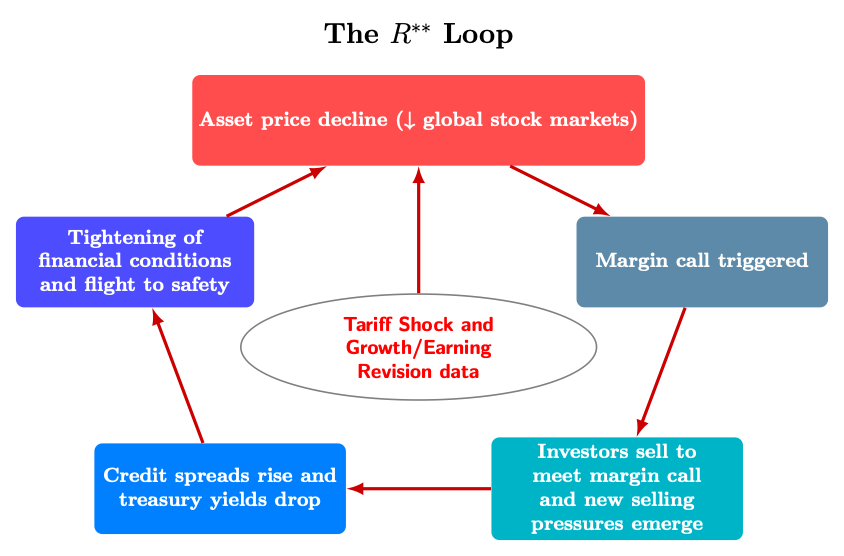

Gianluca Benigno It points out that large and broad tariffs have the meaning of macros that promote delaveRaging and r** reduction in r** in the harmful (my word) feedback loop.

sauce: G. Benigno (2025).

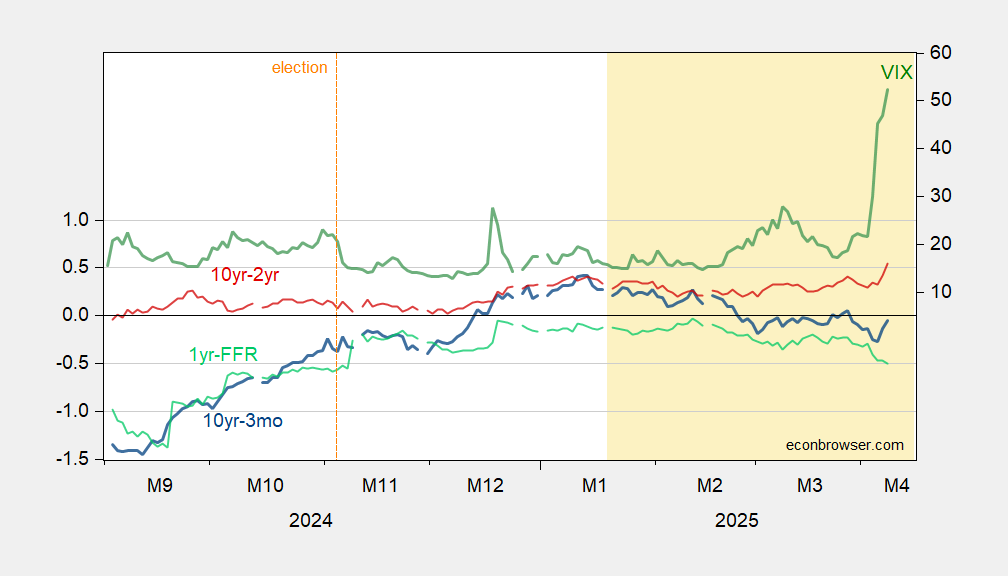

With 10-year yields surged, some spreads are growing rapidly.

Figure 1: 10yr-3mo financial period spread (blue, left scale), 10yr-2yr financial long-term spread (red, left scale), 1yrfed fund (light green), all %, nearby vix (green, right scale). Source: CBOE Ministry of Finance via Fred.

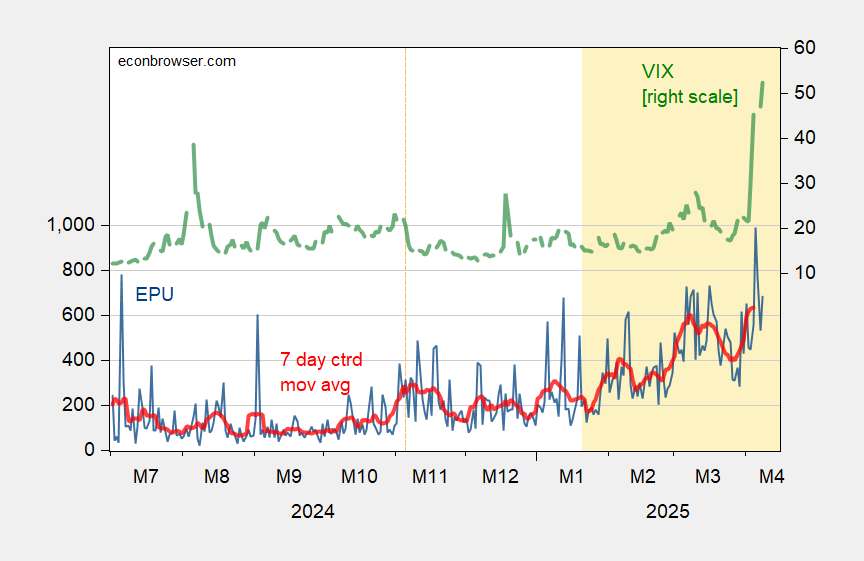

And VIX is rising due to increased uncertainty in measured policies.

Figure 2: Focusing on EPU (blue, left scale), as well as 7-day moving averages (red, left scale), and VIX (green, right scale). Source: PolicyUncEnterty.com, CBOE via FRED, and Author Calculations.

Interpreting uncertainty shocks as negative demand shocks means that the work is missing from the model I used to analyze trade wars. The IS curve shifts inwards online, adding devastated investment and consumption in addition to retaliation effects.

If the dollar loses its safe shelter status, even if it is limited, the dollar will depreciate rather than be grateful (as I had expected).

This should put even more upward pressure on import prices (excluding comprehensive and customs duties).

In short, we are heading towards economic turmoil, in addition to macro hits. It’s all finished with a bigger question mark than I thought exactly a week ago.

Kalshi now records the odds of the recession at 66%, up 23 percentage points from just a week ago.