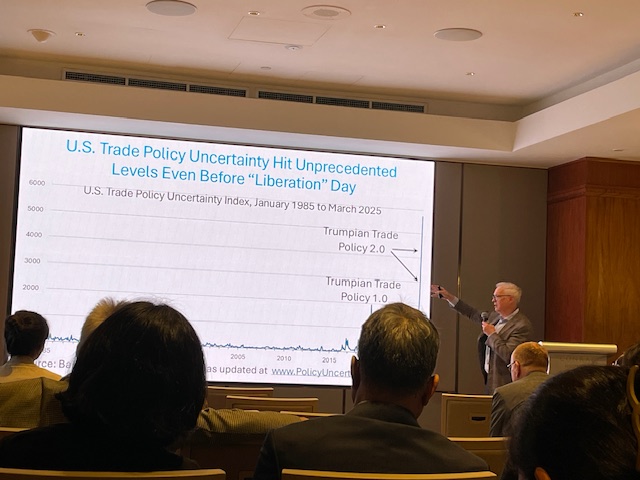

I attended a meeting in Singapore – actually two – Asia Bureau for the Annual Conference of Finance and Economic Research,and Asian Monetary Policy Forum. First, I attended a talk by Stephen Davis (Hoover) on “Measurement of policy uncertainty and assessment of results.” One slide almost summed up my feelings about these times…

The discussion really focused on new research into stock price jumps and their determinants.

in Asian Monetary Policy ForumAdam Posen (Peterson Iie) began his presentation for the day, noting that fragmentation into the block would dissipate the benefits he enjoyed in the wake of the fall of the Soviet Empire.

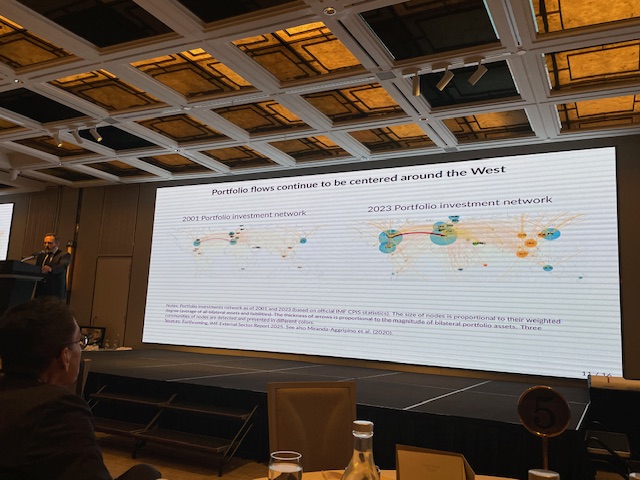

Pierre Olivier Gourinchas (IMF Research) provided insight into the ongoing work of the global economy. This shot shows the difference between trade and financial networks.

I apologize for the poor photography (the good thing I aimed for a career in economics…).

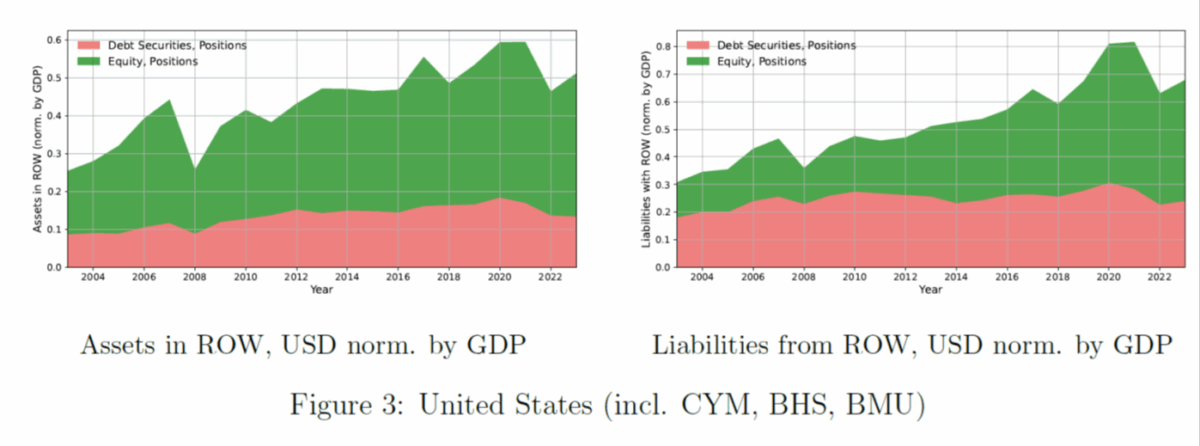

All cases were fascinating, including a commissioned paper by Helen Ray and Vania Stablakeva (both LBS) entitled “Interpreting Turbulent Episodes in International Finance.” Olivier Jeanne (JHU) and I were able to discuss. We have put in place a paper embargo, and I think we can share one graph that we find particularly interesting.

sauce: Rey and Stavrakeva (2025).

The value of the cross-border holdings of stocks currently exceeds the value of bonds (of all types). Therefore, given the determinants of exchange rates, it seems plausible to rely solely on bond yields as an important factor.