No matter how much we want them, the stocks can’t go straight forever.

Social media has become a breeding ground for retail investors’ sentiment, and with this there is a significant portion of the emotional outburst. As stock prices drop in quite a bit, accusations of short selling and dark pool activity are common. That said, a simpler explanation: it’s important to consider a healthy pullback.

Imagine this: you buy stocks for $10 and buy skeloquets for $20 within a month. The stock then fell to $18. Panic sets come in and social media chatter grows about potential causes.

The next thing you know is that the stock is $14. It’s not the end of the world.

In fact, pullbacks after strong surges are a natural market phenomenon. Below are three reasons why pullbacks occur:

- Earning Profits: Those who buy early at a low price will see this as an opportunity to cash out some profits, resulting in a temporary decline in stock prices.

- Rating reset: Rapid price increases can exceed the actual basics of the company. Wall Street generally prefers a slow and slow share thanks as the company continues to strengthen.

- Normal market fluctuations: The stock market does not move linearly. Pullbacks are a normal part of the market cycle, and healthy modifications are actually good for the long-term health of the stock.

Note that there is nothing evil. Therefore, take a deep breath and consider these facts before joining the online chorus of conspiracy theory.

- Short sellers are a legitimate part of the market, providing liquidity and potentially identifying overvalued stocks. Their presence does not mean that inventory is automatically doomed.

- A dark pool exists to promote large institutional transactions without causing market disruption. It can be questionable, but it is not inherently negative.

- Pullbacks create opportunities for purchase

GMGI: The right case

Golden Matrix Group (NASDAQ: GMGI) is a leading B2B and B2C gaming technology company that uses proprietary technology and operates worldwide in 17 regulated markets. GMGI’s B2B division develops and licenses the brand’s gaming platform for an extensive list of clients. Rkings, the B2C division, runs a large number of e-commerce sites, allowing end users to participate in paid competitions on their own platforms in the certified market.

In Mexico, GMGI owns and operates MexPlay, a regulated online casino. The company’s global footprint expanded earlier this year with the acquisition of MeridianBet, an established B2B and B2C sports betting and gaming platform operated in regulated markets in Europe, Africa and Latin America.

The acquisition of Meridianbet has been a catalyst for GMGI’s books and stock prices. The total entity achieved the total as detailed in Form 8-k/A submitted to the SEC in 2023 Proforma Sales of $137.17 million and 57% total margin. Total revenue for the first quarter of 2024 was $36.69 million, with a total gross profit margin of 57.4%. Total net income for the first quarter of 2024 was $2.06 million.

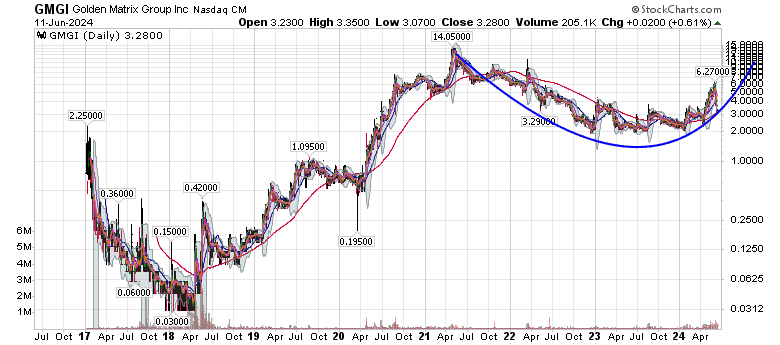

GMGI chart responds

The positive development was fully exhibited on the GMGI chart. Keep an eye out for a notable surge in cumulative volume as the stock bounced at $2.22 on April 15th.

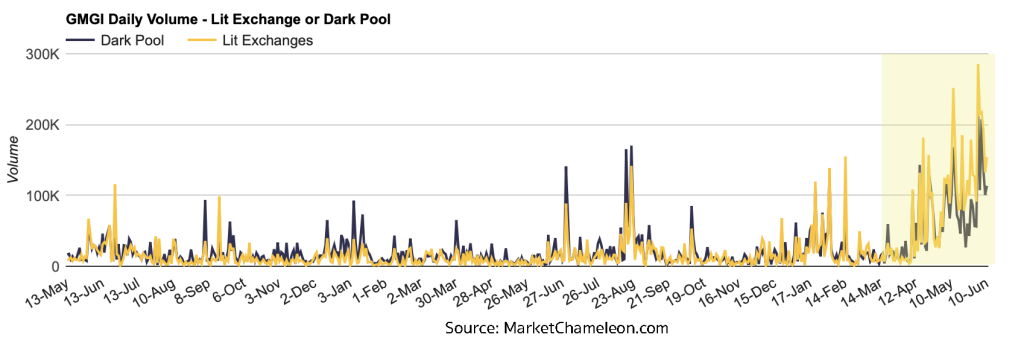

Naturally, the sale continued. But was it driven by something bigger than natural deals? Take a look at GMGI Dark Pool’s deals Markethameleon.com Over the past few months, it has not shown identifiable jumps and lit deals in the dark pool.

It just so happens that dark pool trading is a big money playground (e.g. hedge funds, institutions). Market Chameleon’s chart shows that almost every GMGI transaction is small and retailer. This could change soon as the Golden Matrix Group was just added Russell 3000 On June 5th, we were able to raise the attention of more funds investing in popular indexes.

So, it has to be shorts, right? no. data fintel.ioRetrieving data from Nasdaq shows that GMGI is only 96,868 shares, or a day’s worth of trading.

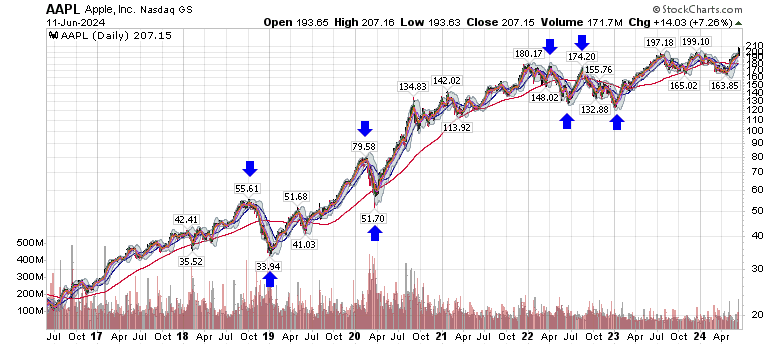

The simple answer is that people have had the opportunity to take away some profit as GMGI reached a multi-year high. That happens to all companies. Even Mighty Apple (NASDAQ: AAPL) is pretty much engraved during its incredible value creation (and it was halved many times when you went back to its early days).

Savvy traders use up and down movements to review investment papers and ask if the company’s foundations still support initial investment decisions and whether pullbacks are an opportunity for dollar cost averaging.

Long-term focus: Don’t get caught up in short-term price fluctuations. If you believe in the company’s long-term outlook, a pullback can be a great opportunity to buy at a discount.

For GMGI, the better question than what the pullback culprit is is a bullish continuation pattern when the chart forms a large cup and handle. In the chart above, we certainly noticed that the shares sharing the support level and 200-day moving average have been noticed in the chart above. This will result in the case the third newest high is retained.

From here on, continuing to climb smoothly and maintain higher lowers and higher prices is what builds a strong chart and reflection of the inventory worthy of being part of the Russell 3000.

To make your investment successful, you need discipline and a clear mind rather than being influenced by noise. Analyze the situation reasonably and remember, sometimes remember that a pullback is just a pullback.

This content is provided by J Ramsdell Consulting (“JRC”), an investor relations consulting company specializing in social media management and corporate communication solutions for public and private companies around the world. JRC encourages all readers to consult with a qualified professional advisor before making an investment decision, not a registered broker/dealer or financial advisor. JRC is not responsible for any investment measures implemented by readers. All content is generated from publicly available information and is considered accurate. However, the accuracy or completeness of the information is as reliable as the sources obtained. All material created by JRC and made publicly via distribution services, social media, websites or other means of transmission are not considered investment advice or solicitations to buy and sell securities, and is intended for useful purposes only. JRC is compensated by GMGI for investor-related services. It happens to include creating and managing content. This inherently creates a conflict of interest in JRC’s ability to remain objective in communications about client companies. Additionally, this article contains forward-looking statements relating to the business plans of client companies, particularly in the sense of Section 27A of the Securities Act 1933 and Section 21E of the Securities Exchange Act 1934, and subject to the safe ports prepared by these sections.