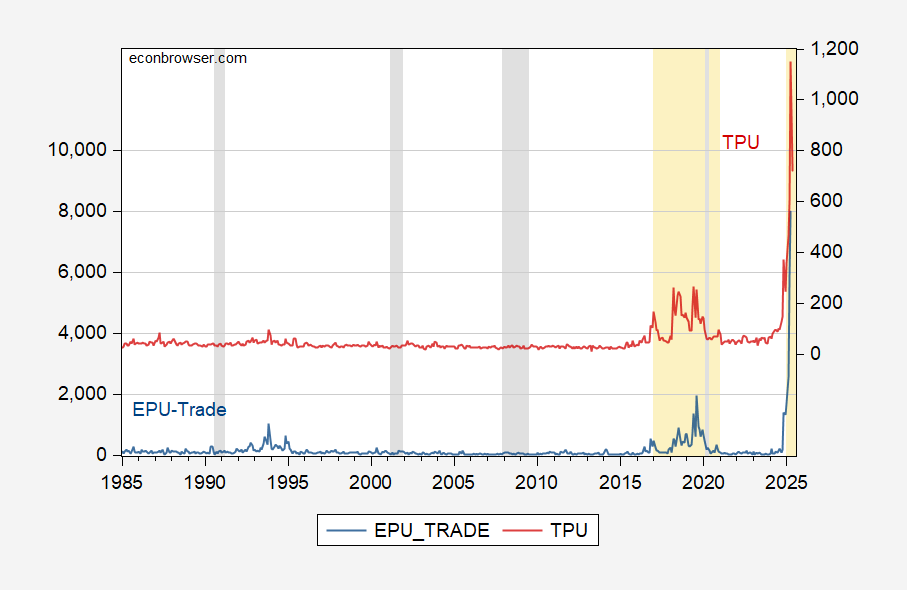

One point is that these estimates do not incorporate the effects of policy uncertainty. However, policy uncertainty has been found to be important, especially as policy uncertainty measured on the EPU is about four times as high as before Trump. Assuming linearity, Ferrara and Guerin (2018) estimates suggest that unemployment rates are about 2 ppt lower than otherwise. This means almost 1.5 pts lower GDP compared to counterfactuals.

Adding 0.6-0.9 gives you 1.5 ppts. But it adds policy uncertainty (it appears Trump is trying to maximize). This is added to 1.5 PPTS to 1.5 PPTS and totaled to 3 PPTS. If baseline growth is estimated to be 2.3 PPTS (using CBO in January 2025), GDP growth in 2026 will be negative.

So I’m making a conditional forecast here: deportation/removal is nearly 2.1 million, tariffs are universal at least 10%, and policy uncertainty permeates through the economy estimated using historical events, along with retaliation. One point is that policy uncertainty has not risen to these levels these days, with the exception of the first century community pandemic.

Figure 1: EPU (blue, left scale), VIX (red, right scale). The inter-peak recession as defined by Nber is shaded in grey. Light Orange indicates the Trump administration. Source: PolicyUncenterty.com, Cboe via Fred, Nber.

Figure 2: Epu-Trade (blue, left scale), TPU (red, right scale). The inter-peak recession as defined by Nber is shaded in grey. Light Orange indicates the Trump administration. Source: policyuncenternty.com, Iacoviello et al.nber.

Do you rely on forecasts for the first year of recession for the next six months? No, because policy changes implemented over the past five months were well anticipated (at least in the market), so it’s unlikely that normal mechanisms will work.