by Calculated risk 5/14/2025 07:00:00 AM

From MBA: Mortgage applications increase with the latest MBA weekly survey

Mortgage Bankers Association (MBA) weekly mortgage application survey data for the week ending May 9, 2025 shows that mortgage applications increased by 1.1% from a week ago.

The Market Combined Index, a measure of mortgage applications, has increased by 1.1% on a seasonally adjusted basis from a week ago. On an unadjusted basis, the index increased by 1% compared to the previous week. The refinance index fell 0.4% from the previous week, 44% higher than the same week a year ago. Seasonally adjusted purchase index has increased by 2% from a week ago. The unadjusted purchase index has increased by 2% compared to the previous week. 18% higher than the same week a year ago.

“Last week, the FOMC meeting took place as predicted, resulting in a more stable mortgage rate, and market movements increased the mere two-point increase in the 30-year fit to 6.86%,” said Mike Fratantoni, MBA SVP and Chief Economist. “The amount of refinances was largely unchanged that week, with government refinancing slightly increasing, and traditional refinancing declines. This week’s news increased by 18%, up 2.3% from last year’s pace.

“There was a significant profit in government purchase applications, with an increase of nearly 5% in a week and 40% per year,” Fratantoni said.

…

The average contract interest rate for a 30-year fixed-rate mortgage with conforming loan balances (below $806,500) increased from 6.84% to 6.86%, remaining at 0.68 (including original fees) points for the 80% loan and value ratio (LTV) loan.

Emphasis added

Click on the graph for larger images.

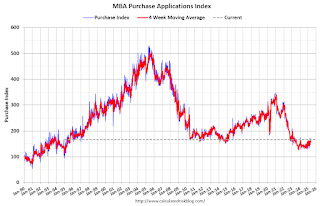

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchasing activity has not risen 18% year-on-year.

Red is the average for four weeks (blue is weekly).

The refinance index fell and remained very low.