by Mike Maherry

After implementing the third-largest budget deficit in history in 2024, the Biden administration began fiscal year 2025 in a similar way.

The federal government has done it $257.45 According to the billion budget shortfall to start a new fiscal year. Latest statement from the Ministry of Finance.

This was an increase of 287% in the deficit in October 2023.

The federal government receipt was $326.77 billion. This is about 19% decrease compared to October 2023. One influx of tax payments that was postponed as last year’s wildfires increased revenue in October 2023.

As has been the case for several months, the big problem lies with the spending side of the ledger.

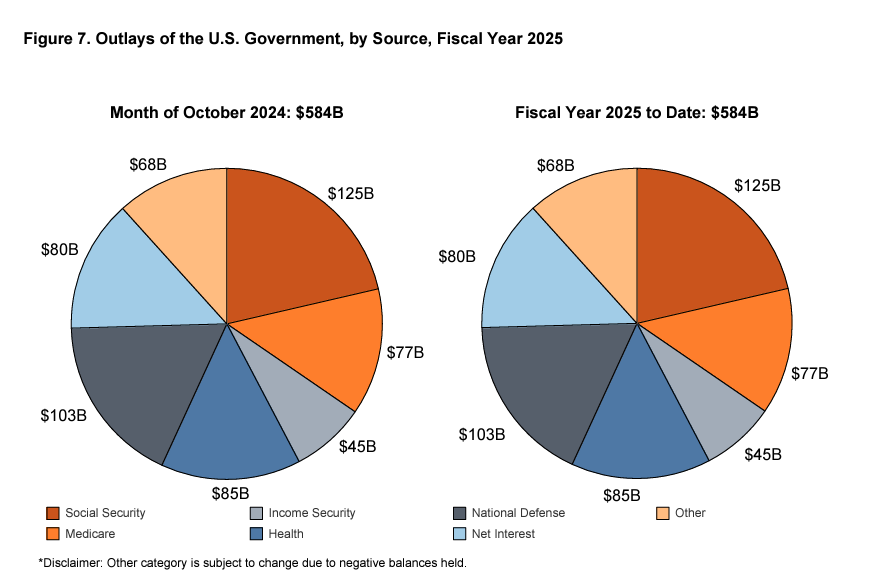

The Biden administration exploded $58.422 billion last month. This was an increase of 24% from the previous year. Social Security, Medicare and national defense spending all increased.

You may remember President Biden promised that. [pretend] Expense reductions will save “never millions” on debt cap transactions (also known as [misnamed] (Fiscal liability law).

It never happened.

The federal government continues to find new reasons to spend money, whether it’s a natural disaster at home or a war abroad. The Biden administration spent an astounding $6.75 trillion in fiscal year 2024, up 10% in 2023 spending.

The federal government spent $82 billion on interest costs last month. This was an 8% decline, the first annual interest expense since August 2023. The Treasury said the decline was driven by a $12 billion cut in inflation protection securities payments thanks to a decline in CPI.

The net interest cost was $80 billion. This was an increase of $4 billion by October 2023.

Uncle Sam paid 1.13 trillion dollars Interest expenses for fiscal year 2023. It was the first time that interest costs had been overturned $1 trillion.

Interest payments increased 28.6% at the 2023 fiscal year level.

Don’t trick you with a slight drop in interest expenses last month. The general trend remains upwards. Despite recent cuts in the Federal Reserve, Treasury yields are being pushed up As demand for US debt. Since Trump’s election victory, the Treasury yield has increased by 15 basis points in 10 years.

Many of the debts currently listed in the book were funded at very low rates before the Federal Reserve began its hiking cycle. Each month, some of that Super Lifield’s paper needs to be replaced with bonds that mature and produce much higher rates.

The impact of debt

We see these big deficits every month, but most people don’t catch the eye. It seems there’s a feeling that it’s not really a problem to spend more than you take each month.

However, anyone who says, “deficits don’t matter” is misled.

As The Bipartisan Policy Center points outthe increase in citizens’ debt and financial irresponsibility undermine the dollar.

“The confidence in US creditworthiness may be undermined by a rapidly deteriorating financial situation, which has led to growing concerns about a significantly increased federal debt over the next few years.”

This could lead to reduced economic growth, increased unemployment and reduced investment wealth.

Lack of confidence in the US financial situation could also reduce demand for US debt. This will make the interest rates at the US Treasury even higher, exacerbating the interest payment problem in order to attract investors.

National debt Continue the spiral upwards at a dizzy pace. It officially will be at $36 trillion in just a few days. According to the national debt clockwhich represents 122.85% of GDP. Research shows that a debt-to-GDP ratio of over 90% slows economic growth by about 30%.

Debt could be one of the biggest issues President Trump faces when taking the reins of power. With Republicans controlling both Congressional meeting rooms and the White House, there is an opportunity to tackle the issue of spending, but it remains to be seen whether the GOP has the political will to make substantial cuts.