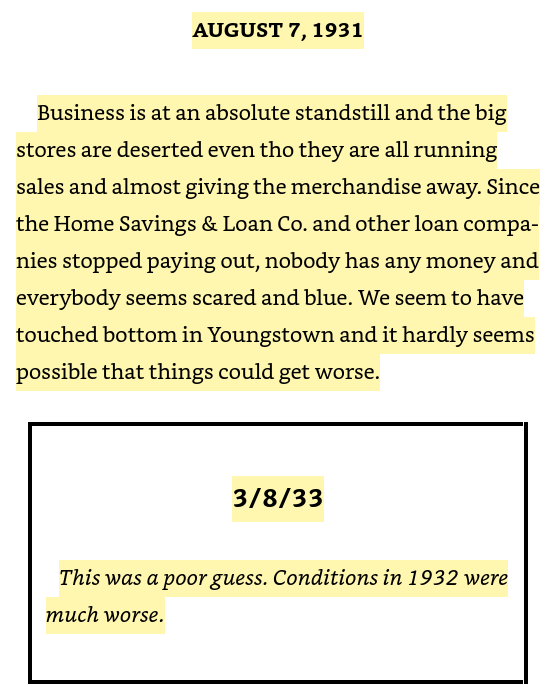

Great Repression: Diary It’s the best book written about the worst crash in history.

Most history books are written in the benefit of hindsight, but this is a real-time account from an Ohio lawyer and it was about what it’s like to overcome depression. Benjamin Ross also returned and made notes on previous passages as he proceeded.

This provides a good example of what it was like to live through this period of this never-ending economic conflict.

The constant beatdown of Great Fear Presion left a scar on people across generations.

the study It was found that babies with depression experience long-term negative effects on education, revenue and health. Those who spent that period were not willing to take risks, were more modest with their own money and were less likely to own stocks.

At the beginning of the pandemic, some people pondered whether they would experience similar outcomes of low-risk appetite. The unemployment rate rose by more than 14%. It seemed like all kinds of businesses were destined. The stock market crashed quickly. Things were dark.

Governments around the world then threw trillions of dollars on businesses, municipalities and households. We went to the race.

The assumption was that the speculative attitude ignited by the pandemic spending rampage was short-lived. For years, people have sought an end to these actions.

Wait until the professional sports bets return. People then give up on the stock market.

Wait until the meme stock epidemic is over. The retailer goes home with a tail between his legs.

Wait until all the pandemic’s oversavings are gone. It stops all consumer spending.

Wait until inflation hits. This will cause households to slap hatches.

Wait until it becomes a bear market. After that, everyone panic sells.

All of these voluntary critic deadlines remain strong in household appetite for risk.

Right now Wait until a once-in-a-lifetime crash occurs, like the Great Recession. Certainly, however, these crashes are by definition rare.

Everyone thinks about this idea through the lens of this behavior being cyclical.

My question is this: what happens if it’s secular?

What happens if people of all ages experience the opposition of a baby with depression? What if the pandemic turns the switch over for people who are more willing to take risks?

What does that mean in the future?

I’m still pondering the potential implications, but let’s first look at some of the evidence.

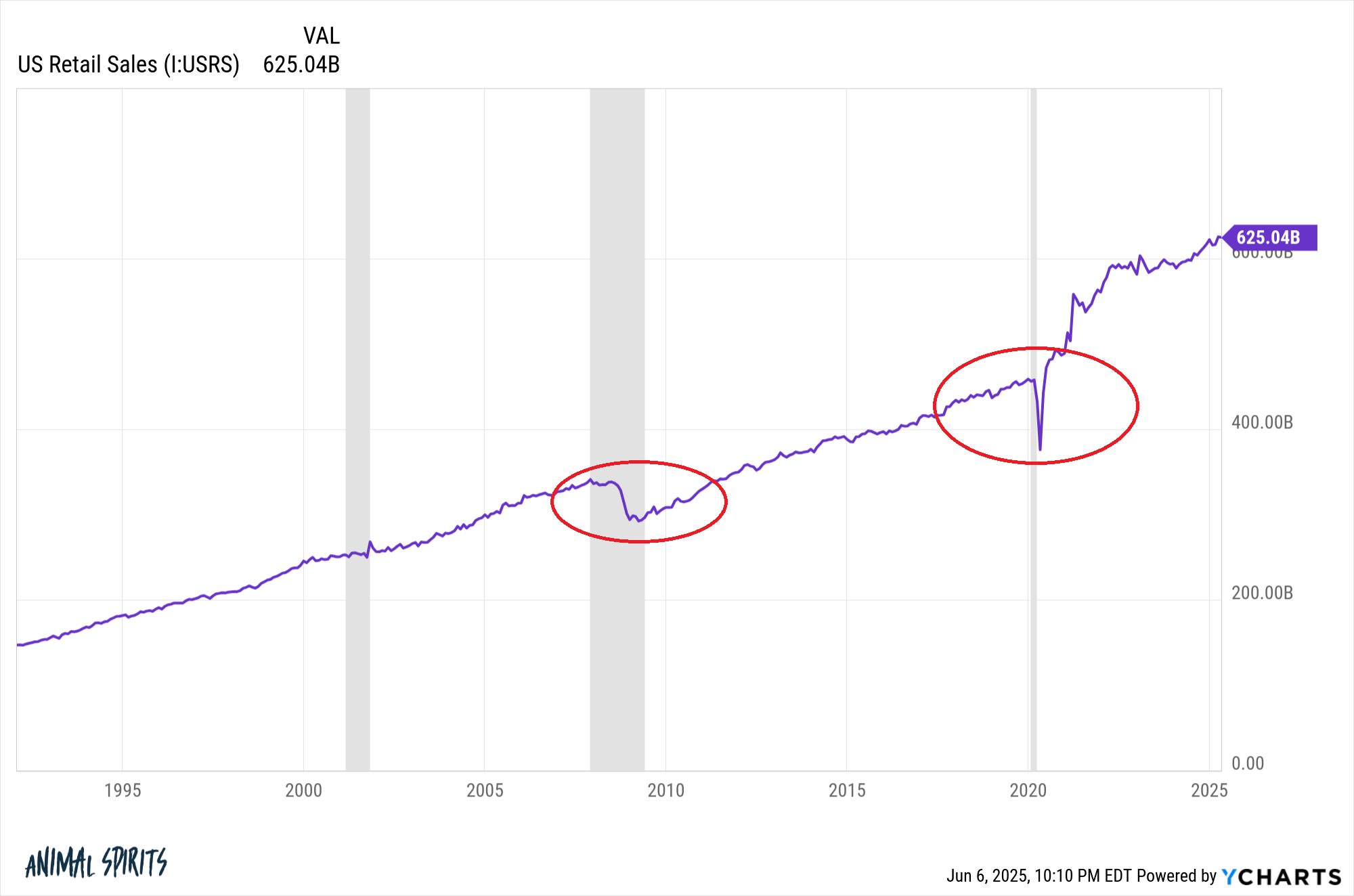

Consumer spending has knocked down Pegs following the Great Recession. In the 2020s, spending took off like a rocket1 And then we set out on a new trajectory:

Gallup For years, I’ve been tracking ownership in the stock market in my household:

After a massive increase in stock market ownership since the boom days of the 1990s, the household share of stocks fell to 52% by 2016 after peaking at 63% in 2004.

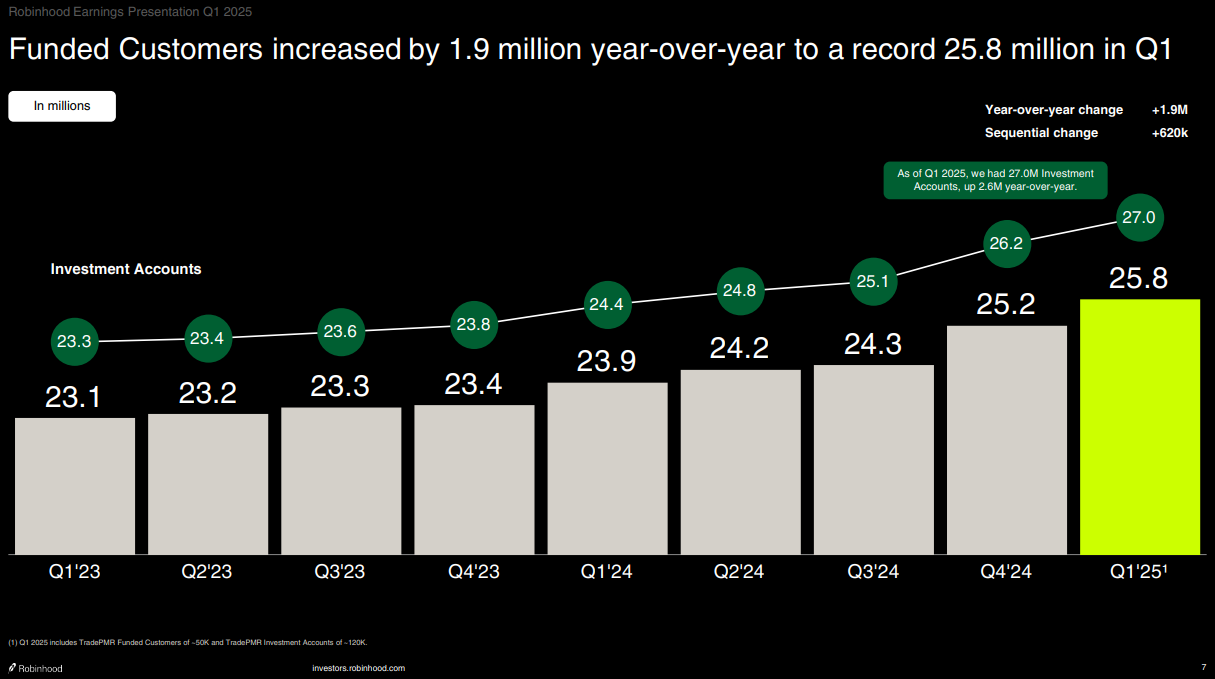

Now, a new generation of investors are entering the market, so it goes back to 62%.

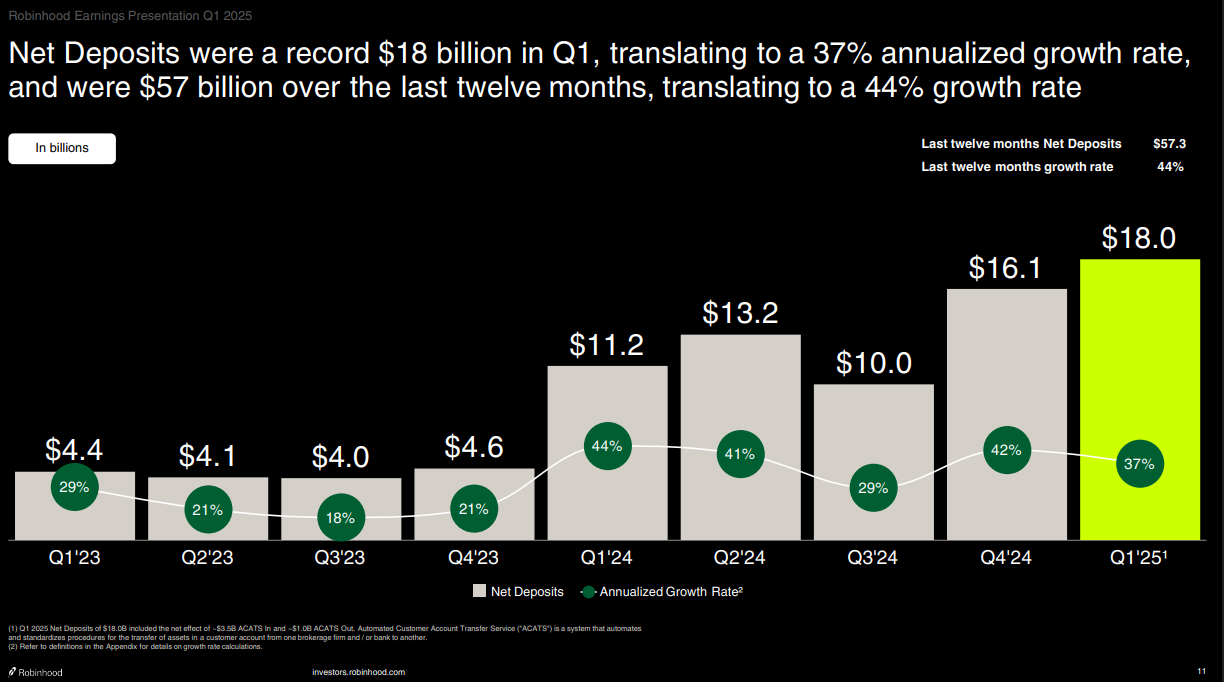

Robinhood currently has nearly 26 million customers.

For about half of these customers, it is their first securities account. And they will continue to concentrate their money on their accounts for more investment:

It’s not just stock.

Bitcoin could be the first financial asset owned by a retailer before institutional investors. Many early Bitcoin investors are younger. They were rewarded with huge returns, but there are also some bon-rushing crashes:

Bitcoin has dropped by more than 75% over the past eight years. Most investors hold despite their big losses.

In 2019, the amount of bets was less than $1 billion. In 2024, it was pretty much $150 billion.

People are happy with the risk. They are more comfortable with volatility. They are more comfortable spending money.

Now, perhaps the appetite for this new risk will disappear during the next recession. We have not experienced a real recession for over 15 years.2 Certainly, the slower risk attitudes and consumer spending behavior can result in wrist slaps in the form of a recession.

But what if we only get a recession of the escape?

What if this risk remains here?

Could that lead to more asset bubbles?

Could it lead to more frequent volatility and bare markets?

Could that lead to more V-shaped recovery?

I don’t know the answer to these questions. This is because it is difficult to predict how experiences shape the future and how the future shapes people’s actions.

But this has been going on for quite some time, so it is worth considering the idea that we can witness an entire generation of people who are willing to take risks.

This could have long-term impacts on the economy and markets for years to come.3

This week we discussed the idea in more detail about the Chicago Chop Shop complex and live recordings of friends.

https://www.youtube.com/watch?v=inxhy9lst0o

Read more:

Two of the biggest trends of the decade

1Some of this is of course from inflation, but the points remain.

2The pandemic recession is not counted. It was all too fast, even those who lsot their jobs, by higher unemployment insurance.

3And what if we get a recession that completely changes people’s behavior? Well, that’s humanity to you.