by Calculated risk 6/24/2025 04:06:00 PM

From InterContinental Exchange: ICE First Look at Mortgage Performance: Delinquent Reductions Raises Stable Foreclosure Sales to the highest level since early 2023

Intercontinental Exchange, Inc. (NYSE: ICE)…Today we released the May 2025 Ice First Look. This indicates that delinquency and foreclosure activity continues to rise slightly over the year despite improvements related to seasonal and disaster recovery.

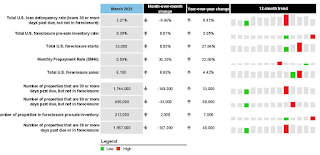

ICE First Look reports on end-of-month delinquency, foreclosure and advance payment statistics raised from a loan-level database that covers the majority of the US mortgage market. Here are some important takeaways from this month’s survey results:

• National delinquency rate was checked at 3.20% on 2 basis points (BPS) in MayHowever, this is an increase of 5.2% (16 bps) from the previous year (Yoy).

•Serious late – Loans have passed more than 90 days but not foreclosure – has improved seasonally for the fifth consecutive year, but has seen a 56K (14%) increase at the same time last year.

• Disaster-related delinquency has also been improved, with those related to the 2024 hurricane season being reduced by a more modest 9% mom in the 1 month (MOM) and Los Angeles wildfire-related arrears.

• Foreclosures began, and aggressive foreclosure inventory climbed back and forth to commemorate the largest volume of 7K foreclosure sales in May in over two years.

•As measured by one-month mortality rate, advance payment activity was driven by a seasonal increase in home sales-related advances at a maximum of 0.71%, the highest level since October 2024. Advance payments increased 23.4% year-on-year.

Emphasis added

This is the table from the ice.