United Health coming in April was the second-largest stock on the Dow behind Goldman Sachs.1

The stocks were also working well during the tariff tantrums. The stock market fell 15% a year, but UnitedHealth rose up by up to 18% in mid-April.

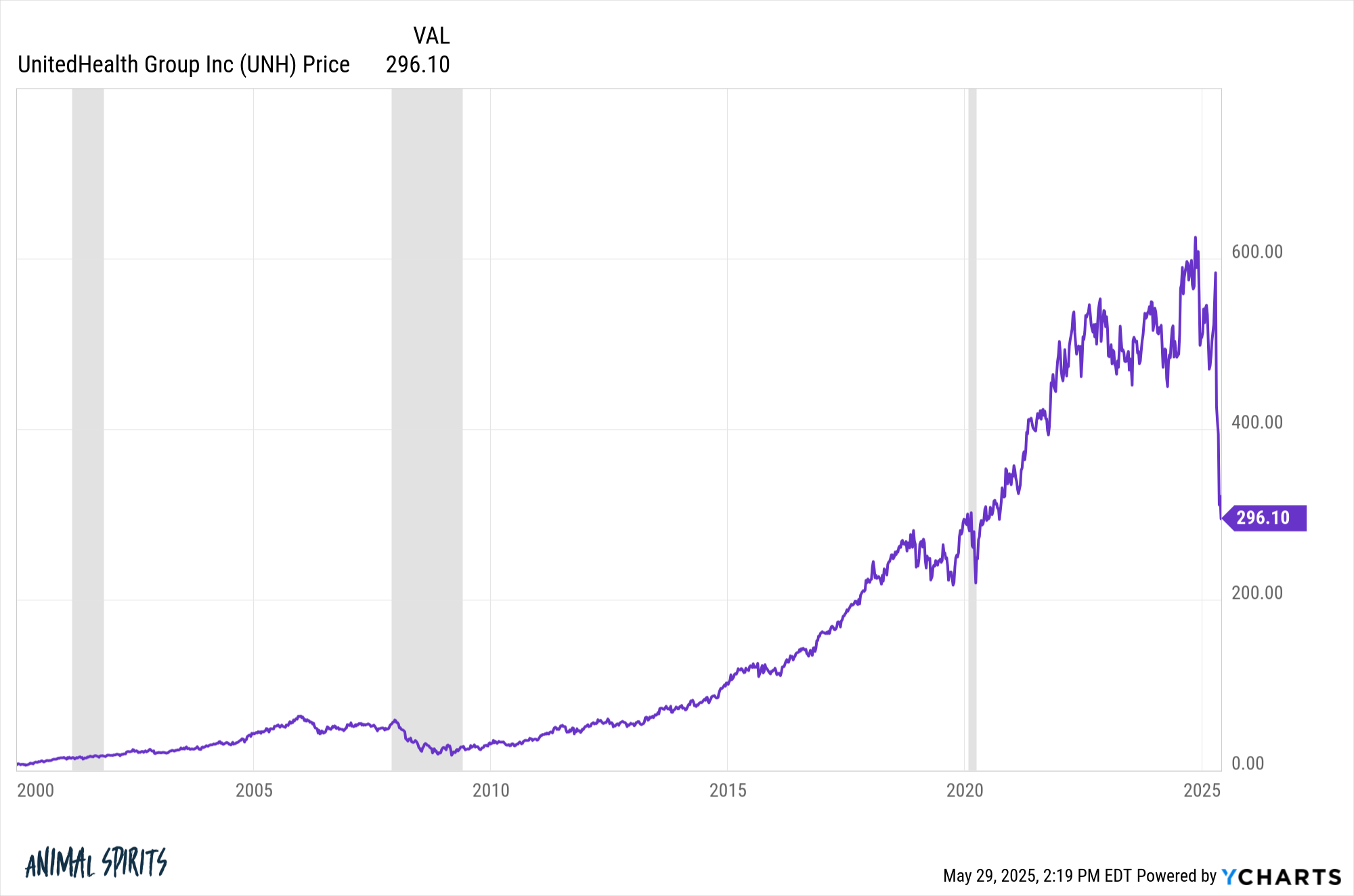

Then it fell off the cliff, Weil E. Coyote Style. This long-term chart looks like a fat finger mistake in a spreadsheet.

Stocks were just over 50% in a month, and for a company worth nearly $600 billion, a massive conflict has occurred in such a short period of time.

For investors who want to avoid catching a falling knife, this is the big question: Will it come back?

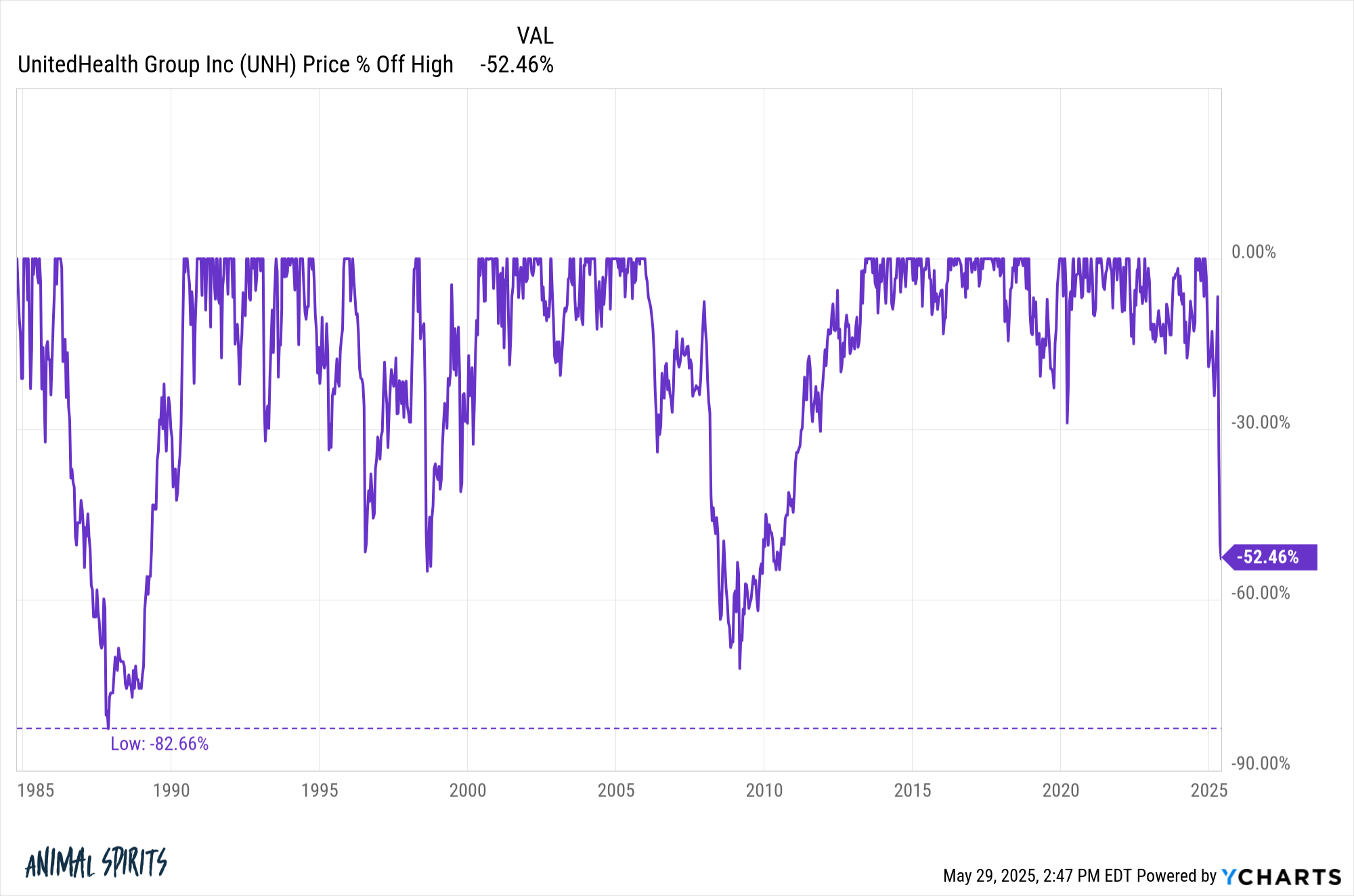

In its history, stocks have experienced major drawdowns on three separate occasions.

It fell by more than 80% in the 1980s, nearly 55% in the late 1990s and 72% in the major financial crisis. Every time it comes back.

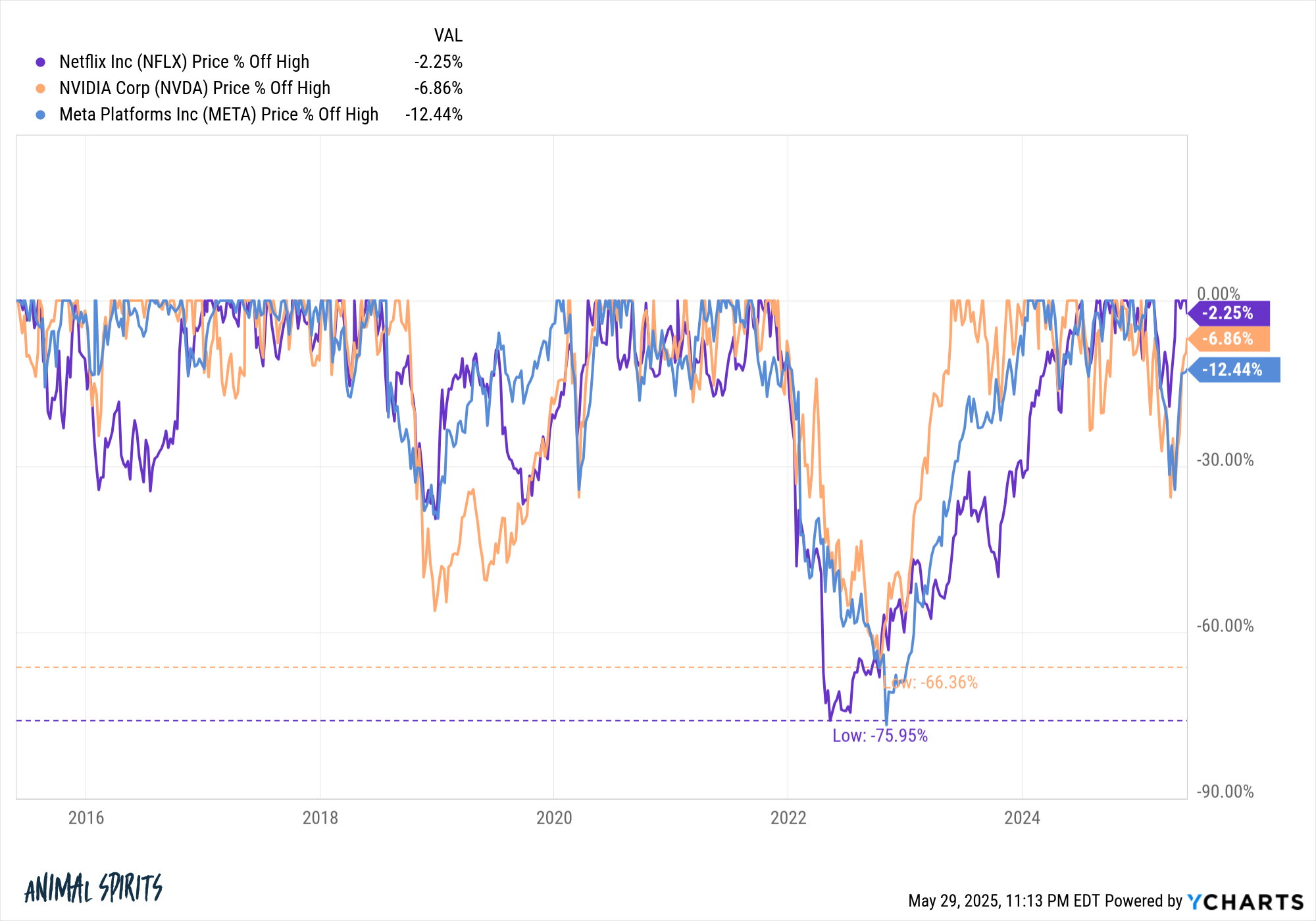

There are recent examples of famous companies experiencing huge drawdowns.

Nvidia lost two-thirds of its value. Facebook and Netflix have fallen by 76% in recent years. These were great buying opportunities for name brand companies.

This is a stock dream.

However, many stocks won’t come back from a big drawdown.

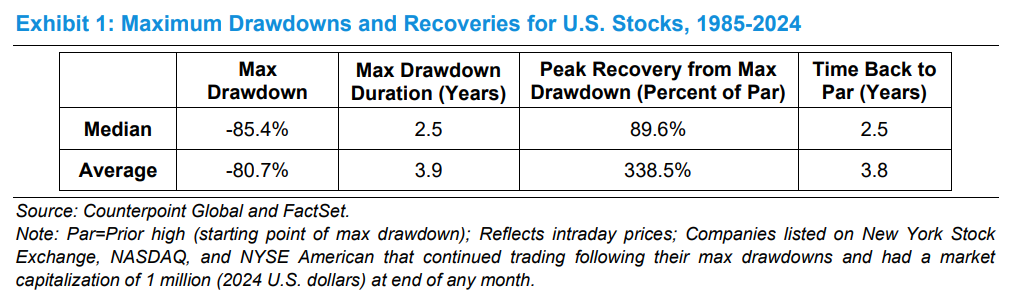

Michael Maubusin There are new research articles on drawdown and recovery of individual stocks. He saw 6,500 shares over the 40 years from 1985 to 2024 and found the median drawdown was an astounding 85%.

54% of these strains were unable to recover from their previous peaks. The reason the mean recovery gain is much greater than the median is that a small number of stocks distorted the numbers more. The odds aren’t your favorite.

Famous companies like Citigroup:

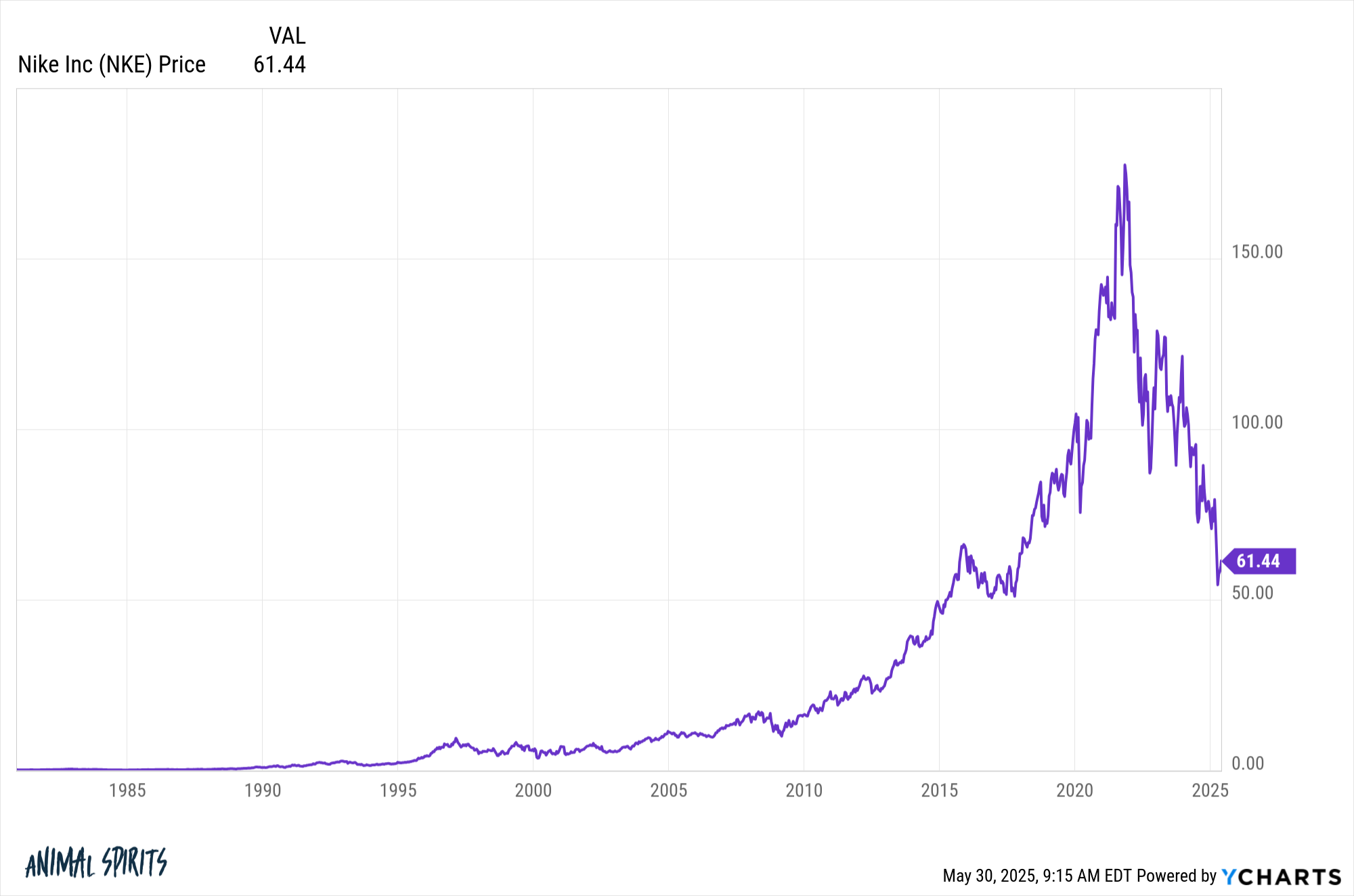

Nike:

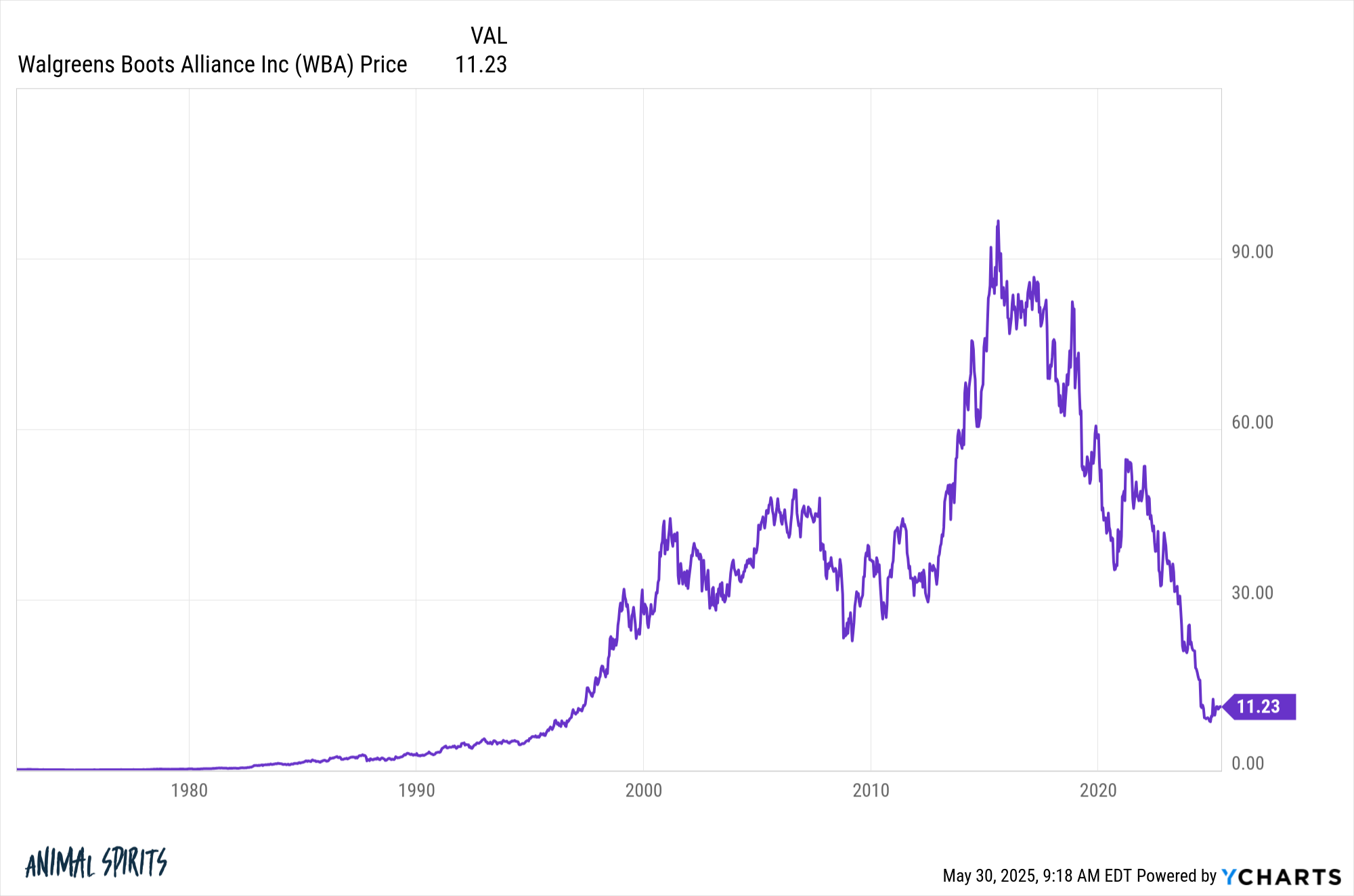

Walgreens:

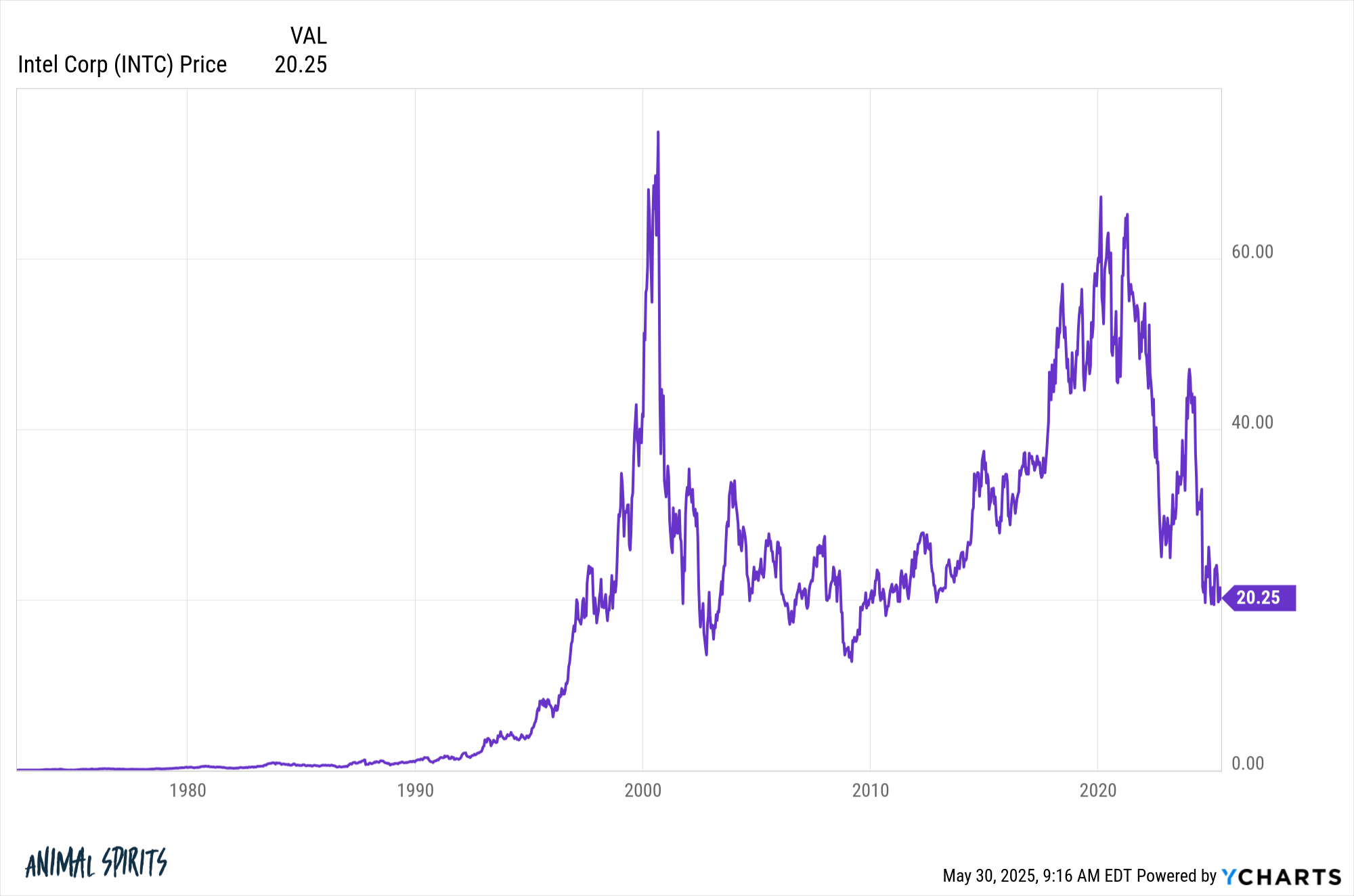

Intel:

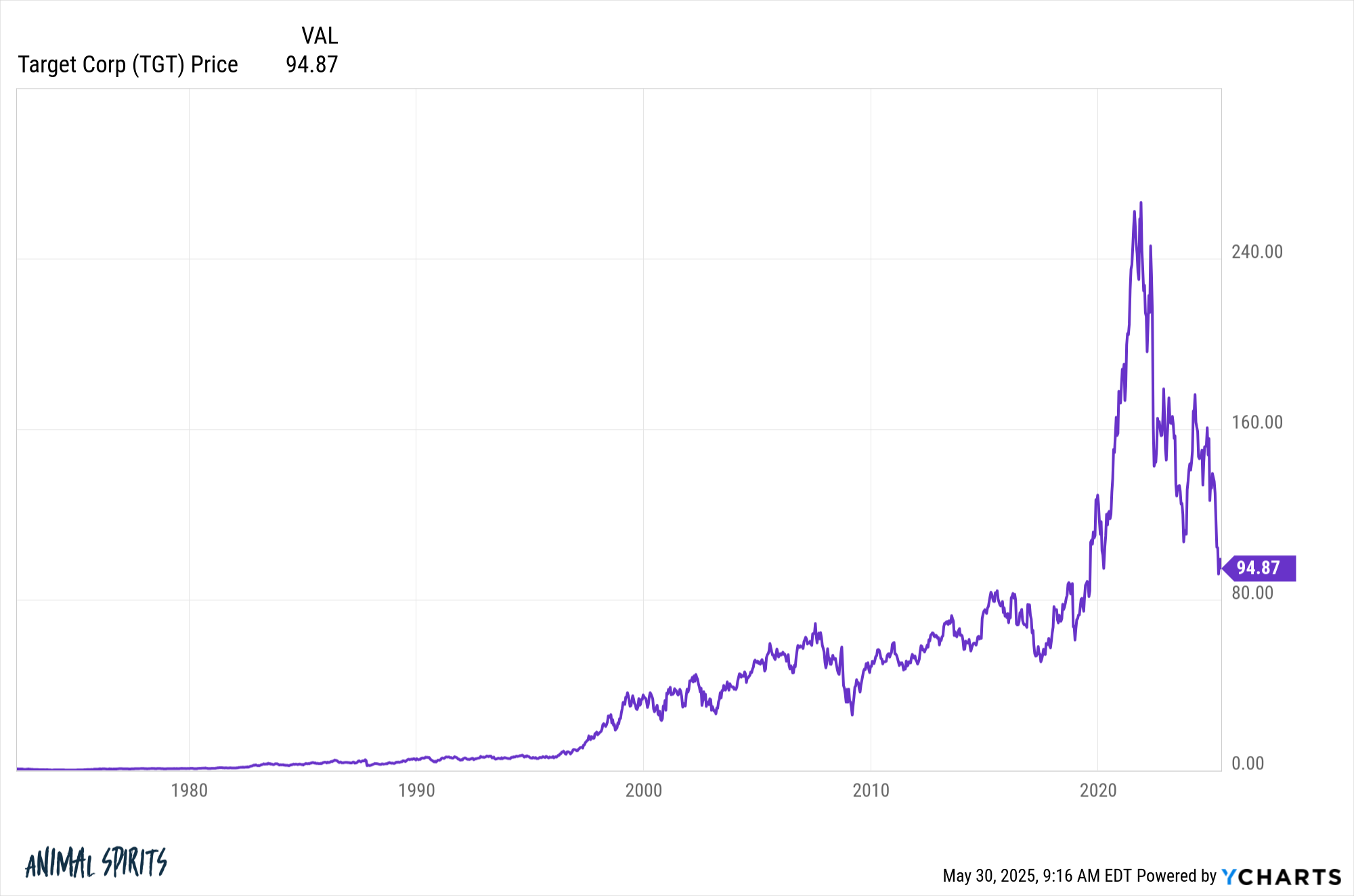

target:

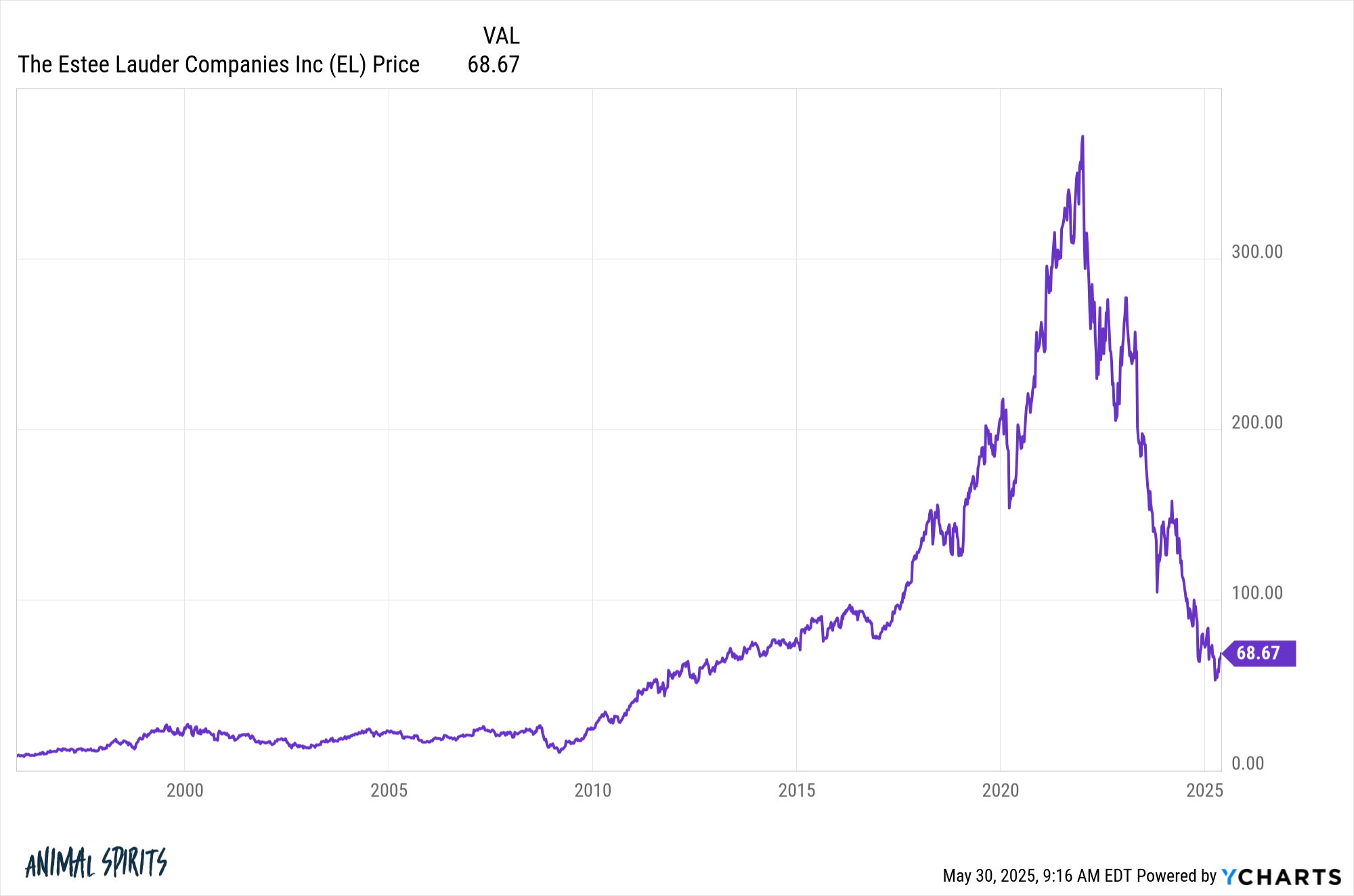

and Estee Lauder:

These companies sit at drawdowns of -87%, -65%, -88%, -73%, -64% and -82%, respectively.

For years, some have been drawing down from the highest ever. Decades have passed.

Being a paradox can be a profitable strategy, but there are a few considerations if you plan to load it onto your new Lows list.

- You need to be patient.

- Other than buying something with a lower price, you need to plan. Value is also important.

- You can’t spend the perfect time on these things, so you need a disciplined process that you can be willing to follow, whatever the outcome.

- Being an investor on the other side can be lonely and painful.

- Avoid locking it into past price ranges. The stock doesn’t need to back up to its previous high just because it was there before. If the company or sector foundations change, past price levels are meaningless.

- It’s easy to find ones with lower prices, but it’s much harder to know if they’ll turn around.

- Trends can last much longer in both directions than most investors expect. Emotions can be such that price hastily detached from the foundation and remain so for a long time.

Obviously, no one actually buys it on the top or bottom. That’s a dream. And even if you haven’t reached your previous peak level, you can still make money on stocks with big drawdowns. This is something to consider if you’re holding a dramatically fallen stock and waiting for it to break.

That may not happen.

Some of these strains will never rise to their height again.

Michael and I talked about this week’s Animal Spirit Video, including drawing down a single strain and more.

https://www.youtube.com/watch?v=cxjmfvin1x8

Subscribe to Compounds So you won’t miss an episode.

Read more:

The stock market will pick the winner for you

Here’s what I’ve been reading recently:

Book: Book:

1Don’t forget that the Dow is a price-weighted index.

This content, including security-related opinions and information, is provided for informational purposes only and should not be relied upon in any way as professional advice or endorsement of practices, products or services. There is no guarantee or guarantee that the views expressed herein may be applicable to any particular fact or situation. You should consult your own advisor regarding legal, business, tax, and other related matters related to your investment.

The commentary on this “post” (including related blogs, podcasts, videos and social media) reflects the personal opinions, perspectives and analysis of employees at Ritholtz Wealth Management who provide such comments and should not take into account the views of Ritholtz Wealth Management LLC. or as a description of the advisory services provided by the performance returns of their respective affiliates or Ritholtz Wealth Management or Ritholtz Wealth Management Investments clients.

Any reference to securities or digital assets, or performance data, is for example purposes only and does not constitute an investment recommendation or offer to provide investment advisory services. The charts and graphs provided internally are for informational purposes only and should not be relied upon when making investment decisions. Past performance does not indicate future results. Content will only be spoken as of the date indicated. The forecasts, estimates, forecasts, targets, outlooks and/or opinions expressed in these materials are subject to change without notice and may differ from opinions expressed by others.

Compound Media, Inc., an affiliate of Ritholtz Wealth Management. receives payments from various entities for related podcasts, blogs and email ads. The inclusion of such advertisements does not constitute or imply any endorsement, sponsorship or recommendations or affiliation by the Content Creator or Ritholtz Wealth Management or its employees. Investing in securities involves the risk of loss. For additional advertising disclaimers, please visit: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosure here.