I frequently check in to see items floating around Wall Street circles and blogs.

-

Long-term trends in markets and economies.

-

Additional details about what appears to be underestimated or exaggerated.

-

Link to some great explanators about the concept.

** Everything from January 10, 2010

I rarely give people straight trade ideas or tips.

a) Literally millions of people throwing snake oil stock tips on the internet

b) I am not licensed or certified to provide investment advice

c) That’s not actually the point of this feed.

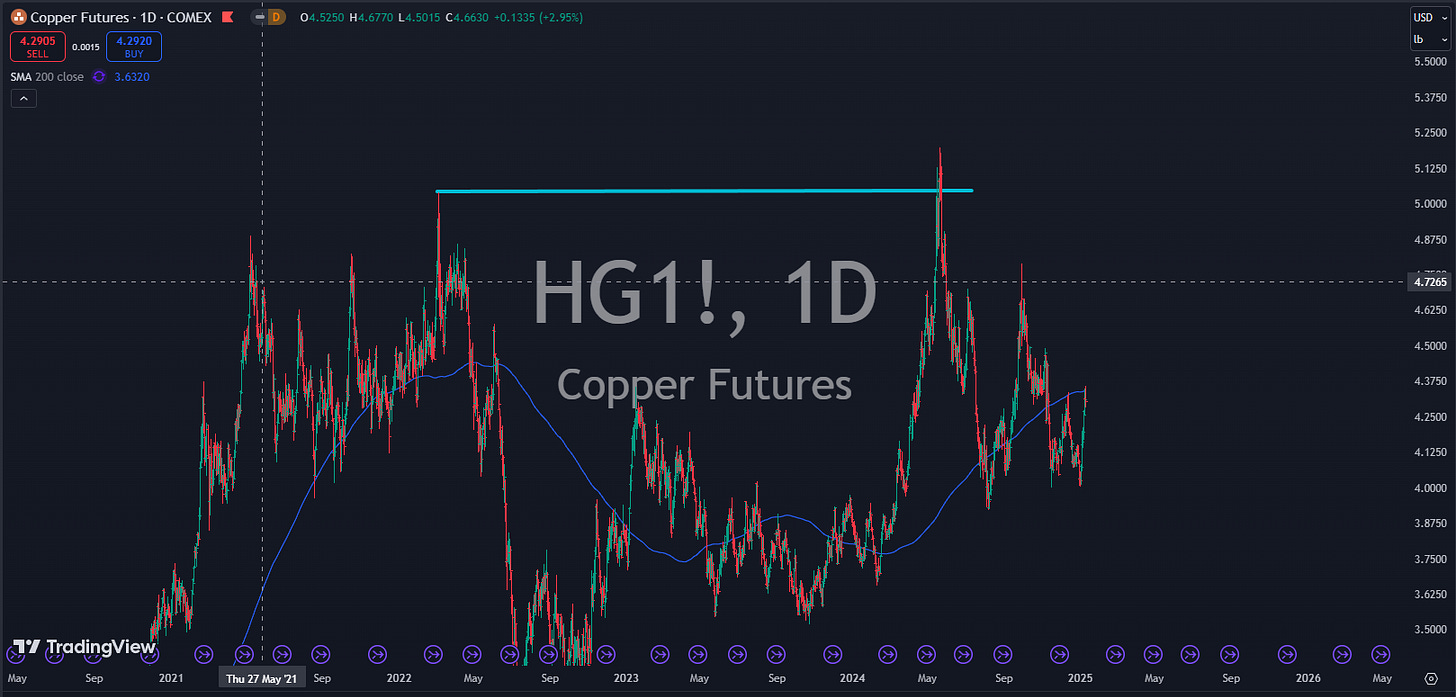

But copper has been nibbling on me for a while. Copper futures formed “slender eyes and we call it close enough.” Double Top Formation Back in June, he showed his respect by pulling back 25% soon.

So what now? I think we’re at the bottom in the end and are on the crisis of massive double-top crushing towards the new highs in red metal from 2025 to 27/2026.

why?

Copper as an industrial metal is used for all kinds of purposes, so the price tends to follow the boom-bust cycle. (See Housing Boom Bust vs Copper Prices from 2006 to 2008)

What is the biggest boom at the moment?

AI chips, AI data centers and Cooling components To do both tasks, copper is required to manufacture the parts.

Copper demand It’s almost doubled In a relatively short time frame, as the AI arm race is heated.

I agree with the chart. In the long run, copper is already quite expensive, but appears to be caught up in the breakout.

You won’t be able to zoom in and run a good bull in a triangular pattern that will rise as the potential tip of the spear in the coming months.

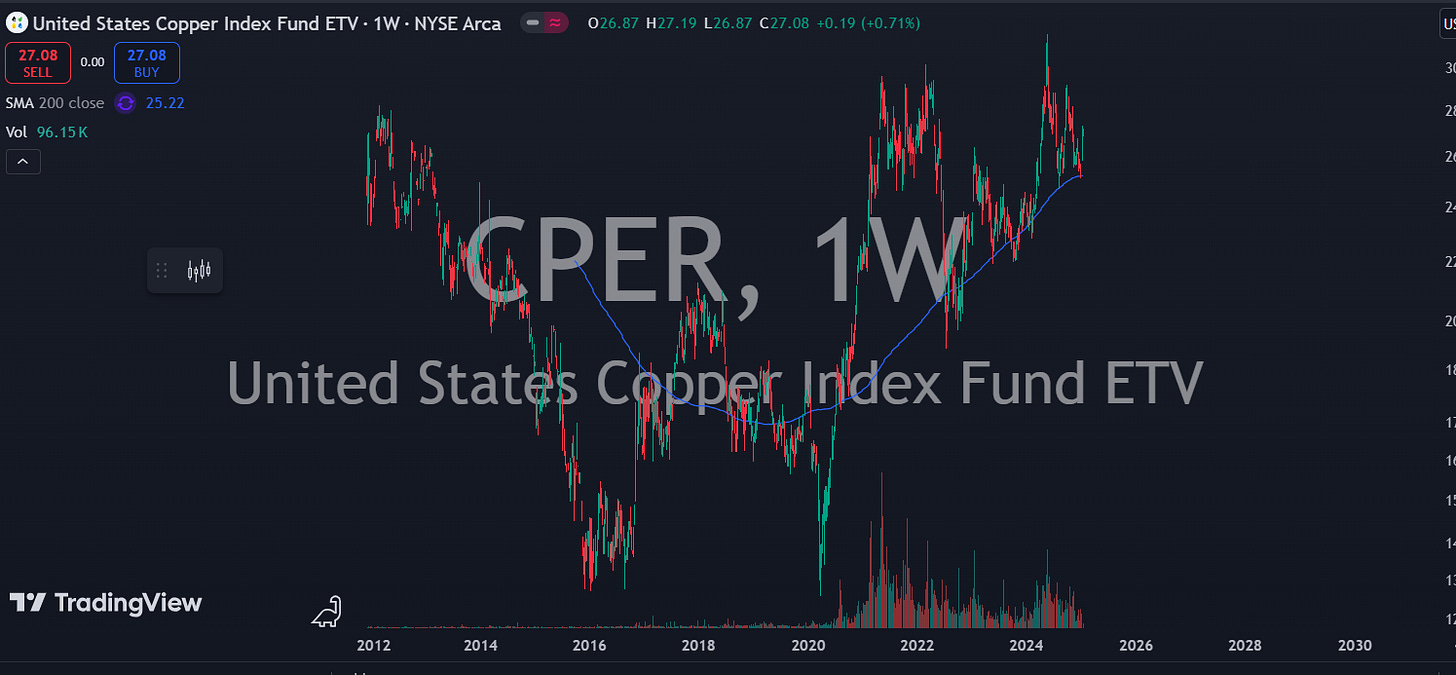

Finally, for stock equivalents, you can use CPER, which is an ETF that holds futures contracts for raw metals, rather than many copper ETFs that hold copper miners’ inventory.

This leaves the business risk elements of minor ETFs in straight metal play, including interest costs and changes in regulations.

Finally, how is this not a big stock chart meme?

“I don’t even see a price. All I’m looking at is buying, buying, selling.”

“I can’t even see candlesticks. All I see is support, resistance and breakout.”

There are like 100 of them!

Are you interested in joining the Trader Papa Podcast in 2024? Shoot the email! I want you to sit for discussion

thought? question? comment?

Reach out! Maybe I’ll post the full topic or as a Q&A

corderdads@substack.com