I don’t know how good it is.

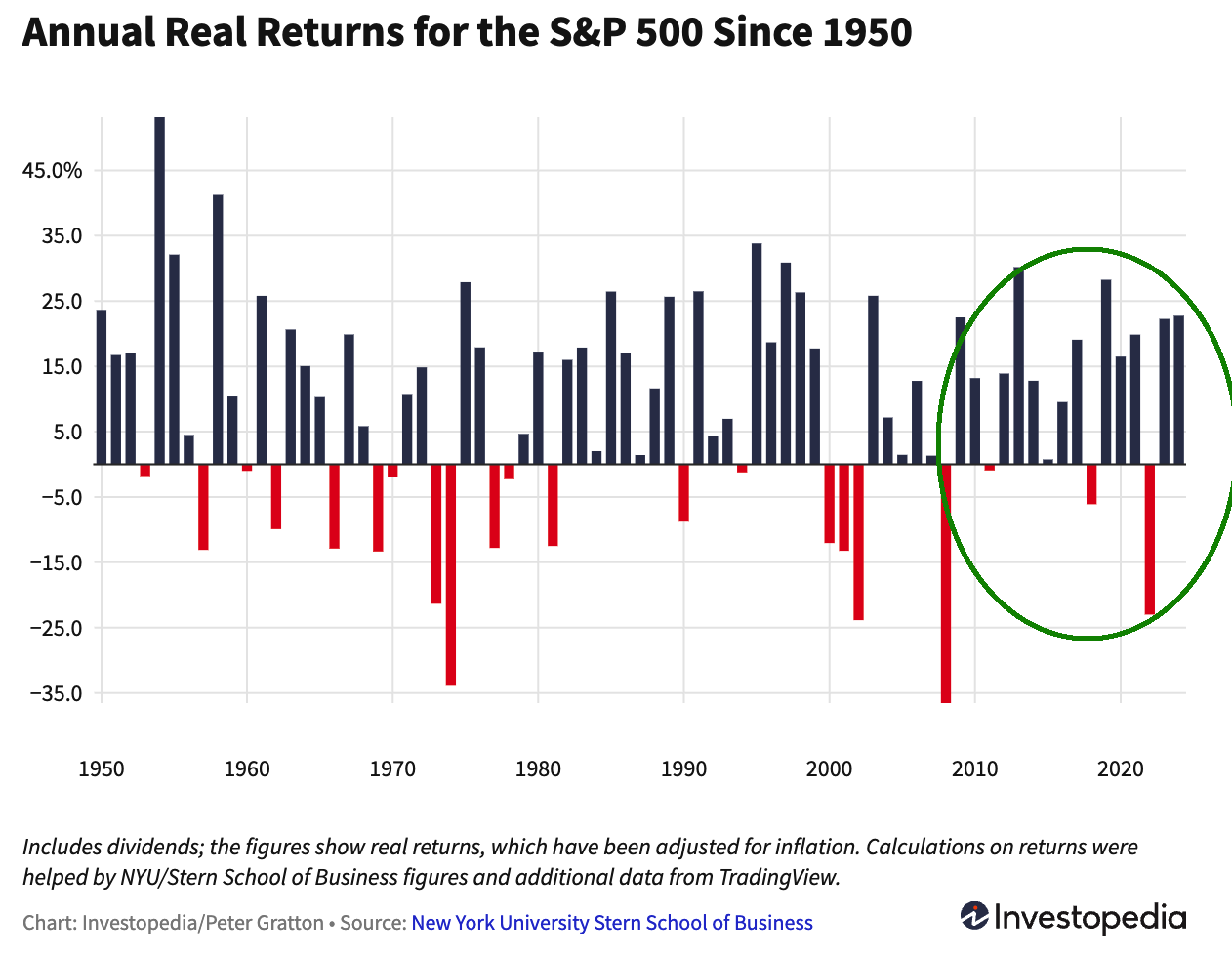

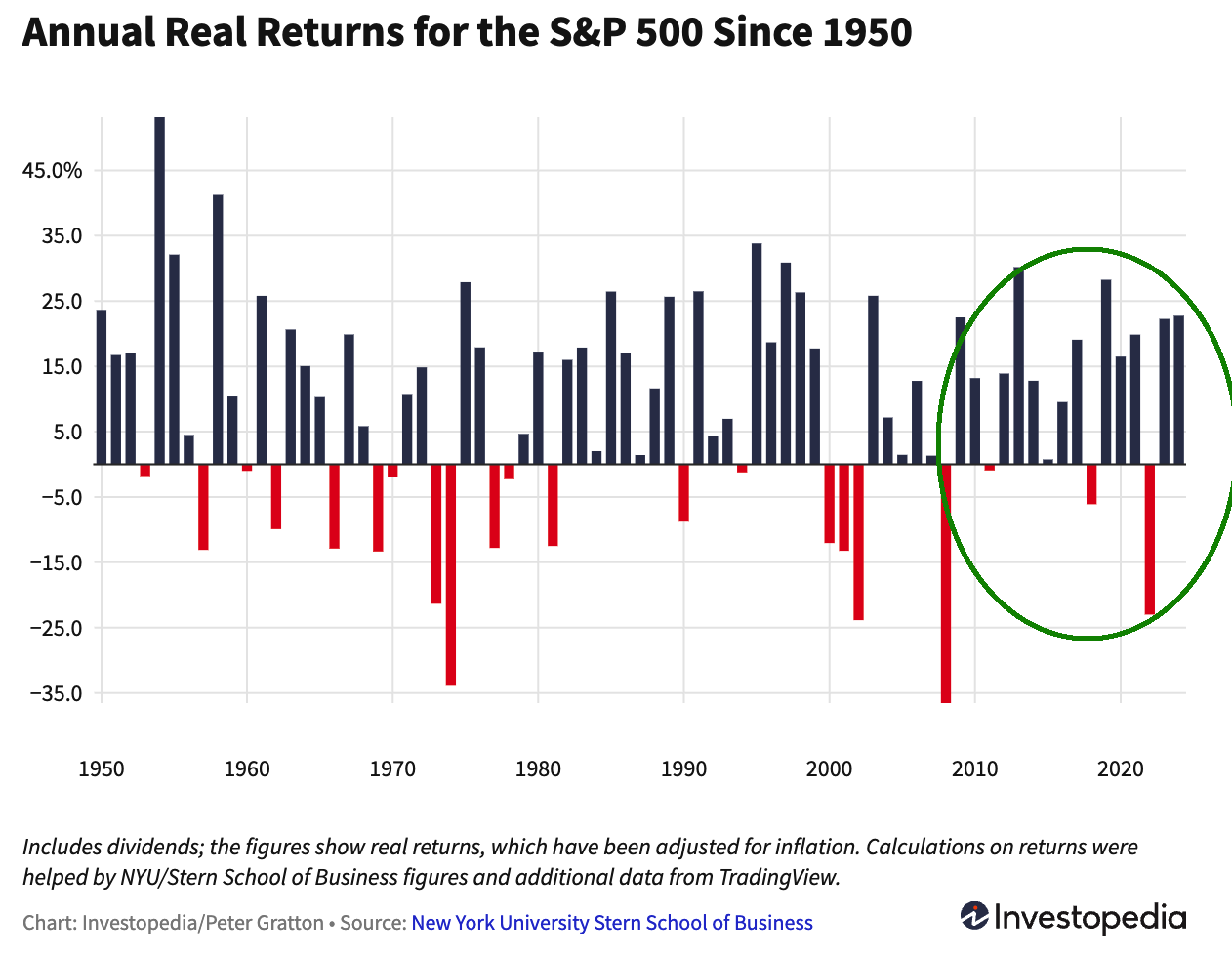

Consider returns data from the Great Post-Financial Crisis Period (GFC) and then unpack what it means.

From January 1, 2010, the S&P 500 generated total revenue (dividends were reinvested) of 566.8%or 13.3% From the beginning of 2010 to the end of the first quarter of 2025. The Nasdaq 100 almost doubled that. (The above chart has been in March 2009, but that’s a fraud.)

Compare this to an average 15-year revenue period over the past century. ~8.7%. The average annual return for the past century is 10.4%.

Using the 15-year return, you can see how there is atypicality this There is a time. The only two good times are World War II Until May 1957 (approx. 18% High-tech boom of the 1980s and 90s, peaking in April 1999 in 15 17% ). This current peak for 15 years was until February 2024.16%.

Over the post-GFC era, it averages more than a third of the typical annual returns since 1925, almost twice the average 15-year stretch.

And the epic run of returns from that epic financial crisis was accompanied by a small setback.

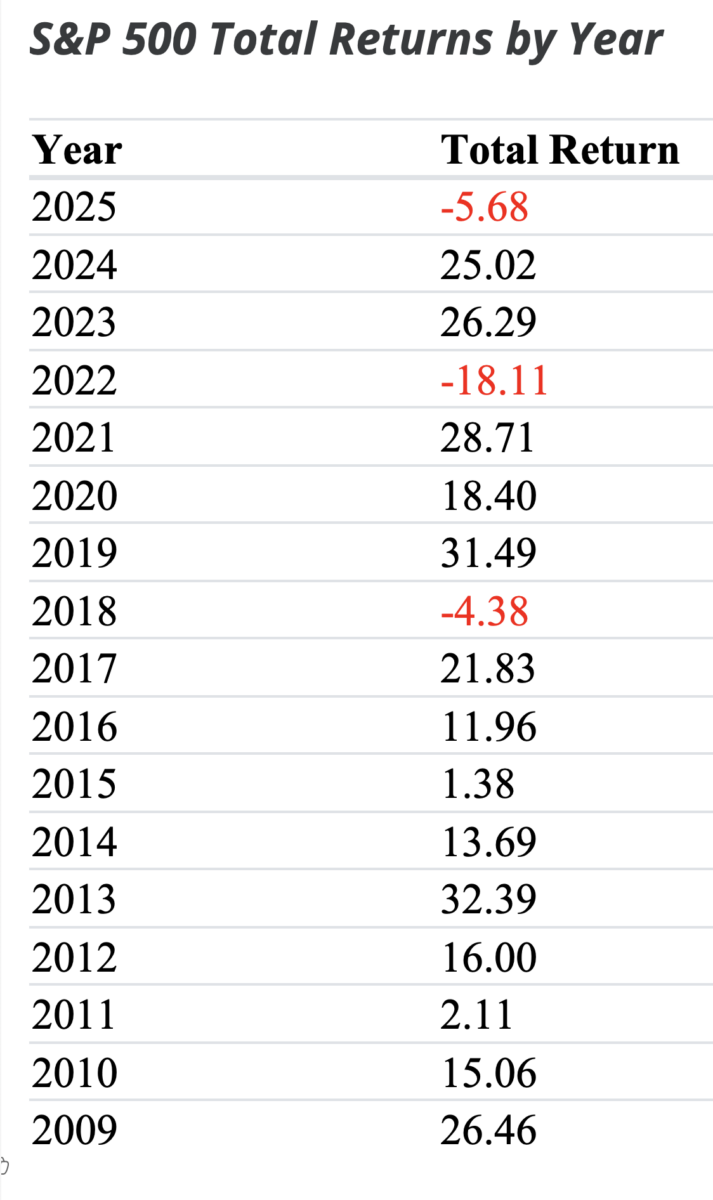

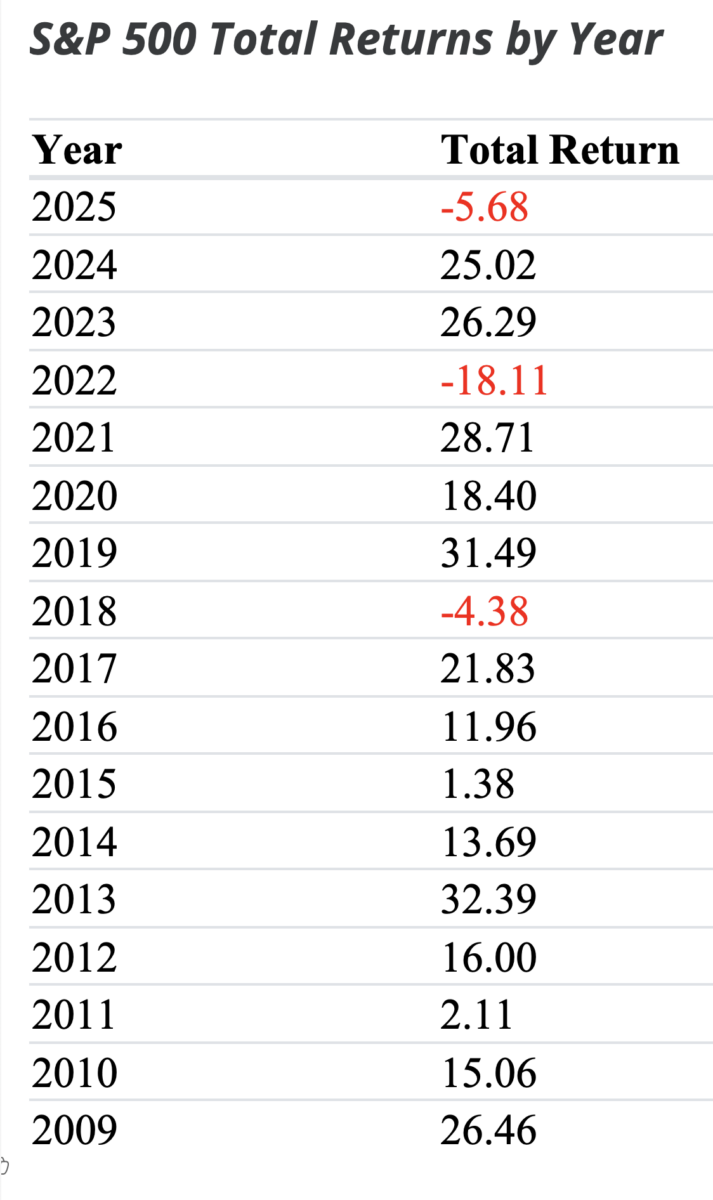

– Flash crash in 2010.

-2011 “Only” 2.1% profit

-2015 “Only” 1.4% profit

-2018 saw a 4.4% drop, with Q4 drops containing nearly 20%.

-Q1 34% down due to the 2020 pandemic.

-2022 saw a decrease of 18% per year.4

The full table of gains is as follows, as GFC looks like this:

Via the table SlickCharts

~~~

Main Street is now a regular “BTFD” player. This is a direct result of Muscle memory – a Latest Effects Impact driven by market profits over 15 years. Throughout the post-financial crisis era, we enjoy rising stock markets, with interest rates falling or zero rates falling through 2022. The good news is that this is how you build wealth over the long term. Nick Maggiuri’s book “Please continue to buy“This case is very convincing.

When we talk about muscle memory, what we really discuss is the habits we have constantly rewarded. What breaks that previous habit depends on how you change your behavior according to its punishment and reward.

Remember what happened during previous changes to the market regime.5 In the 1980s and 90s, despite the crash fall of 1987 (the ultimate 22% dip!), the recession of 1990, the presidential ammo each, the Thai Bad crisis, the Russian ruble default, and the collapse of long-term capital management, dip buyers were rewarded.

For 20 years, every dip purchase paid off quickly.

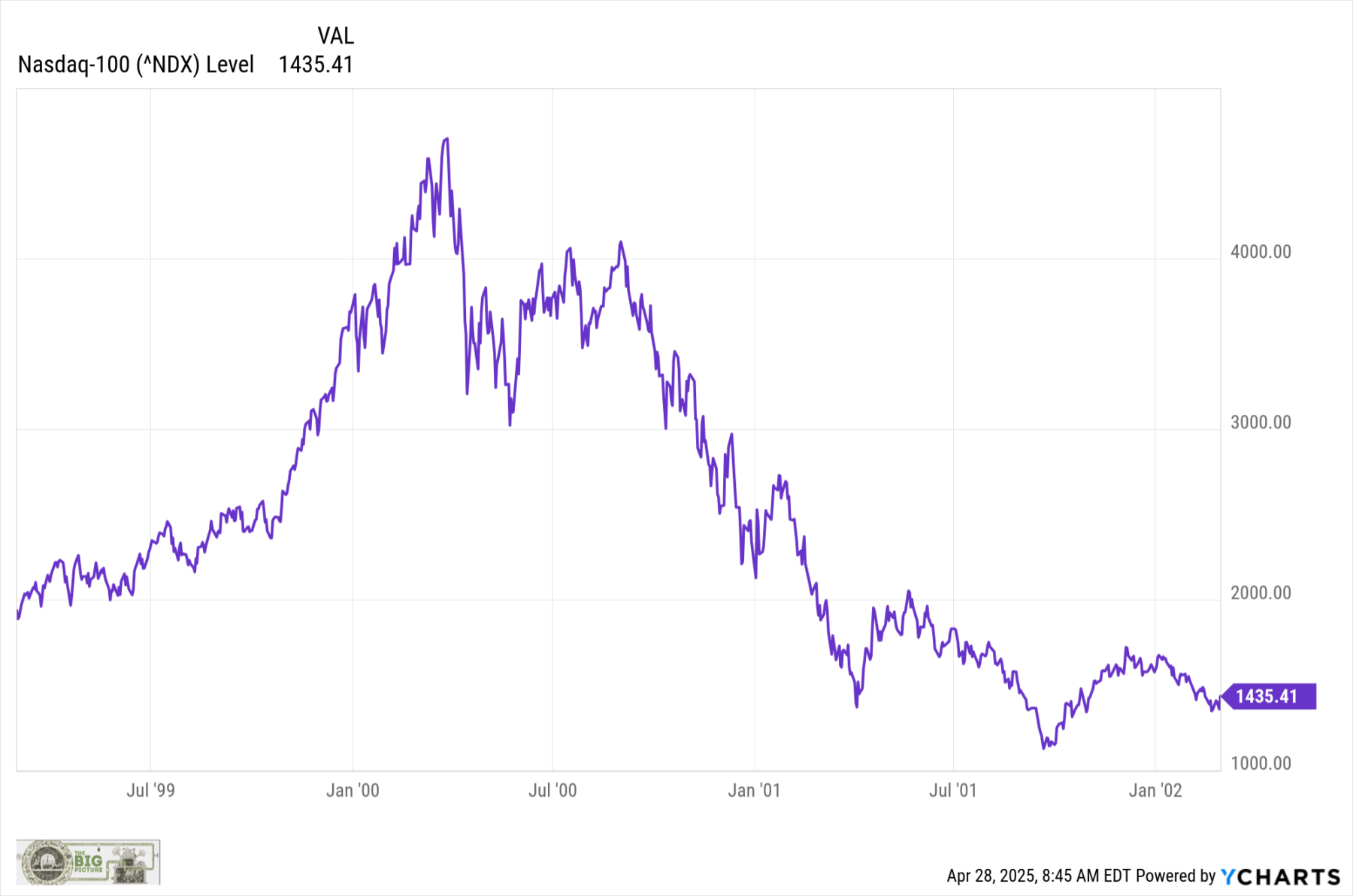

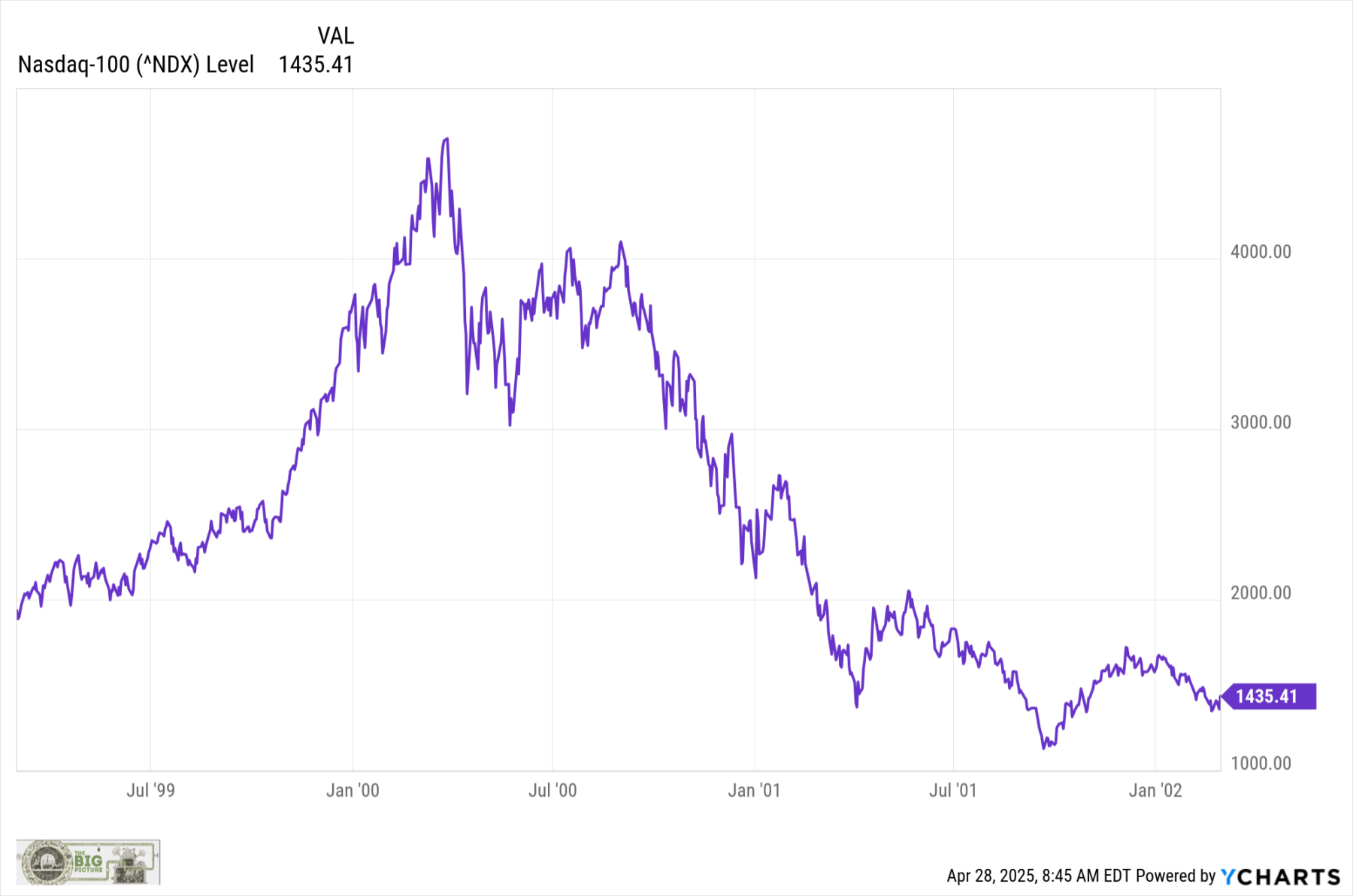

It takes time to change the behavior. Watch the explosion on dotcom (and the terrorist attacks on September 11th). From the double values from March 2000 to October 2002 and March 2003, the Nasdaq 100 fell to 82.9% (peak to the trough). It wasn’t a straight line…

~~~

Even if we didn’t feel that way, we might have had it too long and too long. In October 2009, I wrote The Move Off the Low.The most hated gathering in Wall Street history. “In seven months, the S&P 500 moved 57.5% from the bottom, and the Nasdaq 100 won 64.6%.

History informs us that when the US market declines by 56%, it creates a very favorable entry point for fresh capital stocks. The latest effects challenge us to overcome the psychological stress caused by fresh and memorable crashes. People fought the rally overall and continued for years. “Financial control” was a rallying cry for a low-performing manager.

Over the next 16 years, the crowd may have forgotten the pain. A day when the market rises 12.5% is not what risk managers call a reasonable trading day.

Over the past decade and a half, BTFD has simply worked like a charm. Perhaps it worked Too much. The risk is that some traders will adapt slower if trends change. Investors may be disappointed when they learn that “long-term” investments are measured in decades rather than months or quarters.

People hated the stock market rising in the early 2010s. The current concern is that, thanks to the effects of modernity, they no longer dislike it enough…

Updated: April 28, 2025, 3:21pm

Goldman Sachs makes the following observations:

Goldman Sachs flags constant retail purchases as one of the three major positives in the US stock market

One increasingly prominent story to explain April’s V-shaped price action is that US stocks trust and retailers caught them. Scanning the list of top-performing stocks from Rose Garden Mutual tariff announcements from April 2nd to Friday ends, Palantir’s 29% profit along with double-digit profits such as Netflix and Crowdstrike, not short of popular names.

Goldman Sachs calls this relentless retail bid “one of three constructive dynamics that are occurring in the market today. Retail buyers aren’t blinking (unless they start to see unemployment rates rise). This cohort has become a more aggressive part of the market during the recent rebound of the major index.

-via Sherwood

Previously:

Most hated rally in Wall Street history (October 8, 2009)

______

1. Data from NickMagiulli’s return calculator.

2. If you want to select data, you can start at the end of GFC in March 2009, the return will be much higher, dated from the Pre-GFC peak in October 2007, lower the return.

3. See also Lazy Portfolio Rolling return.

4. Plus bonds 15% – first double digit drop in both asset classes for the first time in 40 years.

5. I am not necessarily arguing that a change of government is above us. Rather, it is a reminder of what happens when the secular trends in the market are reversed.