It’s election season, so naturally, critique and policy proposals are going back and forth between all aspects. One of the items on either side of the aisle emphasizes: Child Tax Credit. A great rebate from Uncle Sam to parents who discharge their bank accounts with monthly childcare, sports registration fees, and Applebee’s raw children’s menu items.

$2,000 credit since 2017 With the kids Families under $400,000 can be applied to the tax bill. In other words, if you have three children, you can knock $6,000 out of your income tax liability! Better yet, if you pocket cash every spring and don’t pay taxes, you still get a refund.

The policy is currently set to expire in 2025. What happens when that nail returns and how to improve it for the future.

The original child tax credit and subsequent expansion are widely regarded as an effective and cost-effective tool to alleviate child poverty and food insecurity among millions of low-income families.

Covid Era Policy In 2021, expanding policy proved to expand its benefits. During this period, people can get just as much $3,600 per child is split into monthly payments. If you had kids during Covid, you may remember getting hundreds of dollars a month.

As families did not have to earn a certain amount to qualify, 19 million children from low-income families became eligible and began receiving monthly benefits.

Why do you expire this?

The answer seems to be politics. Democrats proposed expansion during the Republican administration solely to be blocked on technical grounds. Republicans proposed similar ideas during the Democratic administration, but were blocked for the same reasons. It seems to be that policy

-

Reduce child poverty

-

We will support the cost of today’s children’s counterattack

-

The future society is back and is making a big bang for your spending

-

Incentivize families to have children during national fertility decline

It makes too much sense to keep the book up.

In theory, this is not easy. Rights love low taxes. On the left I love social programs. Joint Tax Commission (JCT) The total cost of making the 2021 expansion permanent is estimated to be $105.1 billion per year.

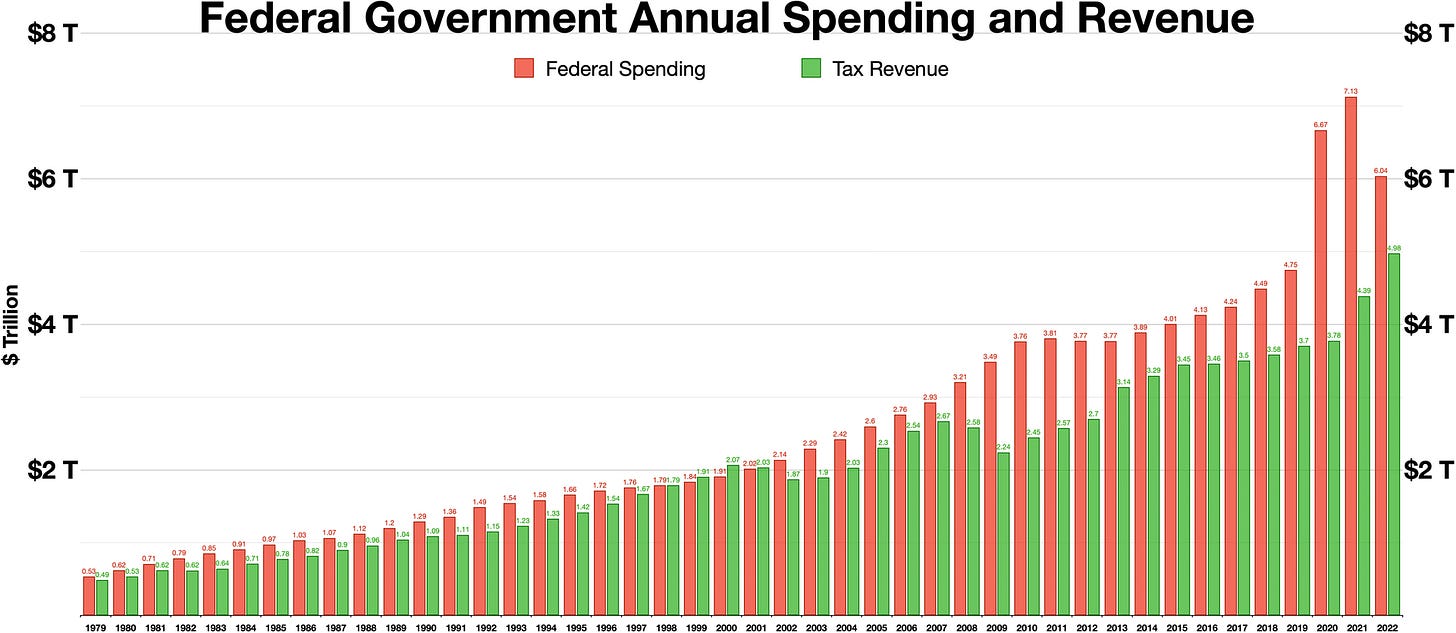

About some reference points for what $105.1 billion is US Government Budget,

-

The government spent $6 trillion in 2022, a rise in total annual spending by just 1.75%

-

In 2022, we spent 26.6% on $1.6 trillion or budget social security (opposite to supporting children)

-

Since 2022, Ukraine has approved $170 billion to fight Russia

-

Other programs like Snap (food stamps) and calmed school lunches will probably see some savings as money is sent directly to the family

Let’s try and see who’s entered the office next year!

Dad – Use the same persuasion that applies to your wife on a Saturday night. She may not be in the mood, like Congress, but it never stopped you. You may not be able to amortize mistakes immediately – I mean love your life.

Are you interested in joining the Trader Papa Podcast in 2024? Shoot the email! I want you to sit for discussion

thought? question? comment?

Reach out! Maybe I’ll post the full topic or as a Q&A

corderdads@substack.com