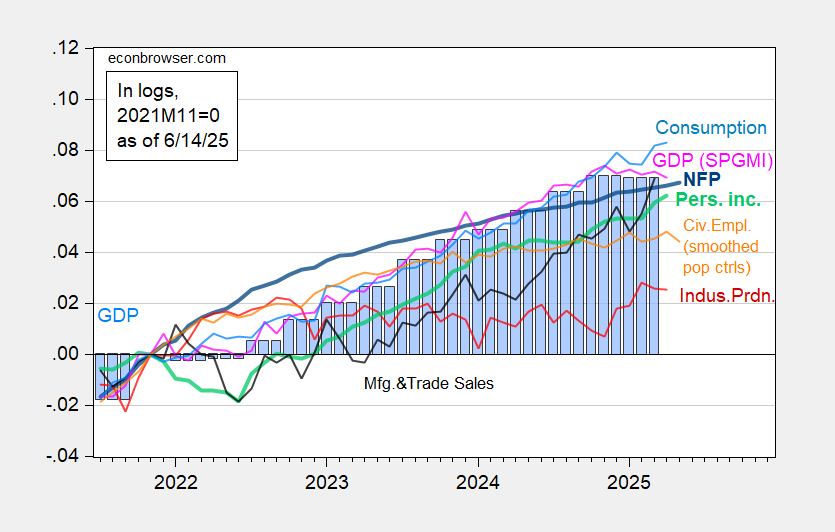

SPGMI’s monthly GDP includes the following photos from a series focused on by the NBER Business Cycle Dating Committee.

Figure 1: Benchmark revision of non-agricultural pay pay bands from CES (Bold Blue), smooth population control (orange), private employment using industrial production (red), personal income excluding current transfers of CH.2017 $ (BOLD Light Green), manufacturing and trade sales of CH.2017 $ (black), consumption of CH.2017 $, GDP (PICK), BRICH.2017 $) All logs were normalized to 2021M11 = 0. 2025Q1 GDP is the second release. Source: BLS via Fred, Federal Ferrment, Bea Insights into the S&P Global Market (NEE MacroeConomic Advisers, IHS Markit) (6/2/2025 release), and author calculations.

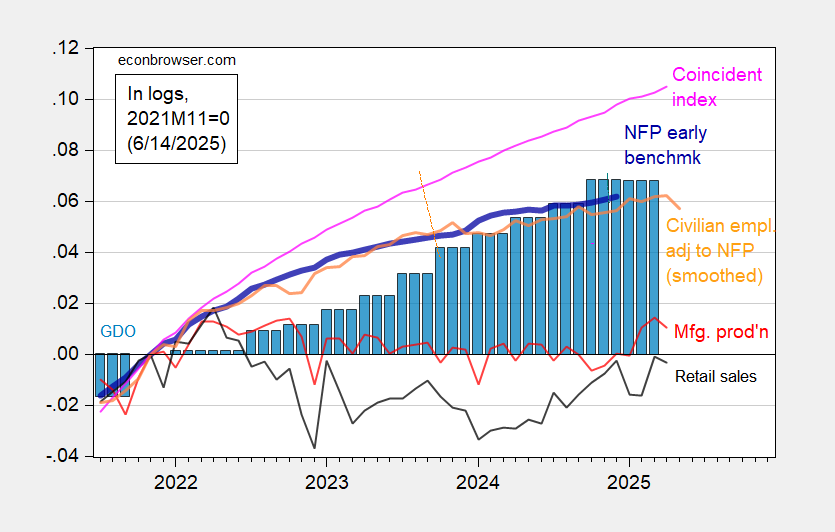

Some alternative indicators are shown in Figure 2.

Figure 2: Preliminary Non-Agricultural Payroll Early Benchmark (NFP) (Bold Blue), Civilian Employment Adjusted to the NFP Concept, Smooth Population Control (Orange), Manufacturing Production (Red), Real Retail Sales (Black), CH.2017 $ (PINK), GDO (Blue Bars), All logarithmic accidental index normalized to 2021M11 = 0. sauce: Philadelphia Fed [1], Philadelphia Fed [2]Fred, Bea 2025q1 via the second release, and author calculations.

Monthly GDP, civilian employment, private employment adjusted to the NFP concept, manufacturing production and retail sales all declined in recent months. Given the high level of sampling uncertainty, the home survey-based series had little weight. Nevertheless, there are plenty of “flat-like” series. Consumption rose in April, but it slowed down.

Interestingly, the Philadelphia federal government’s accidental index, which is supposed to track GDP, deviates substantially from monthly GDP (10.4% vs. 6.9%).

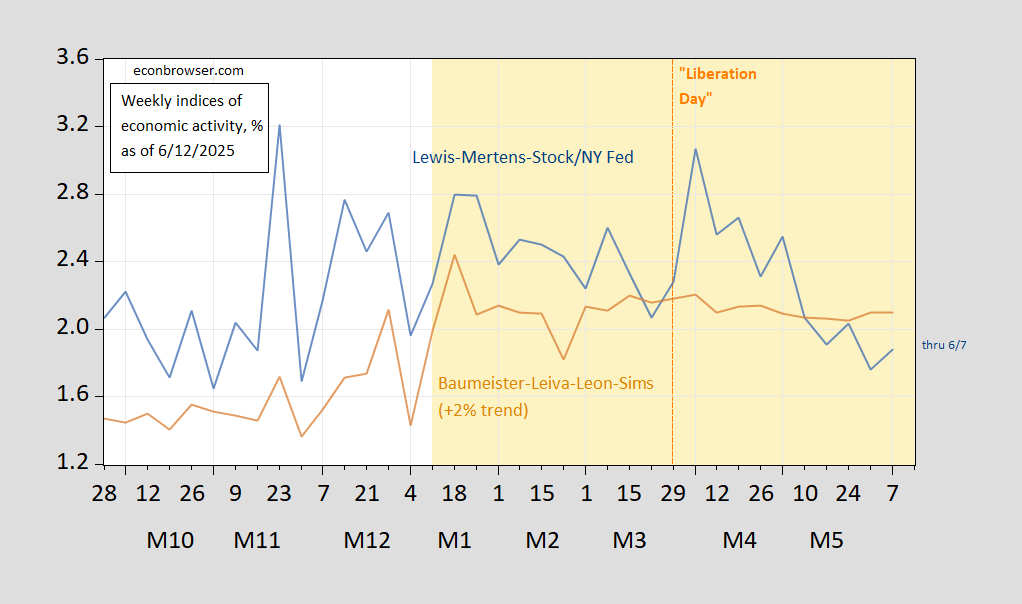

As explained in this post, the Lewis-Mertens-Stock Index slowed down until early June.

Figure 3: 2% trend (TAN) for Lewis, Mertens, Stock Weekly Economic Index (blue), and Baumeister, Leiva-Leon, Sims Weekly Economics Contion Index for US, all Y/Y growth rates. Source: Dallas Fed Via Fred, Weciaccessed 6/12/2025.

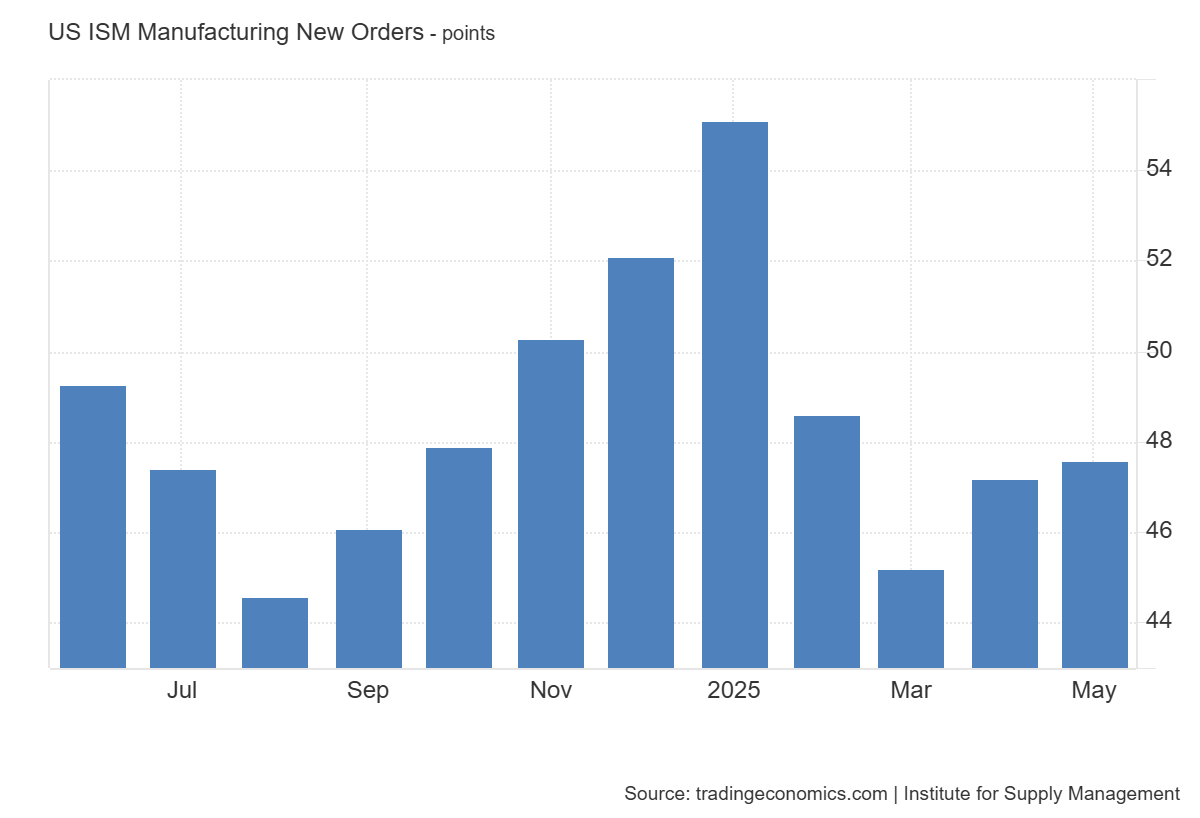

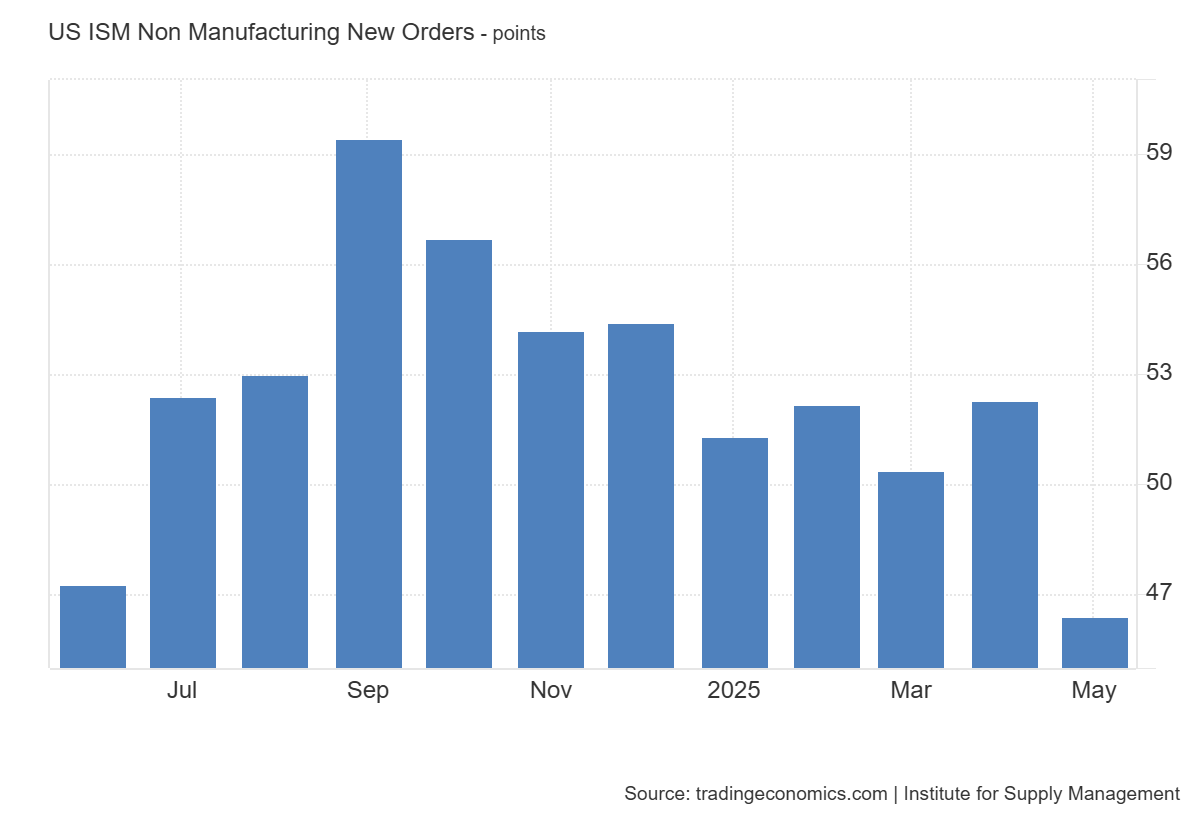

New PMI orders also suggest a slowdown, with both sectors registered under 50.