The spirit of animals today is brought to you by Nuveen and Fabric:

look here For more information about Nuveen’s alternative strategies, please see

I’m going meetfabric.com/spirits For more information about Fabric’s life insurance by Gerber Life, please visit:

Get a combined product here

look here AI Demo Drop Information

Subscribe to unlock For the hardships about what AI does to the wealth industry

Today’s show explains:

Please listen here

Recommendations:

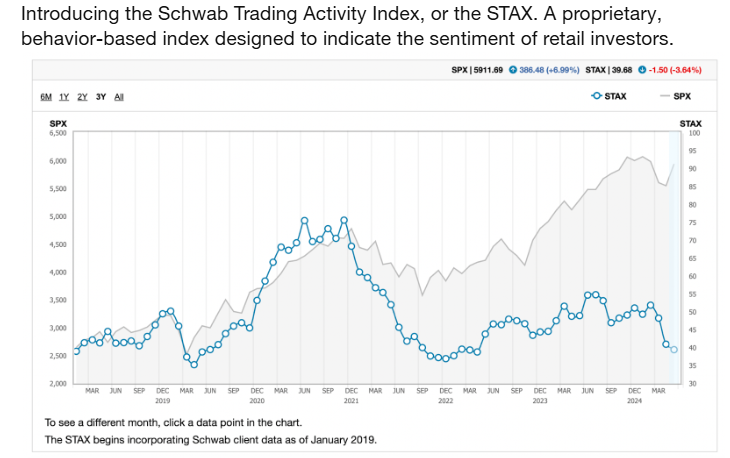

chart:

Tweet/Blue Ski:

Quantum drinks $qubt It’s a $3 billion company that trades daily dollar amounts than Intel. $ intc However, forward forecast revenues are less than in one Chick-fil-a location. https://t.co/7rmxf45mxn

– Consensus Media (@consensusgurus) June 11, 2025

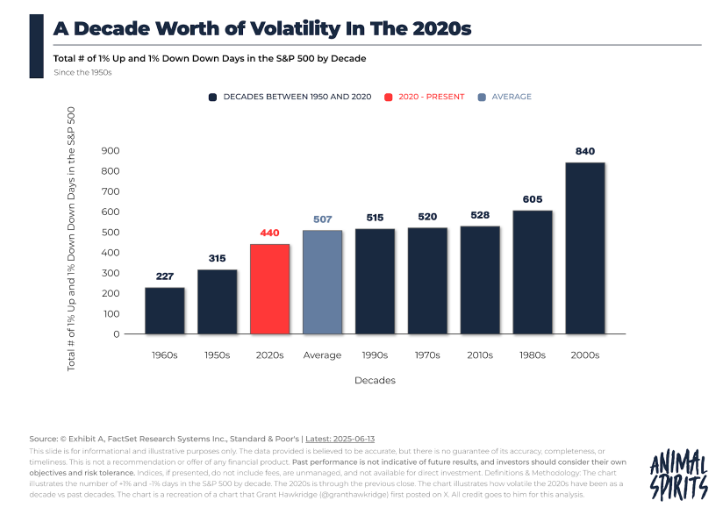

Counting 437±1% days.

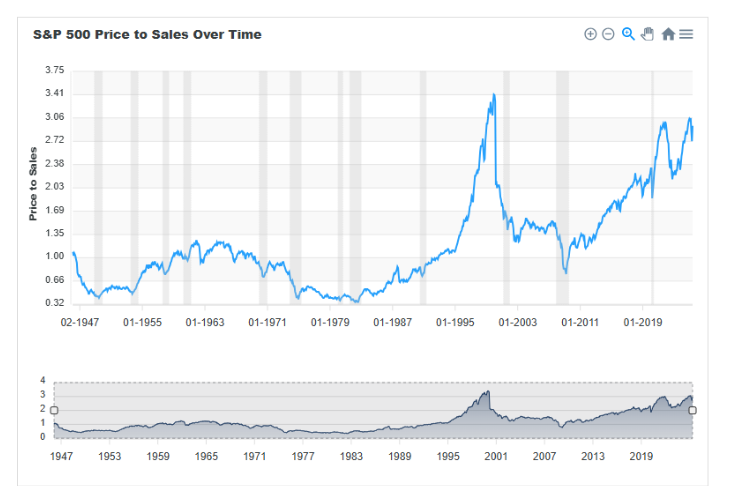

The 2020s are moving smoothly as the most unstable decade in market history.

But here’s the twist… The S&P 500 has grown by more than 80% since 2020.

Big movement. Great profit.

It’s not a combo we’re used to.

👉https://t.co/geftcgarz0 pic.twitter.com/7zstycqq5f

– Granthawkridge (@granthawkridge) June 13, 2025

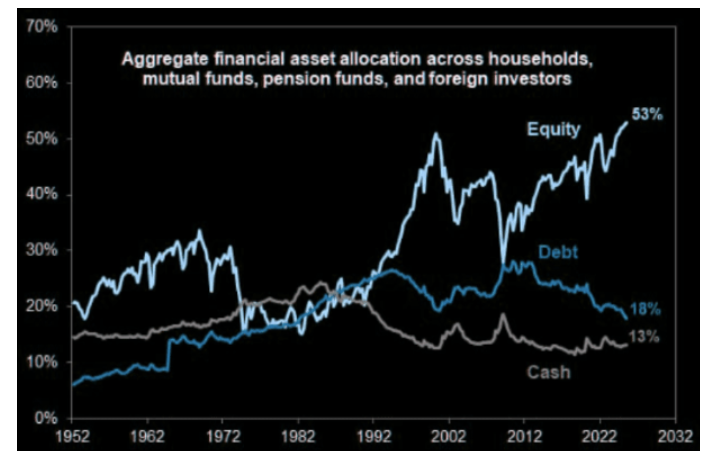

The top 1% owns 51% of the stock

1% at the bottom 50% pic.twitter.com/jjvensmmxa

– Mike Zaccardi, CFA, CMT🍖 (@mikezaccardi) June 14, 2025

Restaurant & Bar Retail Sales fell by -0.9% in May… Worst since February 2023 pic.twitter.com/zjxgdinpbr

– Kevin Gordon (@kevrgordon) June 17, 2025

errata: There were no latest predictions from Goldman in the table above. They are at the start of the December cuts, not July. pic.twitter.com/opr4le2ajq

– Nick Timiraos (@nicktimiras) June 11, 2025

It’s surreal how big the polymake has become pic.twitter.com/ixt52yqkey

– Shayne Coplan 🦅 (@shayne_coplan) June 13, 2025

Bitcoin is currently at $105,300

If you want to purchase from Coinbase, we charge you $106,900. If you want to sell it, it’s $103,950.

wtf? ! ?

– lynk (@lynk0x) June 14, 2025

The circle made about $200 million after paying the incentive in 2024.

Trade ~ 162x these numbers.

The market cannot get enough Stablecoin exposure. https://t.co/w9bemswzyy

– Zaheer (@splitcapital) June 16, 2025

Ingvar Kamprad was the founder of Ikea

He was worth nearly $60 billion at the time of his death

I really love some of his simple habits

– He drove a 1993 Volvo for 20 years

– I bought clothes from a flea market

– I got his haircut abroad

– He flew coach pic.twitter.com/1k016hdj7o– Dividend Growth Investor (@dividendgrowth) June 10, 2025

Spaceballs 2 may have already revealed its title almost 40 years ago. https://t.co/bitgsrvut3

– Screentime (@screentime) June 13, 2025

#mastersoftheuniverse It wrapped up production.

Via Nicholas Garitzin pic.twitter.com/rxn0ztesw8

– RottenTomatoes (@RottenTomatoes) June 16, 2025

follow me Facebook, Instagramand YouTube.

Check out T-shirts, coffee mugs and other stolen items here.

Subscribe here:

There is no investment advice, performance data or any particular security, portfolio, trading, or investment strategy on this blog is suitable for a particular person. References to specific security and related performance data are not recommendations for buying and selling that security. Any opinions expressed herein do not constitute or imply any approval, sponsorship, or recommendations by Ritholtz Wealth Management or its employees.

Compound, Inc., an affiliate of Ritholtz Wealth Management. received compensation from the sponsor of this ad. The inclusion of such advertisements does not constitute or imply any endorsement, sponsorship or recommendations or affiliation by the Content Creator or Ritholtz Wealth Management or its employees. Investing in speculative securities involves risk of loss. This website will not be used in connection with offers to sell or hold interest in security or investment products, or offers to offer to sell or hold.

This content, including security-related opinions and information, is provided for informational purposes only and should not be relied upon in any way as professional advice or endorsement of practices, products or services. There is no guarantee or guarantee that the views expressed herein may be applicable to any particular fact or situation. You should consult your own advisor regarding legal, business, tax, and other related matters related to your investment.

The commentary on this “post” (including related blogs, podcasts, videos and social media) reflects the personal opinions, perspectives and analysis of employees at Ritholtz Wealth Management who provide such comments and should not take into account the views of Ritholtz Wealth Management LLC. or as a description of the advisory services provided by the performance returns of their respective affiliates or Ritholtz Wealth Management or Ritholtz Wealth Management Investments clients.

Any reference to securities or digital assets, or performance data, is for example purposes only and does not constitute an investment recommendation or offer to provide investment advisory services. The charts and graphs provided internally are for informational purposes only and should not be relied upon when making investment decisions. Past performance does not indicate future results. Content will only be spoken as of the date indicated. The forecasts, estimates, forecasts, targets, outlooks and/or opinions expressed in these materials are subject to change without notice and may differ from opinions expressed by others.

Compound Media, Inc., an affiliate of Ritholtz Wealth Management. receives payments from various entities for related podcasts, blogs and email ads. The inclusion of such advertisements does not constitute or imply any endorsement, sponsorship or recommendations or affiliation by the Content Creator or Ritholtz Wealth Management or its employees. Investing in securities involves the risk of loss. For additional advertising disclaimers, please visit: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosure here.