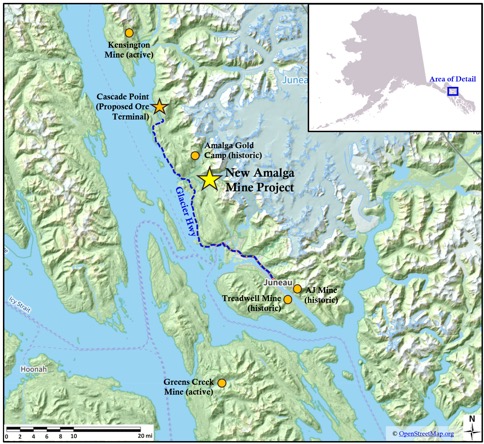

Grande Portage Resources Ltd. (TSXV: GPG) (OTCQB: GPTRF) (FSE: GPB) (“Grande Portage” or “Company”) will be releasing the results of test work on a sensor-based ore sorting system using composite core samples from the new Amarga Mine Project, located approximately 16 miles (25 km) northwest of Juneau city.

Result Summary:

|

Disband feed |

Sorter refuses |

Sorted Products |

|

|

Mass (kg) |

64.8 kg |

37.2 kg |

27.6 kg |

|

% mass distribution |

100% |

57% |

43% |

|

Gold grade (g/t) |

5.9 g/t |

0.6 g/t |

12.9 g/t |

|

% gold distribution |

100% |

6% |

94% |

Commenting from the CEO and CEO, Ian Klassen: “We are very pleased with the results of our test work using Steinert Ore’s sorting equipment. This demonstrates our excellent ability to identify and reject non-impermeable particles within samples of new amarga material, reducing by 57% with a 120% increase in gold grade and a very minimal gold loss.”

Klassen continued. “These results are changing the game for many reasons. By integrating ore sorting into ore production plans, we significantly reduce the amount of mined rock that requires transportation and processing at third-party facilities, reduce costs per ounce, and provide useful salter rejection material for underground reclamation. As demonstrated by test results, it may create an opportunity to include thin veins in mining plans.

background:

As previously announced, the company’s conceptual mining plan envisions a selective underground mining operation in which the ore is processed offsite at third-party facilities that allow future developments of the new Amarga Goldmine to be made possible less than four miles (6.5 km) from the existing highway at the site of the project near the deposit (Figure 4). This dramatically reduces the footprint of the mine site by avoiding chemical treatment and tailing storage facilities.

The purpose of ore sorting is to quickly separate rock particles from removed diluted rocks without the use of chemical reagents. The goal is to significantly reduce the amount of material being transported offsite to third-party processing facilities.

Grande Portage assembled a drill core composite containing both ore and waste to reflect dilutions from the Wall Rock (waste) that are inherent to underground explosions of narrow ore veins. Core Composite was exposed to a sensor-based ore sorting test process at a facility at Steinert US Inc, a global manufacturer of ore suction equipment.

Technical description of the mineral sorting test process:

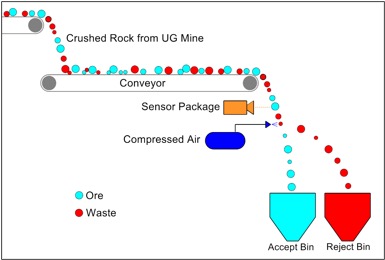

Sensor-based ore sorting uses a variety of measurements to determine whether the particles are ores or waste, such as colour, electromagnetic induction, lasers, or X-ray analysis, and evaluate elemental composition. The crushed rocks are placed on a conveyor belt and passed in front of the sensor, and the individual rocks are rapidly analyzed. When a rock is identified as waste, a puff of compressed air redirects it to a “reject” bin. The remaining pieces of rock are sent to the accepted “product” stockpile. (Figure 2)

High-quality materials usually combine fine particles to effectively sort with “product” stockpiles, as high-quality materials produce more fines in crushed stone and the brittleness of the quartz venous rocks is fragile, effectively sorting with “product” stockpiles.

In the test work, a series of reference samples were analyzed by sorter machines, reflecting various categories of core materials, such as “high quality ore”, “intermediate ore”, “low grade ore”, and “waste”. This allowed the sorter to learn the properties of each type of material to generate a sorting algorithm. Each of these reference samples was fed from multiple drill holes at various locations within the sediment to capture spatial variability in rock properties.

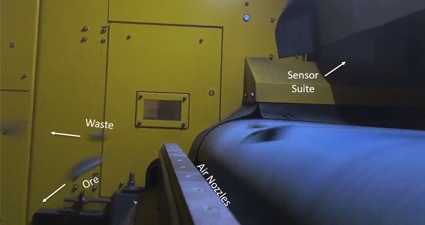

After the sorting algorithm was developed, composite samples were fed to the sorter machine (Figure 3). This composite was fed through multiple drill holes in different regions of deposits that differ from the reference sample. This includes approximately 55% wall locks and 45% venous rocks, reflecting potential waste dilutions within the running material to minify areas narrower than the minimum mechanized mining width.

In addition to the “product” material, three splits of “reject” material were generated from sample sorting at a gradually increasing level of selectivity, reflecting the machine’s behavior on varying degrees of sorting criteria. All materials were then assayed with SGS-Lakefield.

All three “reject” splits return assays below the level of what is considered feasible for transport and processing in third-party facilities and are therefore classified as waste, indicating that the highest level of sorter selectivity is appropriate. In total, the sorter rejected 57% of the feed material, indicating excellent consistency with the wall rock content of about 55% of the composite sample.

Additionally, all materials were screened prior to assay and unretained fines (<1 cm) were collected. This was assayed separately. This confirmed that the fines include high gold mineralization and are appropriate to combine with "product" samples. The complete table of results is shown below (Figure 1).

Figure 1: Table of Assay Results

|

Reject #1 |

Reject #2 |

Reject #3 |

Sorted Products |

Detainable fines |

|

|

Mass (kg) |

12.2 |

13.1 |

11.9 |

22.6 |

5.0 |

|

au (g/t) |

0.48 |

1.09 |

0.30 |

12.9 |

13.1 |

|

Overall waste was denied |

Overall product |

||||

|

Mass (kg) |

37.2 |

27.6 |

|||

|

au (g/t) |

0.64 |

12.94 |

Figure 2: Simplified conceptual diagram of an ore sorting system

Figure 3: Image of the ore sorting test work carried out in the new amarga sample

A short video of the test work process is available on YouTube https://youtu.be/k4xzorbjcxa

Figure 4: Location of the new Amarga Mine Project

PE. Kyle Mehalek is a QP within the meaning of NI 43-101 and has reviewed and approved technical disclosures in this release. Mehalek is independent of Grande Portage within the meaning of Ni 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly-published mineral exploration company focusing on the advancement of the new Amarga mine project, the growth of Herbert Gold Discovery, located approximately 25 km north of Juneau, Alaska. The company holds 100% profits on the new Amarga property. The new Amarga Gold System is open to length and depth and hosts at least six major composite venous disorder structures, including ribbon-structured quartz sulfide veins. The project is prominently within the 160km long Juneau gold belt, producing over 8 million ounces of gold.

The company’s updated NI#43-101 Mineral Resources Estimate (MRE) is reported at a cut-off grade of mineral resources of 2.5 grams (g/t au) per tonne and consists of designated resources of gold with an average grade of 9.47 g/t au (4,726,000 tonnes). An estimated resource of 515,700 ounces of gold with an average grade of 8.85 g/t au (1,813,000 tons) and a designated resource of 891,600 ounces of silver with an average grade of 5.86 g/t Ag (4,726,000 tons). Estimated resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tons). MRE is David R. Dr. Webb, Ph.D., P. Geol. , prepared by P.Eng. (DRW Geological Consultants Ltd.) Effective date on July 17, 2024.

On behalf of the board of directors

“Ian Krassen”

Ian M. Krassen

President and CEO

Tel: (604) 899-0106

Email: ian@grandeportage.com

Notes on future outlook

This news release contains certain “forward-looking statements” under applicable Canadian securities laws. Forward-looking statements include estimates and statements describing the company’s future plans, objectives, or goals, including terms of effectiveness that the company or management expects to experience the terms or outcomes stated. Forward-looking statements may be identified by terms such as “believe,” “expected,” “expected,” “estimate,” “estimate,” “possible,” “possible,” “will,” or “planned.” Forward-looking statements are based on assumptions and address future events and conditions, and by their nature include inherent risks and uncertainties, as stated in the company’s filing with Canadian securities regulators. There is no guarantee that such statements will prove accurate, as actual results and future events may differ materially from those expected in such statements. Therefore, readers should not undue rely on forward-looking statements. The Company disclaims any intention or obligation to update or modify any forward-looking information as a result of new information, future events, or other means, except as required by law.

Please note that at National Instrument 43-101, the company must disclose that it is not based on preliminary estimates, preliminary economic assessments, or feasibility studies in accordance with NI 43-101, and production decisions historically made regarding production decisions made without such reports. These risks include areas that are analyzed in more detail in feasibility studies or preliminary economic assessments, including the application of economic analysis to mineral resources, mining and recovery methods, environmental analysis, environmental, social and community impacts, and areas that are analyzed in more detail in feasibility studies or preliminary economic assessments. The decision to operate the new Amarga mine at the intended level by managers, expand the mine, make other production-related decisions, and carry out mining and processing is primarily based on data from internal private companies and reports based on exploration and mining operations by the company and its company-engaged geologists and engineers.

Neither TSX Venture Exchange nor regulatory service providers (as the term is defined under the exchange’s policy) accept any responsibility for the validity or accuracy of this news release

To connect to Grande Portage Resources (TSXV: GPG, OTCQB: GPTRF, FSE: GPB), click here to receive your investor presentation