One of the risks of being prolific and public is the built-in assumption that your readers are familiar with your work. We all occasionally engage in shorthand based on previous beliefs, ideas and philosophy.

This turned out to be an error.

Everything you write is on a continuum of pre-argument discussion. The risk of either standalone part is that it is taken from the context of the philosophy it comes in.

To wit, “Please adjust the noise.”

I was really surprised by the pushbacks this piece received, especially from a behavioral perspective.No one can adjust everything. “My mistake was to assume that the advice I was giving would be interpreted through my broader writings, and, given this completeness, encourage people to properly contextualize noise. How to not invest” (see chapter 10 here) and omnipresent in The Big Picture.

But, alas, it is certainly misunderstood and it is always with the author. I underestimated the impact of my headlines. Perhaps I have moved away from contextualization towards an extreme message to readers (not my intention).

Anyway, I want to clarify my ideas Tuning out Noise management. Let’s take a look at the five concepts needed to frame this better.

1. Information hygiene

2. Is there already a price?

3. Time Horizon

4. What is in your control?

5. Action

A few words about each concept:

1. your Information hygiene It should be better than simply being appropriate: You need a well-developed filter to screen for not only the most obvious nonsense, but also many of the loud, irresistible stupidity that is neither beneficial nor useful. Pay particular attention to the sources of emotionally resonating opinions, speculation and sanctification. The social media I grabbed (below) is classic Argo-driven trash.1

Beware of non-experts (aka sales representatives) who freely share their lack of expertise with their investing countries.

2. Understand whether there is already a price and what isn’t: On television, WSJ/NYT, radio, analyst opinions, blogs and/or Sackak, this information must already be reflected in the stock price. The market may not be completely efficient, but it is It melts slightly and is efficient. Once everyone else interested in this topic sees the headline, hears the CEO, or reads 10Q, you can safely assume that there is already a price.

But the real surprises and new information aren’t.

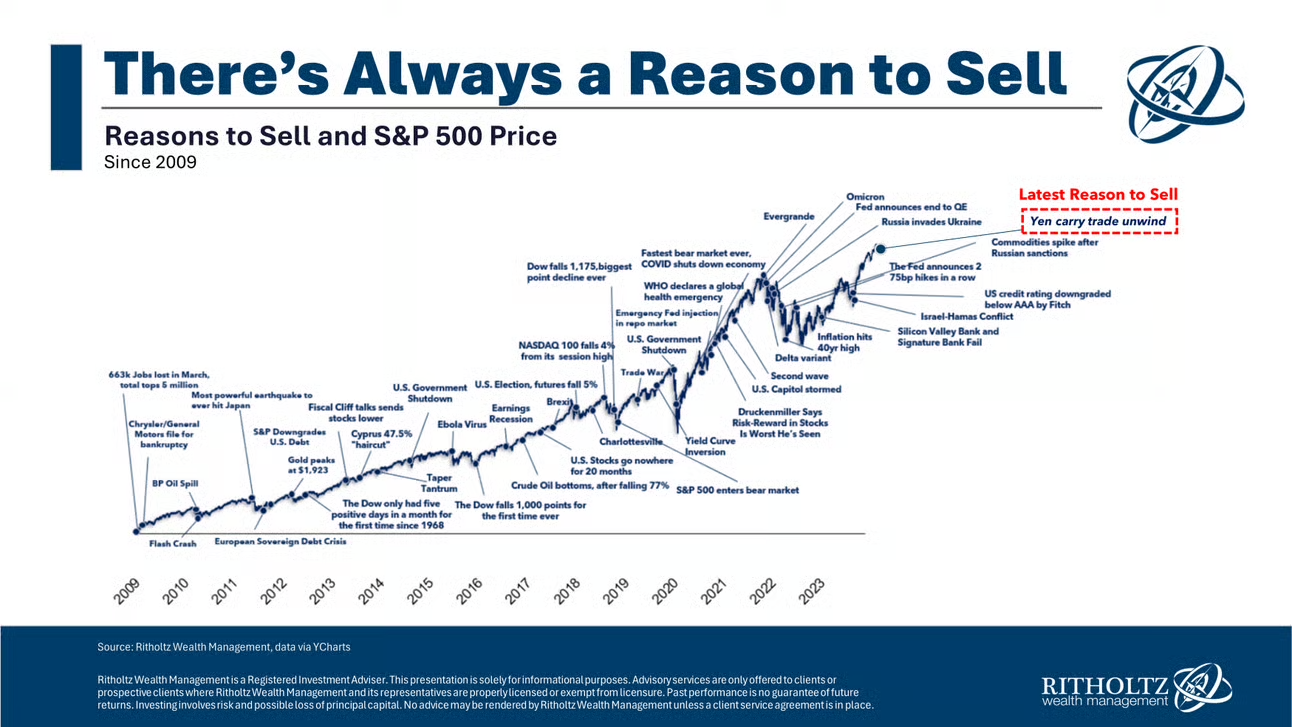

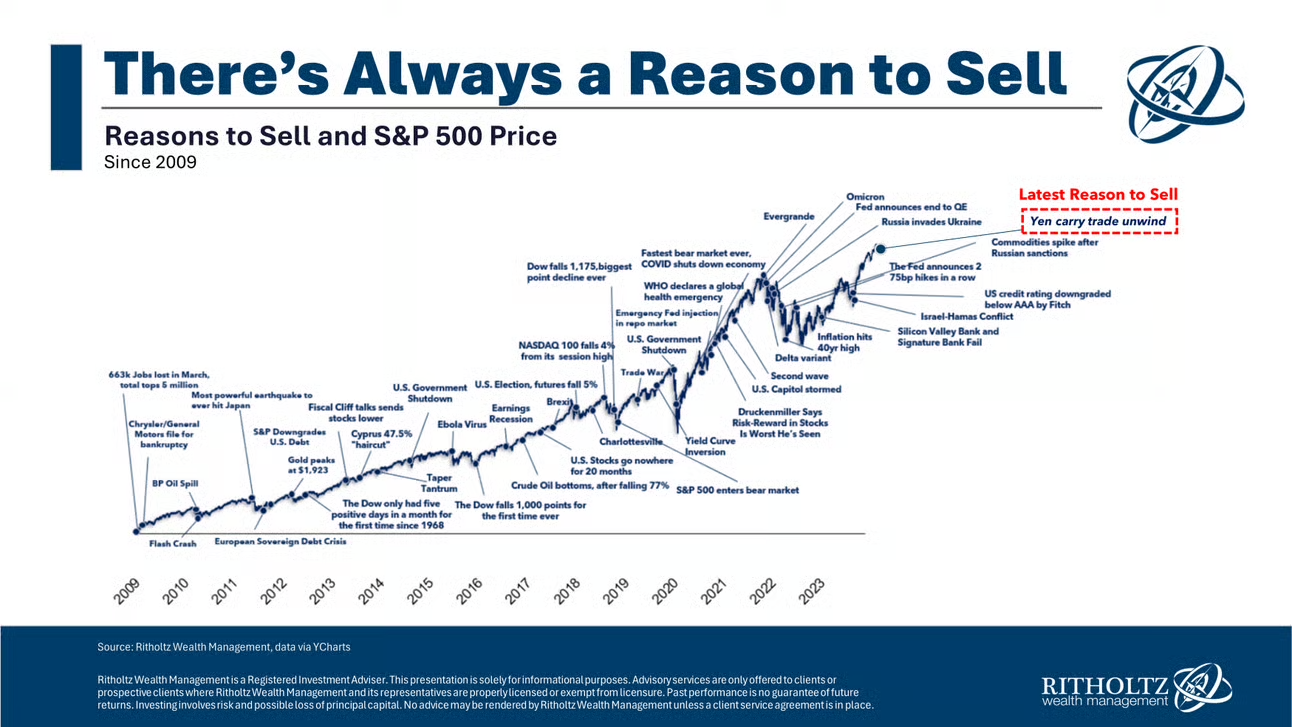

3. Portfolio activity should be synchronized with your time vision: It’s always surprising to have to say this, but if you’re saving up future events on a 10 or 20 year off, what happens on a random Tuesday is unrelated to your portfolio. Events such as the 1987 crash, the terrorist attacks on September 11th, the Flash Crash, Liberation Day, and even the pandemic were quickly etched over by wider economic and market trends.

For long-term investors, the most important thing is not to interfere with the portfolio’s ability to deteriorate over time.

4. Recognise what’s in your control: Most of the noisy information flow from television, radio, web browsers and social media is a temporary emotional issue and is completely out of control. These include the hot conflict between Israel and Iran, Russian invasion of Ukraine, the protests of the “king”, the (funny) crash of reputation, the law firm’s clients who failed to understand their role in the broader legal system, wars between Hamas and Israel that escalated into tariff trade and more.

There is no insight into any of these issues.

There is no insight into any of these issues.

I’ve shown the Batnick charts over and over, but see “There’s always a reason to sell.” 2024 edition) The question is whether your limbic system will succumb to its temptation.

5. Manage your own behavior: How do you respond to this flow of information, the emotional triggers that could trigger you, and the various inputs that feel “different this time”? This determines your successes and failures as an investor or simply someone trying to understand a disruptive world.

But to paraphrase Bill Bernstein, “If you can’t manage your limbic system, you’ll die poor.”

~~~

These five elements are what you consider Canon to manage around noise. You can architect the media diet.

Like many others involved in investing, it’s easy, but difficult…

Note: The headline for the post on February 20, 2025 will be “Adjustable Noise” to “I’ll tune it Controls noise. ” 2

Previously:

Do not take candy from strangers (June 9, 2025)

Beliefs, misunderstandings, actions (February 18, 2025)

Redesigning the Media Diet (February 2, 2017)

Reducing noise levels in investment processes (November 9, 2013)

More signals, less noise (October 25, 2013)

Prices to pay attention (November 2012)

Please refer:

Some thoughts on selling off: Everyone is cool (Michael Batnic, August 5, 2024)

Financial advice that doesn’t work anymore (May 9, 2025)

______

1. There are a few of these and other bots, and some are thought to be state sponsored propaganda.

sauce: x.com

sauce: x.com

2. Repeat what I said in January and what I wrote in February is worth it.

“More importantly, pay attention to the broader context of where we are today. A consecutive year with over 20% of stocks strongly suggests lower expectations for the next 12-24 months.”