Image Source: Getty Images

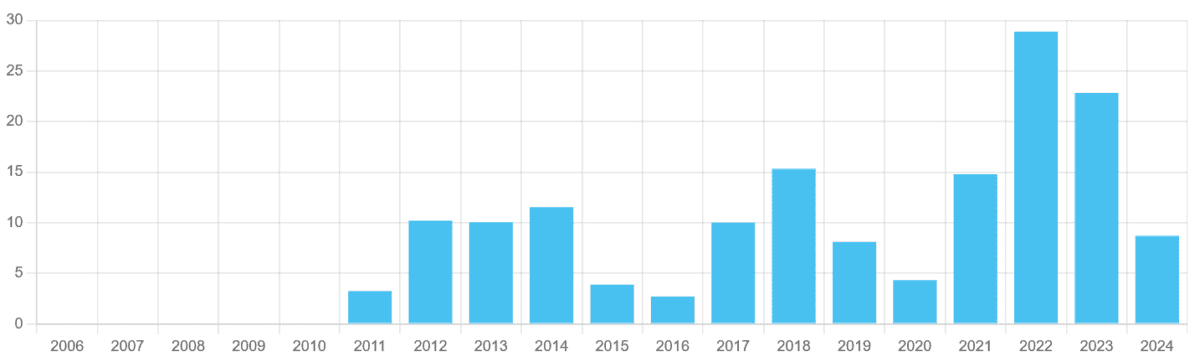

Mining stock is one of the most cyclical. Like shareholder dividends, annual profits can fluctuate wildly depending on the economic situation. This is Glencore (LSE: Glen) has been sharing it for over 10 years.

Since the list of London Stock Exchange In 2011, shareholder payments rose and fell like a seesaw. These days they have sunk as China’s bouncing economy and higher global interest rates reach demand for the goods. In the previous years, they rose strongly as postpartum recovery promoted the value of metals and energy.

But encouraged, city analysts are leaning towards a strong rebound of Glencore stock over the next few years.

9.6% dividend yield

| year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 14 US Cent | 40% | 3.8% |

| 2026 | 22 US Cent | 57% | 6.2% |

| 2027 | 34 US Cent | 55% | 9.6% |

Perhaps this spectacular expected dividend growth is not surprising, consistent with expectations that profits will bounce back significantly.

Currently, Number Kunchers expects Glencore:

- It will swing from a 13 US cent per share loss last year to 20 cents in 2025.

- To record revenue of 33 US cents in 2026, this is a 65% increase from the previous year.

- The following year, it increased by 33% to print revenues of 44 cents.

We expect this kind of growth to far outpace the dividend growth rate of 1.5%-2% for the wider population FTSE 100 In the short term. It also means that dividend yields on Glencore stocks will shoot beyond FTSE’s long-term average of 3% to 4%.

Unstable cover

But of course, dividends are never guaranteed. Therefore, we need to consider how realistic these predictions are.

On the positive side, Glencore’s robust balance sheet may leave a better shape to pay dividends during the new recession than many other miners. As of December 2024, its net liability to Ebitda (revenue before interest, tax, depreciation and amortization) ratio was a modest 0.78.

But as we’ve seen many times, this probably isn’t enough to stop cash rewards from collapse once profits sink. Glencore already appears to be exposed on this front, with forecast dividends covered by 1.3 to 1.5 times with forecast revenues through 2027.

These numbers are far below the two security benchmarks.

Should investors buy Glencore shares?

Balancing it and predicting the magnitude of Glencore dividends in 2027 remains a difficult question given current macroeconomic uncertainty.

Encouraged, the US-China trade agreement is a good for the company’s profits today (May 12th) as well as a steady decline in global inflation. However, there remains a great risk to the global economy (and expansion) including the possibility of fresh dust between the US and other major trading partners.

Therefore, it is helpful to consider the returns that Glencore stocks will offer over the long term, rather than in the coming years. And from this point of view, I am far more cheerful when it comes to assessing the company’s dividends and stock prices.

As both commodity producers and traders, FTSE companies have a great opportunity to take advantage of the next “commodity supercycle.” I think it could potentially skyrocket revenue and dividends as themes like the growing digital economy, rapid urbanization and decarbonization initiatives drive demand for metals.

I will buy stocks based on investment potential for at least 10 years. And on this timescale, I think Glencore is worth considering seriously.