If you’ve been learning to trade for a while, I’m sure you’ll come across the term “overtrade.”

What exactly does that mean?

Well, of course, that means trading is overloaded!

But how can you detect it when you’re trading?

And how about trading?

In fact, the reasons behind both are many and are very common for all traders.

So, is there anything you can do about it?

Luckily, these are exactly the topics we cover for you in today’s guide!

We share important and practical tips to recognize when trading…

…and show you how to improve your trading plan to help you eliminate it completely!

Specifically, you learn:

- What exactly is traded and a starting solution to prevent it

- How market choices put you in a position where you will earn more profits and make you too fewer

- Risk management techniques that ensure that losses are not kept to a minimum, allowing you to return to the game as quickly as possible.

Isn’t it good?

So let’s get started…

What you are trading and how to avoid it

Overtrading occurs when you enter more transactions than you can reasonably process.

The common situation where overtrading can occur now is when you start a “revenge trading.”

Everyone was there…

You will experience some losses, become restless and start to become violent in the market…

Before you know it, you enter the trade completely outside of your trading strategy!

Well, that’s just one of many situations where overtrading can occur.

Simply put, overtrading is often the next mix or combination.

- There is no clearly defined strategy

- Trade at random times of the day

- Hopping from one time to another

- Revenge trade

So, to sum up…

The main thing about trading comes from not knowing what you’re doing!

In other words, it happens when you treat trading as a game or gambling rather than a business.

At this point, the start of the solution should be clear by now:

Create a well-defined transaction plan

There are many ways to trade the market, so I know it’s easier than I say.

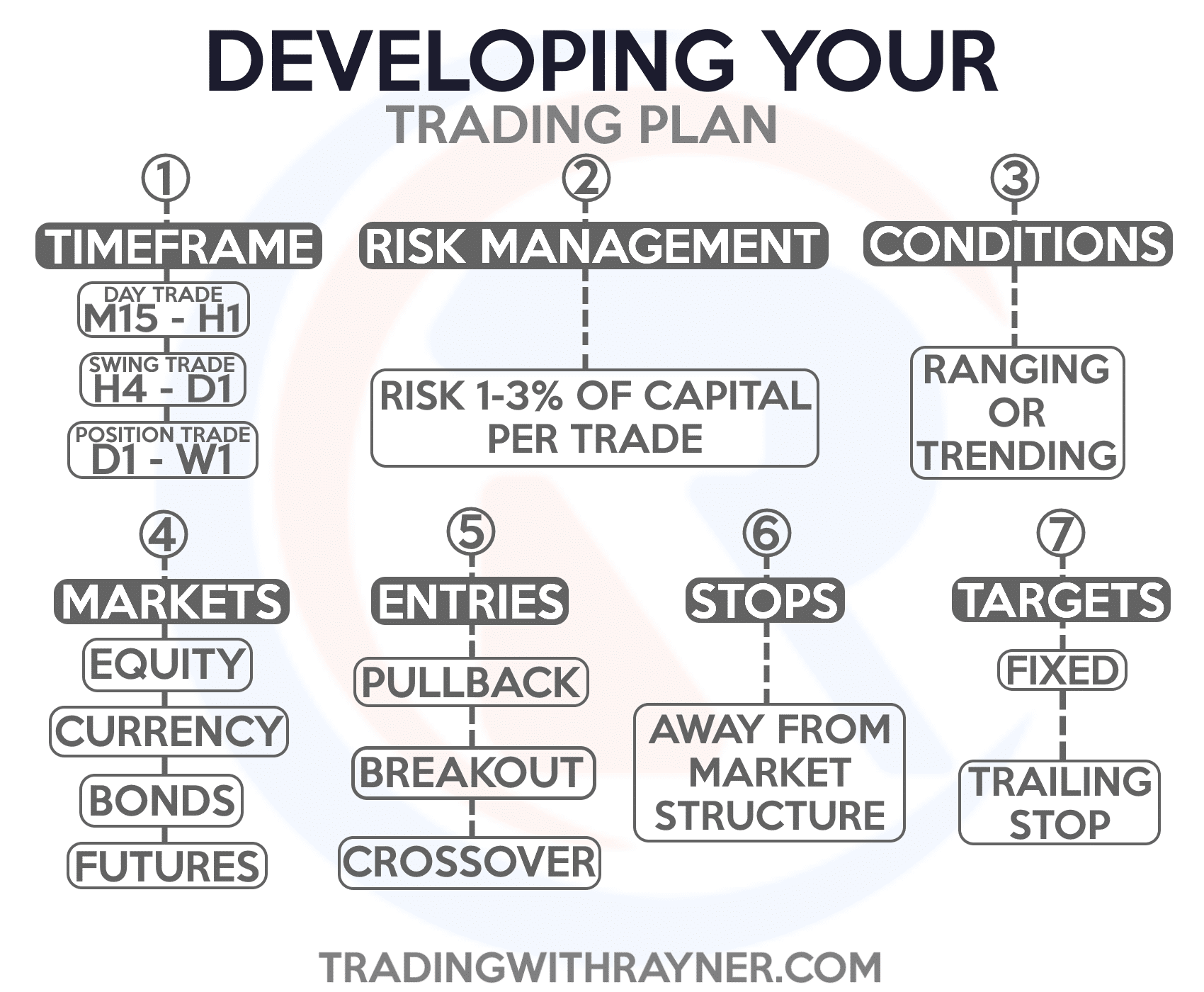

But with this template in mind, it will always move you ahead…

Of course, there are many ways to approach the market, so the type of trading plan varies from trader to trader.

See our detailed guide for an example.

Essentially, maintaining an established trading plan can help you resolve 50% of the symptoms that cause trades.

So now you might ask…

“What other 50% helps prevent excess trading?”

Simple…

Develop well-defined trading routines.

This part is just as important as developing a trading plan.

why?

Divide traders into those who treat trading as gambling and those who treat it as business!

Having a well-defined trading routine helps you understand when it’s the right time to trade.

Let’s say you’re someone who trades off higher time slots, such as daily time slots…

…Well, you just need to check the chart once a day at a certain time.

However, if you’re exchanging a lower time frame, such as within 15 minutes…

…Do you think it’s best to check the chart?

Surprisingly… the worst thing you can do is trade all day long!

That’s right!

Just because you take the market out of your scalp doesn’t mean you need to trade all the time.

(The key in your case is to trade only if there is liquidity.)

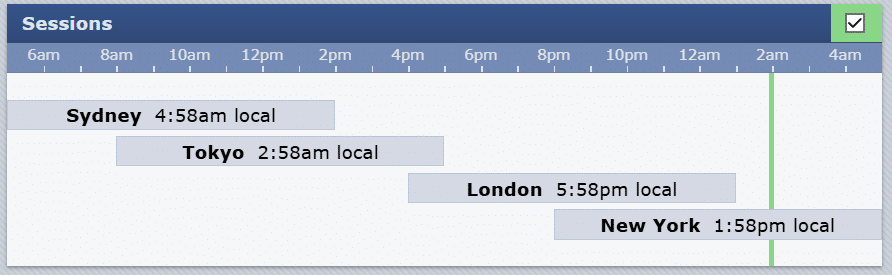

One good example is trading duplicate sessions in London and New York…

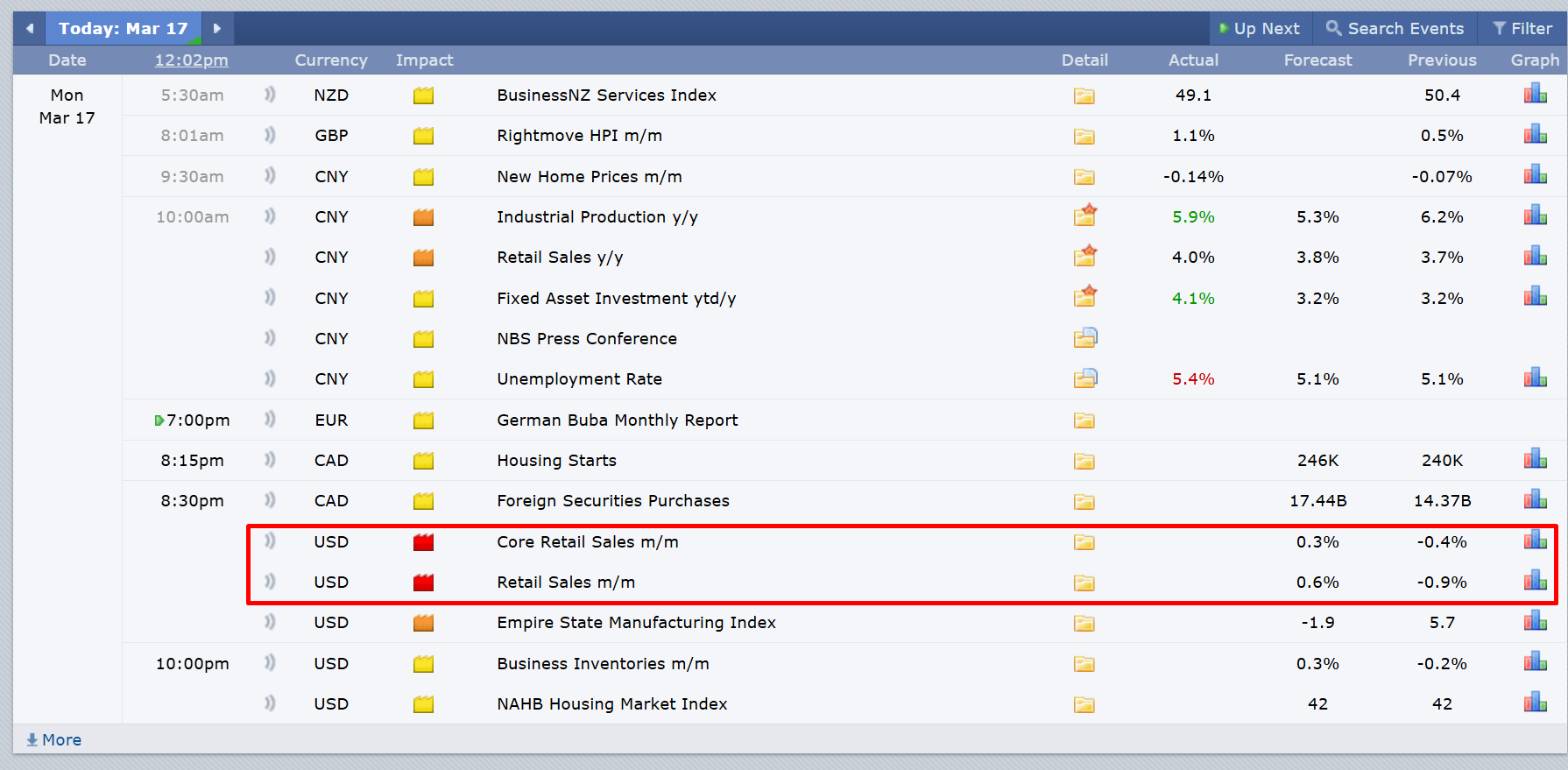

sauce: Forex Factory

This means that if you trade lower time frames, you only trade from 8pm to 1am (at least in my timezone)

And you may be wondering…

“Why this particular session?”

“Why is Sydney and Tokyo not overlap?”

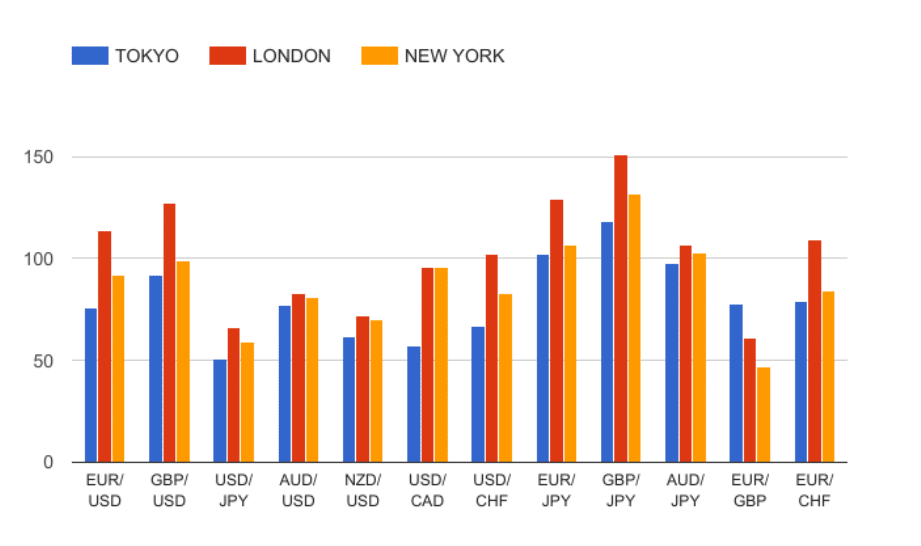

Well, as you can see below, it’s volatility…

sauce: BabyPips

The market moves most during sessions in London and New York.

For example, there was a massive movement of about 150 pips during the London session using GBPJPY!

To put together this part, here are cheat sheets you can refer to depending on the time frame you want to trade.

- Daily time frame = Check once a day at a consistent time

- Time frames ranging from 1 hour to 4 hour = Check once every 4 hours

- 30 minutes or less = Proactively trade only during large market sessions

Remember, the lower the time frame you choose to trade, the more important market choices.

Knowing when not to trade puts your mind on an objective level, which will help you avoid trading in the market.

So, shall we go deeper?

Because despite I share some broad concepts with you, the questions remain…

“How do you know exactly when you’re trading?”

Let’s give more context in the next section…

Market selection technology that almost eliminates overtrading

This is the problem…

Shifting the definition of overtrade to just have too many open trades can rule out many edge cases.

In other words, there is a trading method in which it is beneficial to have 20 open trades at a time!

On the other hand, there are several trading methods with the largest open trade count of less than 5…

So, what are these trading methods, might you ask?

They are here:

- Next trend (H4 – D1)

- Intraday trading (M5 – M30)

There are many more ways to trade there, but for now, let’s explore these two more in greater depth…

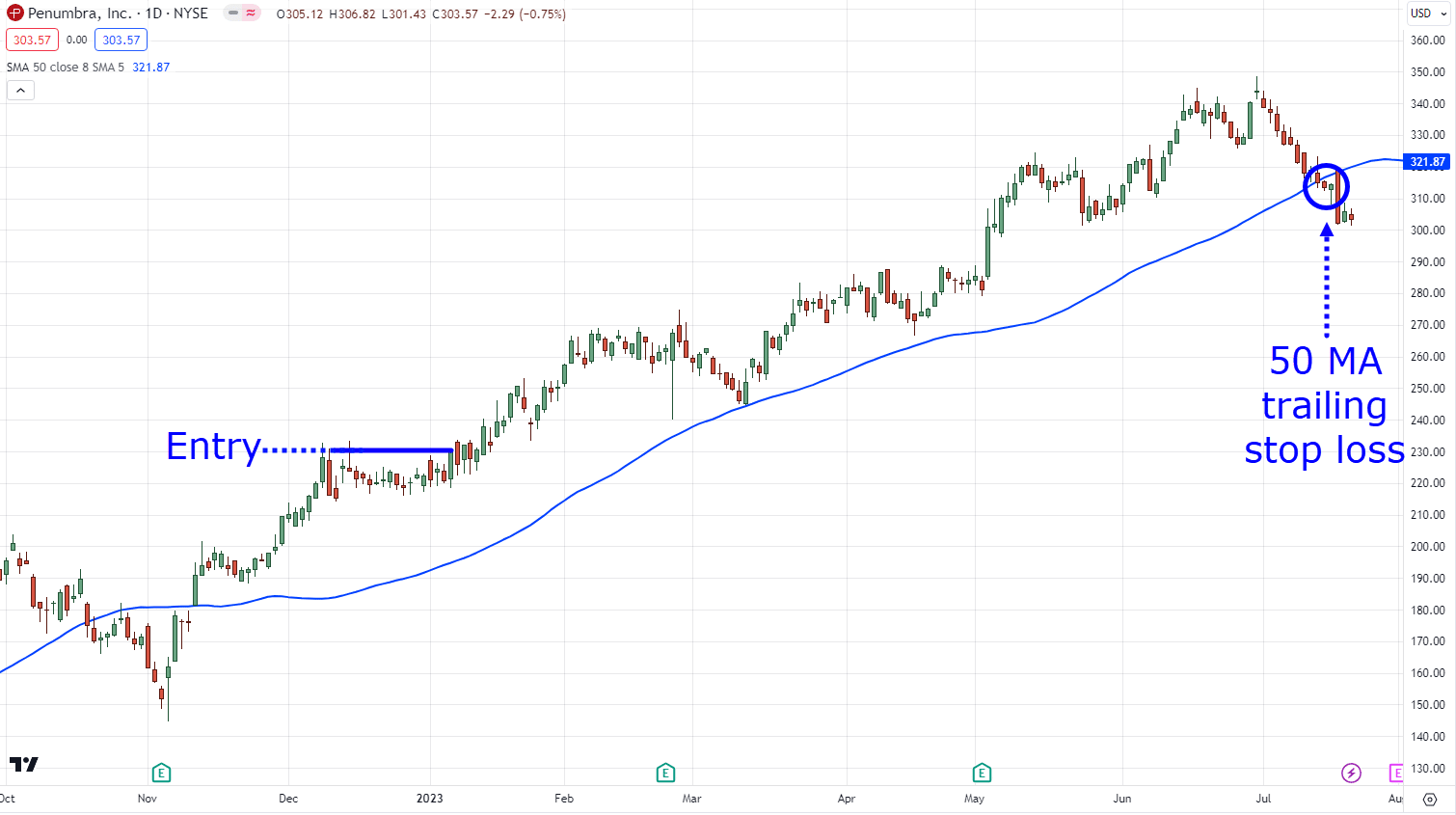

Next trend (H4 – D1)

At this point, you may already be familiar with trend followers.

And as you can see, if the trend is in your favour, your trade can last for several months!

(Even just one transaction!)

However, limiting the maximum open trade to 3 or 5 will bottleneck your portfolio.

Following the trend can last for weeks or months, making more sense to this trading method.

In fact, it could potentially mean 10-20 open trades at once!

As a trending follower, this means you pay, not only looking at the forex market…

…But also consider products, indexes, agriculture and bonds.

This gives you access to a wide range of markets that are not correlated to trade.

On the other hand, what about during the day?

Intraday trading (M5 – M30)

This trading method requires you to be an active market sniper.

what do you mean?

Market selection

The more active your trading portfolio is in the forex market, the more important it becomes to select your market carefully.

But… where do you start?

How do you choose the market to trade?

Well, that’s a combination of a few tools, but one of the ways I use it a lot is to trade after the impactful news…

You’ve probably heard several times that you should try to “avoid” high-impact news.

In a way, that’s true!

You don’t want to gamble how news is going to make news and trade…

…The important thing is to exchange “reactions” to the news.

Do you get me?

When the news comes out, you don’t want to be a deal.

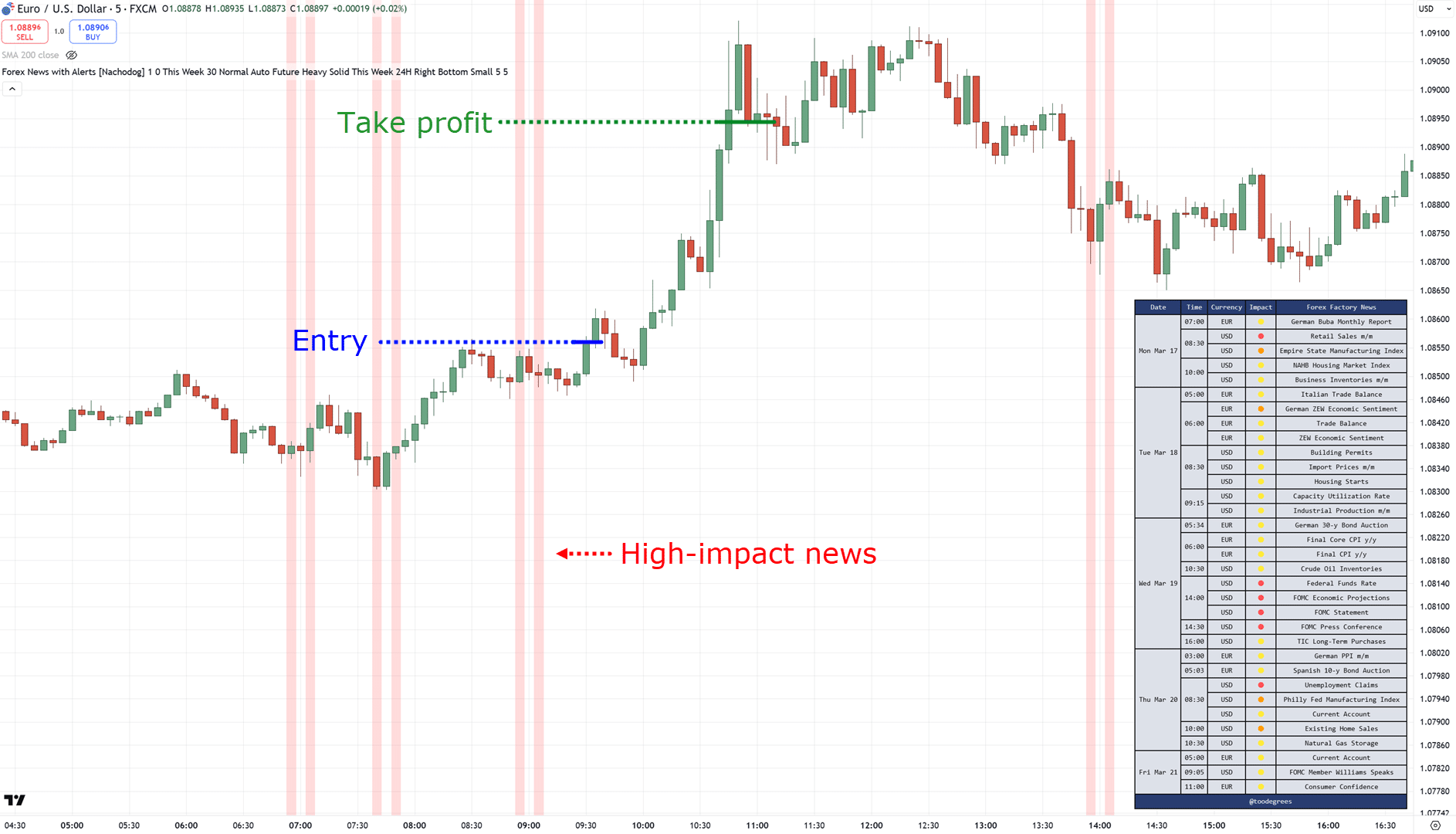

Here is an example of Eurusd in a 5 minute time frame…

As you can see, you just need to use the setup after the news.

It’s all about waiting for a response.

Of course, the market can be barely upset by news releases, but it’s still worth paying attention to that.

Poetry Credit to Nachodog Forex News with TradingView alert indicator

Overall, this is the principle…

- The less frequent the trade, the more open trades are required (diversification)

- The more frequent trade, the less open trades (concentrated)

Does it make sense?

wonderful!

You know when to trade and how many open trades you should have…

…It goes a long way in eliminating the possibility that you are transcending the market.

Keep in mind the reasons behind your market choice.

Yet mistakes are always made.

You and I are human – and it lies in our nature!

So, what if you realize that despite all this, you are still trading yourself?

When your emotions get high and wake up in the middle of a revenge deal?

By applying what you’ve learned so far, the chances of this happening are reduced…

…How can you reduce the damage?

Let me share it with you in the next section…

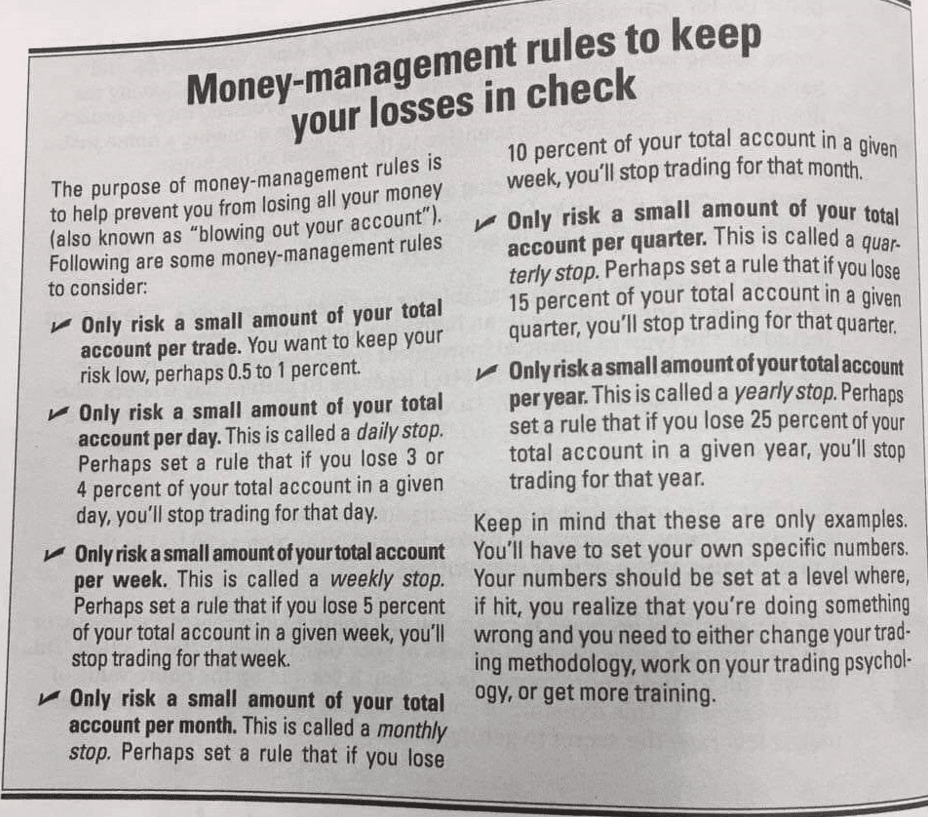

Risk management techniques to reduce transaction damage

This section is the most important part. Submitting to the “human factor” in the transaction.

Honestly, the best way to deal with it is to induce risk management!

And no…

…Limit yourself to 1% of your account per transaction, not risk management you already know…

Instead, I’m talking about emergency braking settings!

This cheat sheet is a hidden gem…

Source: Dummy series, trend trading

However, you only use the ones that are most relevant.

for example…

If you’re there Intraday tradersyou need to add the following parameters:

- 5% maximum risk per trade (trade halt)

- 5% maximum risk per day (daily suspension)

- 10% maximum risk per week (weekly suspension)

Again, this is the worst case scenario, and their values are merely recommended…

…You alone know what your personality is like!

However, in this case, if you achieve a 5% loss of that day as an intraday trader, stop trading, reevaluate the trading journal and return the next day.

If you have a risk of 0.5% per trade, this will give you a ton of breathing chambers as you will need 10 consecutive trades before hitting 5%.

On the other hand, if you’re there Trend Follow In a higher time frame:

- 1% maximum risk per trade

- 10% maximum risk per quarter (quarterly suspension)

- 25% maximum risk per year (annual suspension)

As you can see, there is no need for daily or weekly stops due to low trading frequency.

So it makes more sense to have a quarterly or annual stop.

Remember that the premise in this section is the fact that you may still overtrade.

The key is to minimize the impact.

It gives you more breathing patios and hopefully the opportunity to stay in this business to improve.

Isn’t it good?

So let’s briefly summarize what you learned today…

Conclusion

Overtrading can occur for a variety of reasons!

It may be a lack of trading plans, leading to poor trading psychology and risk management.

But what I want you to take away from this trading guide is an effort to balance all three.

Create sound risk management, consider trading psychology, and create a well-defined trading plan.

Take it apart, here’s what you learned in today’s guide:

- If you don’t have a well-defined trading plan or a proper trading routine, you may experience an overtrade

- Creating market selection rules that depend on how you trade can help you decide and eliminate when you should and should not trade

- Having a relevant maximum risk cutoff reduces damage to overtrade trading, making it easier to deal with even the “worst scenario” in the big picture.

Well, that’s pretty much it!

But now I want to hear your side.

What are some of the overtrade stories you have?

Was it after five consecutive trading losses and decided to kick your strategy out the window? (Who’s not doing it?)

Or was it gambling to trade high-impact news before it was released?

Tell us your story in the comments below!