Image Source: Games Workshop PLC

For the majority of the past two years, growth stocks have acquired the backseat. High inflation, rising interest rates, and neurological investors have driven a shift towards the value and defence sector. But are UK growth stocks ultimately staged their comeback as inflation rates are likely to ease and rate hikes are approaching peak?

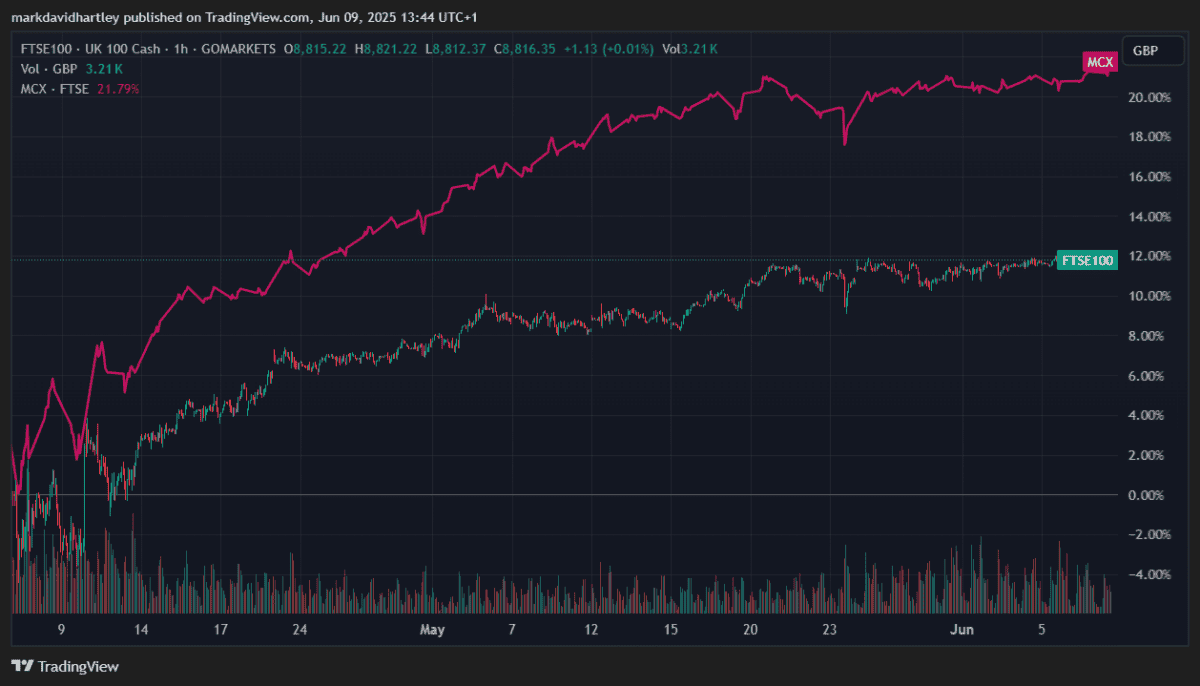

It’s still early in the day, but the signs are encouraging. FTSE 250The home of many of the UK’s best growth names is FTSE 100 Over the last few months. It is usually a sign that investors are beginning to support riskier, faster businesses once again.

Why growth stocks struggled

Growth stocks often promise strong future earnings, but much of their value is tied to forecasts. As interest rates rise, these future profits will be discounted more, and growth stocks will look less attractive compared to alternatives that pay a steady dividend. This is the main reason why high-tech and consumer discretionary companies have slowed performance in 2022 and 2023.

However, UK inflation is currently down below 3%, with the Bank of England expected to cut further later this year. With lower borrowing, growth companies may find it easier to raise, invest and provide these long-term forecasts.

Signs of recovery

Recent results for some growing UK companies are solid. For example, the very popular FTSE 250 companies Game Workshop (LSE:GAW) reported record-breaking revenue and profits in the latest update, and international expansion continued to draw momentum. The stock has grown by more than 20% so far.

With complete control over intellectual property, the development and licensing of increasingly popular products Warhammer The franchise, its future looks promising.

Revenues are growing steadily, supported by a loyal fanbase, new product releases, and expanding retail and online channels. Recent results showed double-digit profit growth, with royalty revenue from media transactions adding a lucrative revenue stream. Despite the niche market, international demand continues to grow.

However, there are risks. The stocks trade at a price of 30 (P/E) ratio, with little room for growth. If the results are not impressed, they can lead to short-term losses. Growth is also linked to consumer spending, which can fluctuate in a recession.

Still, with its cash-rich balance sheet and growing global appeal, stocks are worth considering long-term growth.

Another FTSE 250 shares that have recently been seen renewed growth is a high street tech retailer curry. The stock has skyrocketed 30% this year after strong performance led by sales of artificial intelligence (AI) integrated laptops. Last month, the company raised its third profit forecast this year after its stock price hit its four-year high. Also, with a P/E ratio of just 7.5, it still appears to have plenty of room for growth.

Future opportunities

The tide could be directed towards UK growth stocks. Lower inflation and possible changes in monetary policy have created more favorable conditions for long-term capital appreciation. However, selectivity remains important.

While the FTSE 100 tends to support revenue and stability, there are still plenty of exciting opportunities for FTSE 250 and FTSE growth target market. For investors willing to do homework and willing to do a bit of volatility in their stomachs could now be the right time to reintroduce growth exposures into a balanced portfolio.