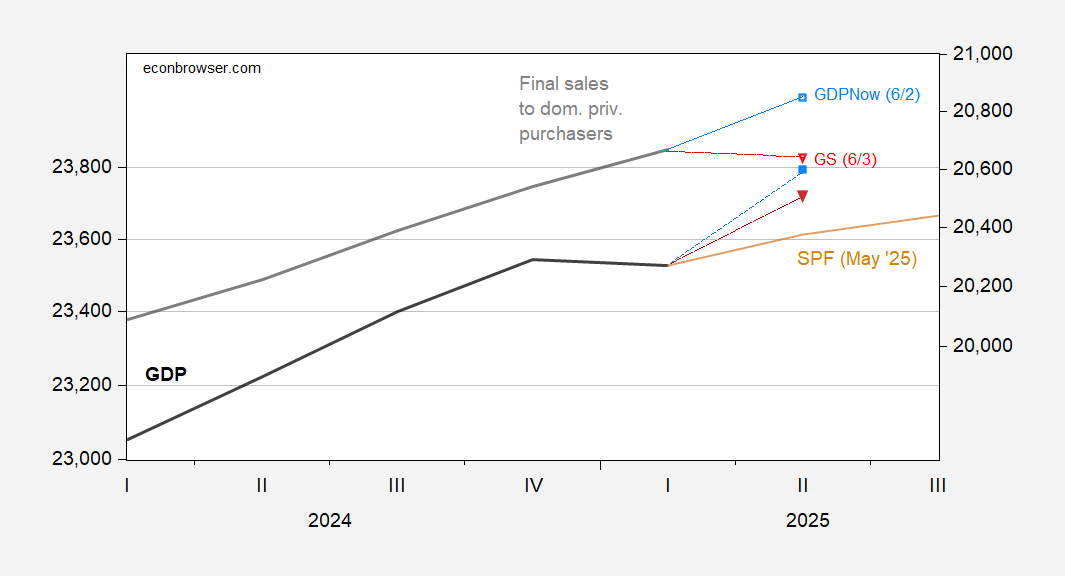

Atlanta Fed Nowcast shows growth of 4.6% Q/Q AR in GDP. Interestingly, this does not revert GDP to its pre-liberation trend.

Figure 1: GDP (Black, Left Log Scale), May SPF forecast (TAN, Left Log Scale), GDPNOW (Light Blue Square, Left Log Scale), 6/2 GDPNOW (Light Blue Square, Left Log Scale), Goldman Sachs (Inverse Red Triangle, Left Log Scale), Domestic Private Purchase Source: BEA 2025Q1 Second Release, Philadelphia FED, Atlanta FED, Goldman Sachs, and Author Calculations).

Goldman Sachs is somewhat pessimistic, especially with regard to “core GDP” (final sales of private domestic purchases).

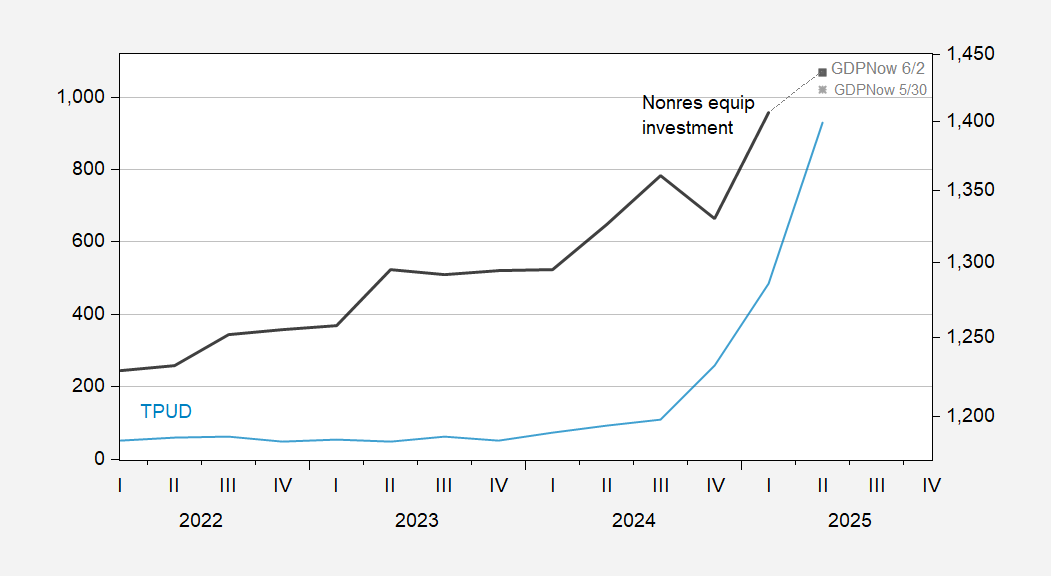

Even with the upgrades, Atlanta took Nowcast to Feed to invest in equipment — generally I think it’s very sensitive to uncertainty — has slowed down significantly.

Figure 2: Trade policy uncertainty (light blue, left scale), equipment investment (BOLD BLACK, right log scale), BN.CH.2017 $, SAAR. Source: Iacoviello, BEA 2025Q1 Second release.