Francross, senior market strategist at Angel Oak Capital Advisor, discusses the impact of geopolitical uncertainty on the market after Israel attacks Iran.

After Israel launched an attack on Iranian nuclear sites, investors flocked to safer assets, including gold and US stocks.

All three of the US major averages fell on Friday, with the Dow Jones industrial average above 500 points or 1%, while the Nasdaq Composite and the S&P 500 lost 0.6% in the mid-afternoon.

| Ticker | safety | last | change | change % |

|---|---|---|---|---|

| I: DJI | Dow Jones average | 42357.97 | -609.65 |

-1.42% |

| SP500 | S&P 500 | 6002.5 | -42.76 |

-0.71% |

| I:comp | Nasdaq Composite Index | 19523.689538 | -138.80 |

-0.71% |

The strike, which began late Thursday, pushed up oil prices from mid-$70 to 11% per barrel level before halving those profits. Exxonmobil, Chevron and Conocophillips gathered, and the US Petroleum Fund ETF was making the highest profit since April.

Tehran, Iran – June 13: Views of damaged vehicles in Iranian capital Tehran following the attack. ((Photo by Fatemeh Bahrami/Anadolu by Getty Images))

Oil and energy

| Ticker | safety | last | change | change % |

|---|---|---|---|---|

| xom | Exxon Mobil Corp. | 111.64 | +1.90 |

+1.73% |

| CVX | Chevron Corp. | 145.24 | +0.27 |

+0.19% |

| Policeman | Conoco Phillips | 96.07 | +1.38 |

+1.46% |

“This will certainly cause some damage to the inflation statistics if they don’t return soon,” investor Louis Navellier wrote in a note to his client. Reports on consumer inflation or CPI show that prices are above the Fed’s 2% target level, but still showed some easing.

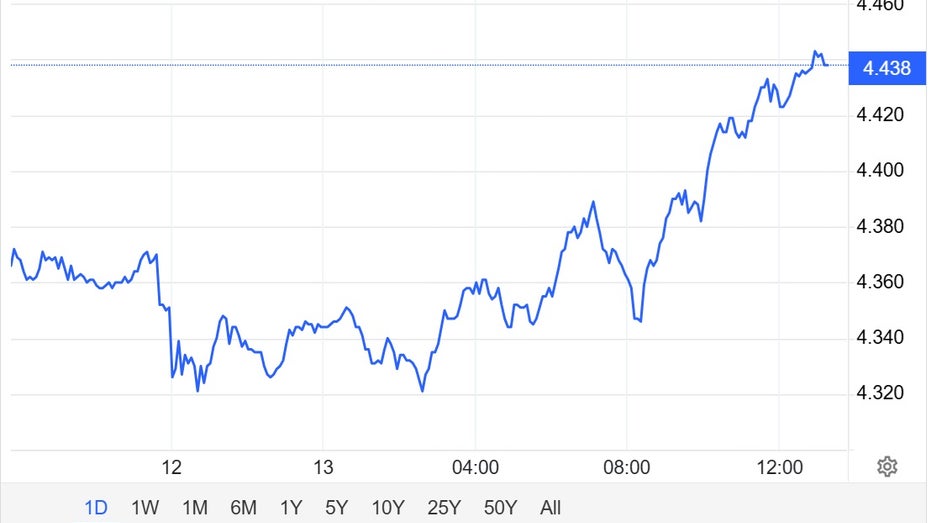

Bond yields rising

Bond yields were drifting lower, but in 2010 the Treasury marched higher above 4.4%, some leading to new inflation concerns.

“This is a classic flight to safety and you’re looking at the yields of your Treasury,” Frank Ross, senior market strategist at Angel Oak Capital Advisor, told Maria in the Morning. “Investors today are interested in the tensions that will be in the future,” he said.

Financial Revenues for 10 Years Old (TradingConomics)

Gold hits new records

Gold reached fresh records, reaching $3,500 per ounce, and was rallying in his third straight session. The SPDR Gold Trust Exchange Traded Fund is the largest fund supported by Physical Gold, heading towards a weekly pop of 3%.

Fed Watch

The Federal Reserve is not expected to adjust interest rates in next week’s meeting or in July. CME FedWatch Tooltracks the probability of movement of rates. There is a growing consensus that interest rate cuts could occur in September.

Trump’s name calls Fed Chair Powell

President Trump has been the public needle to completely reduce Federal Reserve Chairman Jerome Powell, and calls him “Nucskar” and “Mr. To Late” to maintain interest rates at current levels as a foreign counterpart, including the European Central Bank’s reduction rate.

Cryptocurrency

Bitcoin, the largest cryptocurrency by market value, is held at the $105,000 level, below the all-time high of $111,986.44.